Stocks can create vast wealth. Almost a quarter of the names on the Forbes list of richest Americans work in finance. But many average Americans aren’t part of this wealth-creation machine.

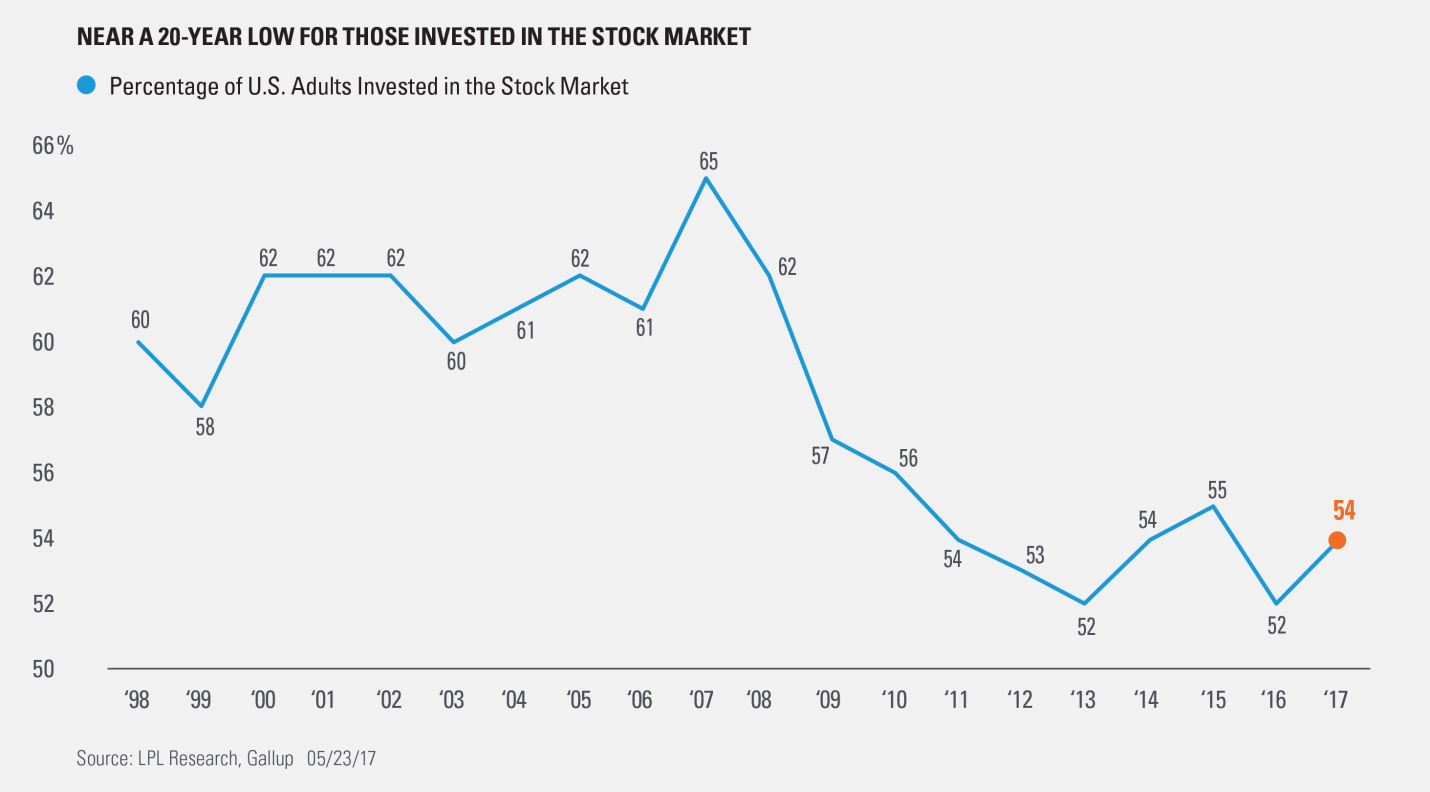

A Gallup poll found that only 54% of American households own stocks. That’s down from a 2007 high of 65%.

Some potential investors fear stocks. After the brutal bear market in 2009, they may be more cautious. But fear only accounts for some of the ownership decline. There was also a bear market in 2000, and after that ended, more than 60% of households still owned stocks.

Some groups still buy stocks. Gallup noted: “Adults aged 65 and older and those with an annual household income of $100,000 or more are two groups whose ownership rates have held firm.”

Older Americans face different problems than younger families. Their homes are often paid for, but they still need income for unpredictable expenses. Their need for income may force them to hold savings in stocks.

Households with income above $100,000 are generally in the top 25% of households ranked by income. High-income earners suffered less in the stagnant economy of the past few years.

For the rest of Americans, paying today’s bills replaced investing in the future. This can be bad for them in the long run, but it could be bullish for those with money invested in stocks now. Low investment rates mean there are many potential owners out there. They’re the families who could invest if wages rise. If that happens, a rising tide could push stock prices up significantly.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader