Latest Insights on GIS

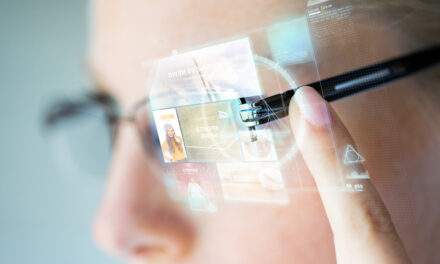

The Next Evolution in Computers Is Almost Here February 1, 2022 Technology, Winning Investor Daily A new way to interact with our computers and our world is right around the corner.

The Next Evolution in Computers Is Almost Here February 1, 2022 Technology, Winning Investor Daily A new way to interact with our computers and our world is right around the corner.  Market Fears, GE’s Fall From Grace and Charles’ Canine Companion January 28, 2022 Investing, Real Talk, Stocks (2-minute read) Market pullbacks are normal. In fact, most of the stock market’s returns have been concentrated in periods of the greatest fear — like right now…

Market Fears, GE’s Fall From Grace and Charles’ Canine Companion January 28, 2022 Investing, Real Talk, Stocks (2-minute read) Market pullbacks are normal. In fact, most of the stock market’s returns have been concentrated in periods of the greatest fear — like right now… Apple’s $124 Billion Cult of Personality, PLUG-ing Back in & An EV Road Trip January 28, 2022 Great Stuff Friday Feedback: The “$124 Billion Question” Edition Great Ones, I don’t cover Apple (Nasdaq: ) much at all. And there’s a reason for that… I don’t like Apple. I don’t like its walled garden App Store. I don’t like how Apple software and devices don’t play nice with my Windows-based laptops and PCs. I don’t […]

Apple’s $124 Billion Cult of Personality, PLUG-ing Back in & An EV Road Trip January 28, 2022 Great Stuff Friday Feedback: The “$124 Billion Question” Edition Great Ones, I don’t cover Apple (Nasdaq: ) much at all. And there’s a reason for that… I don’t like Apple. I don’t like its walled garden App Store. I don’t like how Apple software and devices don’t play nice with my Windows-based laptops and PCs. I don’t […] Lithium’s Lift-Off; Or, Tesla Tests Its Cyber-Luck January 27, 2022 Great Stuff Lithium Slips Into Ludicrous Speed You say you want an energy revolution, yeah? Well, we all want to charge the world. You say it’s just EV-lution, yeah? Well, you know … electric vehicle (EV) sales have pushed global lithium prices into the stratosphere this past year. Sir, the Beatles did not sing that… No, and […]

Lithium’s Lift-Off; Or, Tesla Tests Its Cyber-Luck January 27, 2022 Great Stuff Lithium Slips Into Ludicrous Speed You say you want an energy revolution, yeah? Well, we all want to charge the world. You say it’s just EV-lution, yeah? Well, you know … electric vehicle (EV) sales have pushed global lithium prices into the stratosphere this past year. Sir, the Beatles did not sing that… No, and […] 4 ETFs to Maximize on This Market Rotation January 24, 2022 Big Picture. Big Profits., Economy, Investment Opportunities Last week, growth stocks dropped into correction territory as investors scrambled to reposition themselves for a Fed-dominated year. Many analysts and the talking heads are saying now is the perfect time to buy the dip. This is true, but only if you do it smartly. That's why, in today's installment of Your Money Matters, Ted Bauman and Clint Lee evaluate the market metrics to help you make the most profitable decision. They consider what sectors stand to make the most. That's where you want to go fishing. And they discuss if there is a universal method you can apply to all sectors. Finally, they give you the details of four ETFs to invest in to maximize this market rotation.

4 ETFs to Maximize on This Market Rotation January 24, 2022 Big Picture. Big Profits., Economy, Investment Opportunities Last week, growth stocks dropped into correction territory as investors scrambled to reposition themselves for a Fed-dominated year. Many analysts and the talking heads are saying now is the perfect time to buy the dip. This is true, but only if you do it smartly. That's why, in today's installment of Your Money Matters, Ted Bauman and Clint Lee evaluate the market metrics to help you make the most profitable decision. They consider what sectors stand to make the most. That's where you want to go fishing. And they discuss if there is a universal method you can apply to all sectors. Finally, they give you the details of four ETFs to invest in to maximize this market rotation.