Thursday, June 1, marked the first day of hurricane season in Florida.

With it came the usual dire warnings of how bad it’s going to be, along with the list of names we will be hearing during the next six months as distant tropical depressions spin themselves into something to be feared.

2017 marks my fourth year of living in the danger zone. Yesterday, I cracked jokes with my friends about the lack of action during those preceding years, but this weekend I am still going to check over our supplies to make sure that we’re not caught unprepared and scrambling at the last minute should a truly terrible storm decide to bear down on our little part of the world.

When it comes to Wall Street, a different kind of storm is brewing out in dark waters, and now is a good time to start preparing…

A Rosier Picture

It may be time to accept the idea that the employment picture has improved within the U.S. The Bureau of Labor Statistics reported that the unemployment rate for May sits at 4.3%, falling to its lowest level since 2001.

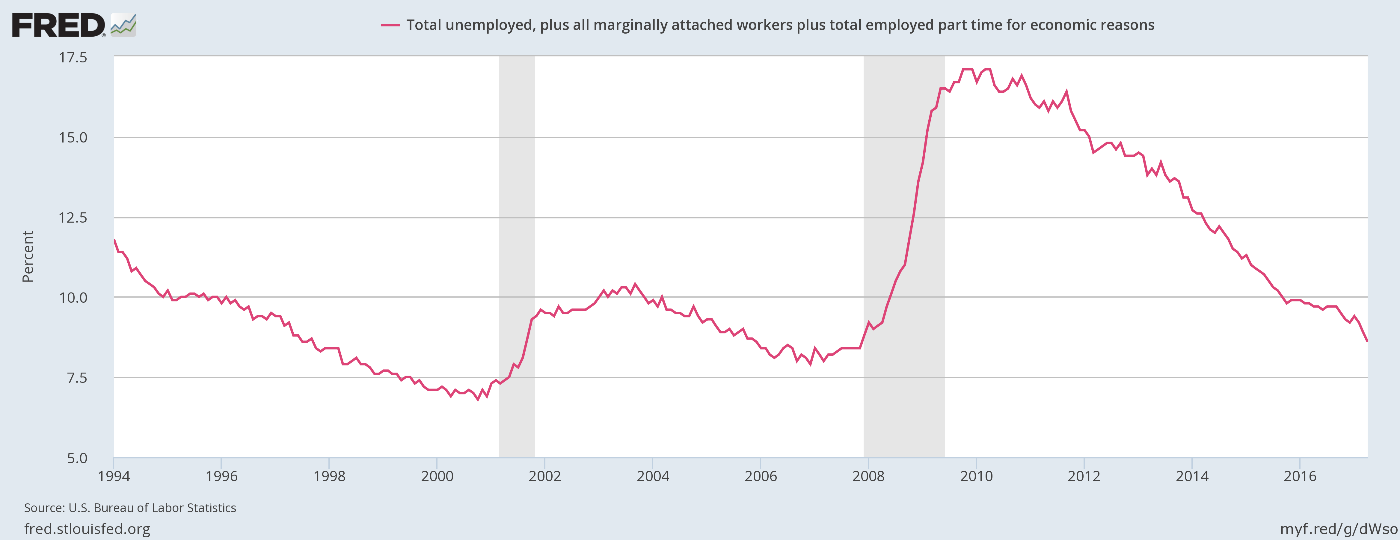

But nobody really believes that headline jobs figure anymore when you consider all the “seasonal adjusting” it goes through before actually being released.

So eyes have turned to the U-6, or the less well-known underemployment index. This index takes in account not just the unemployed, but those working part-time who want full-time jobs, as well as those who are unemployed but not actively looking. The underemployment index dropped to 8.6% in April — the lowest level since late 2007. In fact, this index has mounted its largest three-month decline since 2011.

What’s more, the ADP Research Institute reported on Thursday that private payrolls increased by 253,000 in May, crushing the consensus estimate on Wall Street for an increase of 170,000.

