Latest Insights on FB

The Signal From Junk

The Signal From Junk February 1, 2022 Big Picture. Big Profits., Economy, Investing

That happened fast. Just 15 trading days for the S&P 500 to hit correction territory (at least on an intraday basis) last week, making it one of the fastest in history to kick off a new year. That’s a bit concerning on the heels of a mostly calm 2021, where the S&P 500 barely registered a 5% decline. Does this sudden burst of volatility tell us something about the stock market? Are we now careening over the edge and staring into a bear market abyss? Before you assume that 2022’s bad start is about to turn into something worse, lean on history to guide you. The Next Evolution in Computers Is Almost Here

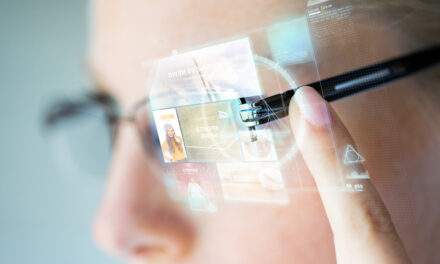

The Next Evolution in Computers Is Almost Here February 1, 2022 Technology, Winning Investor Daily

A new way to interact with our computers and our world is right around the corner.  Time the Bounce for Profit

Time the Bounce for Profit January 31, 2022 Big Picture. Big Profits., Investment Opportunities, U.S. Economy

In today's Your Money Matters, Clint Lee and Ted Bauman review the stock market's terrible start to 2022. But a bad start doesn't always mean a bad finish — just ask the tortoise about his race with the hare.

A big question, though, is how to know when the market has reached the short-term bottom.

If you can spot that, you can grab the opportunity to ride it back up to whatever level it's going to achieve later on.

Clint explains how you can identify that opportunity using easily accessible technical indicators … and why it's so important to wait for confirmation of a rebound before jumping in.  Simmer-Down Sunday: Don’t PUNK With Meta’s Heart

Simmer-Down Sunday: Don’t PUNK With Meta’s Heart January 30, 2022 Great Stuff

We Don’t Need No Meta Nation We don’t need no … Zuck control. Doo-ba-dee-dah … something something. Ahhh, must be Sunday morning again. Welcome! Glad you could join us. We’d never leave you out of the incessant nonsensical rambling. This is Great Stuff — no one gets left behind, right? But out in the metaverse? […] Working From Home Is Here to Stay

Working From Home Is Here to Stay January 29, 2022 Investment Opportunities, Winning Investor Daily

Even if COVID-19 disappears, the majority of workers still want to keep working from home. And that’s a big opportunity.