Latest Insights on AMAT

The Fed’s Failure To Launch, Rivian Rips & McDonald’s Dips February 14, 2022 Great Stuff The Fed Goes Jekyll And Hyde Great Ones, there’s something funny about the Federal Reserve. I mean, when I talk about the Fed, I’m typically talking directly about Federal Reserve Chairman Jerome Powell — aka J. Pow or J. Money depending on which subreddit you’re on. Everybody funny, Mr. Great Stuff. Now you funny too. […]

The Fed’s Failure To Launch, Rivian Rips & McDonald’s Dips February 14, 2022 Great Stuff The Fed Goes Jekyll And Hyde Great Ones, there’s something funny about the Federal Reserve. I mean, when I talk about the Fed, I’m typically talking directly about Federal Reserve Chairman Jerome Powell — aka J. Pow or J. Money depending on which subreddit you’re on. Everybody funny, Mr. Great Stuff. Now you funny too. […] It’s the Perfect Time to Buy EV Stocks February 11, 2022 Investment Opportunities, Technology, Winning Investor Daily There’s never been a better time than now to invest in EV companies.

It’s the Perfect Time to Buy EV Stocks February 11, 2022 Investment Opportunities, Technology, Winning Investor Daily There’s never been a better time than now to invest in EV companies. The 1 Thing That Could Cause a Stock Market Collapse February 11, 2022 Big Picture. Big Profits., Education, Investing “Collapse” is the most frightening word in any investor’s vocabulary. It refers to a steep and sudden decline in stock prices much larger than the standard -20% definition of a bear market. Fortunately, such collapses are rare. But they all have one thing in common: liquidity — the presence of willing buyers — evaporates. In today’s video , I explain how these dreaded events occur … and what to watch for when one threatens.

The 1 Thing That Could Cause a Stock Market Collapse February 11, 2022 Big Picture. Big Profits., Education, Investing “Collapse” is the most frightening word in any investor’s vocabulary. It refers to a steep and sudden decline in stock prices much larger than the standard -20% definition of a bear market. Fortunately, such collapses are rare. But they all have one thing in common: liquidity — the presence of willing buyers — evaporates. In today’s video , I explain how these dreaded events occur … and what to watch for when one threatens. Angry. Disillusioned. Doomed? February 8, 2022 Big Picture. Big Profits., Economy, Investing South Africa is drop-dead gorgeous. Its people are the salt of the earth. But it is one of the most unequal societies in the world, which makes it a challenging place to live … to put it mildly. One thing I've learned in my travels is that when inequality reaches extreme levels, dire consequences follow. So, when a new data set on inequality in the U.S. arrived in my inbox, I realized I had the makings of this week's Bauman Daily. If you doubt the relevance to growing and protecting your investments, read on…

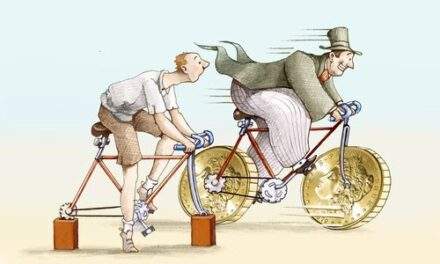

Angry. Disillusioned. Doomed? February 8, 2022 Big Picture. Big Profits., Economy, Investing South Africa is drop-dead gorgeous. Its people are the salt of the earth. But it is one of the most unequal societies in the world, which makes it a challenging place to live … to put it mildly. One thing I've learned in my travels is that when inequality reaches extreme levels, dire consequences follow. So, when a new data set on inequality in the U.S. arrived in my inbox, I realized I had the makings of this week's Bauman Daily. If you doubt the relevance to growing and protecting your investments, read on… Time the Bounce for Profit January 31, 2022 Big Picture. Big Profits., Investment Opportunities, U.S. Economy In today's Your Money Matters, Clint Lee and Ted Bauman review the stock market's terrible start to 2022. But a bad start doesn't always mean a bad finish — just ask the tortoise about his race with the hare.

A big question, though, is how to know when the market has reached the short-term bottom.

If you can spot that, you can grab the opportunity to ride it back up to whatever level it's going to achieve later on.

Clint explains how you can identify that opportunity using easily accessible technical indicators … and why it's so important to wait for confirmation of a rebound before jumping in.

Time the Bounce for Profit January 31, 2022 Big Picture. Big Profits., Investment Opportunities, U.S. Economy In today's Your Money Matters, Clint Lee and Ted Bauman review the stock market's terrible start to 2022. But a bad start doesn't always mean a bad finish — just ask the tortoise about his race with the hare.

A big question, though, is how to know when the market has reached the short-term bottom.

If you can spot that, you can grab the opportunity to ride it back up to whatever level it's going to achieve later on.

Clint explains how you can identify that opportunity using easily accessible technical indicators … and why it's so important to wait for confirmation of a rebound before jumping in.