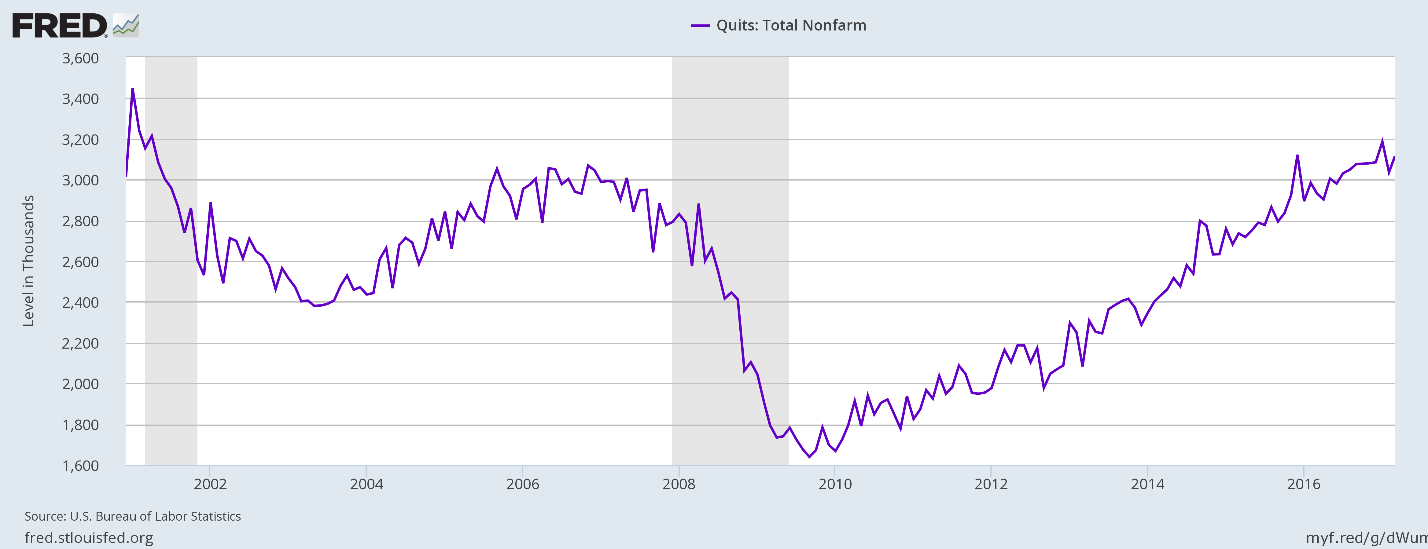

We are also seeing a steady increase in the number of people who are quitting their jobs and seeking employment elsewhere. Job-hopping is something you typically get when people feel secure in being able to find a new opportunity in a healthy economy. As you can see in the chart below, we are back to levels last seen before the Great Recession.

In short, we have a situation where employers are digging deeper in the available pool to fill openings. When they get desperate enough, they will have to raise wages to fill those gaps — something we are just starting to see. In May, average wages climbed 0.2% to $26.22 an hour. Over the past year, wages have increased 2.5%.

The winds are picking up, spinning Hurricane Janet into action.

Another Hike

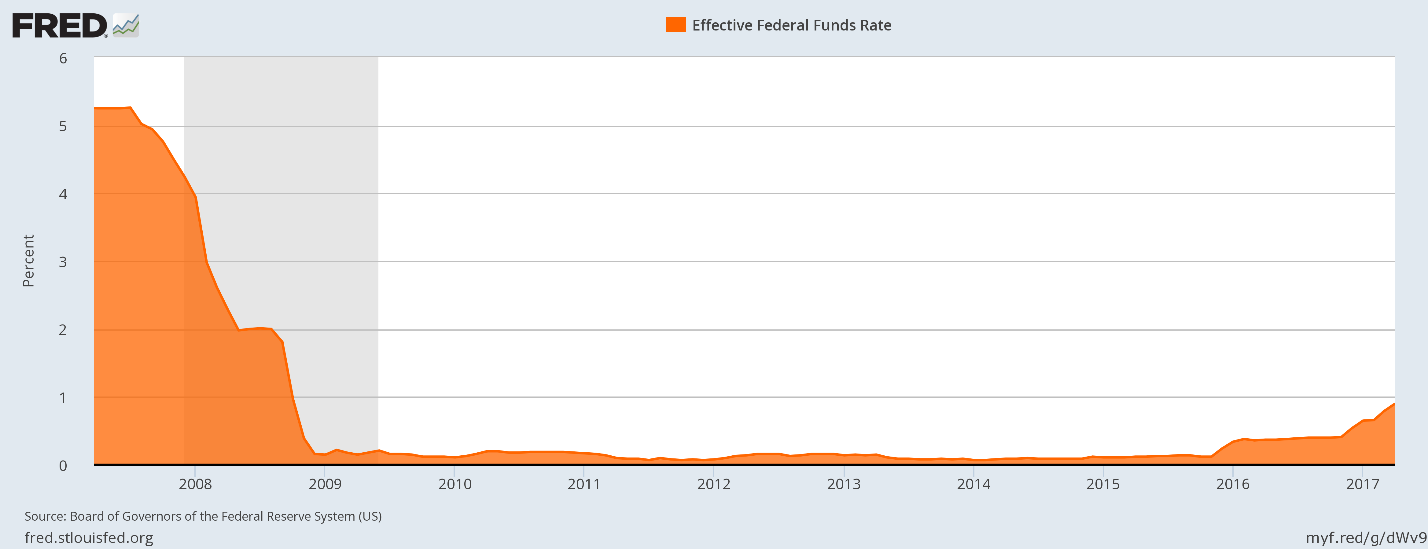

Federal Reserve Chair Janet Yellen & Co. have made no secret that they were aiming for full employment, and all indications are pointing to the fact we are pretty much there now. Interest rates have to continue to inch higher.

The next Federal Open Market Committee meeting is scheduled for June 13 and 14, and the Fed funds futures — which is essentially a way to gauge bets on what the Fed is going to do next — is pricing in a 93.5% chance that the Federal Reserve will lift interest rates by another 25 basis points, putting the effective Fed funds rate between 1% and 1.25%. Interest rates haven’t been that high since September 2008.

Since the end of 2015, we’ve had a total of three rate hikes of a quarter point each, and we are still nowhere near prerecession levels, when interest rates peaked around 5.25%.

But a rate hike wouldn’t be a difficult thing for the market to swallow right now. The housing sector remains strong, as 30-year mortgage rates tagged a fresh 2017 low and U.S. corporations are still hoarding record amounts of cash.

Adding another quarter point to the interest rates isn’t going to significantly derail stocks in their march higher. Michael Carr, editor of Peak Velocity Trader, has pointed out (see “Last Week’s Sell-off Is … Bullish” and “This Indicator Tells Us Something Other Investors Don’t Know”) that we are likely headed for a short-term pullback.

At the moment, it looks like the Fed lifting rates by 25 basis points would be like a Category 1 hurricane that doesn’t quite make landfall. The windows are going to be rattled, the lights are going to flicker and there’s going to be a little debris to clean up from your front yard.

It doesn’t hurt to be prepared with your stops in place to protect your gains, but Hurricane Janet isn’t going to shut down this rally.

Regards,

Jocelynn Smith

Sr. Managing Editor, Sovereign Investor Daily