Latest Insights on ARKK

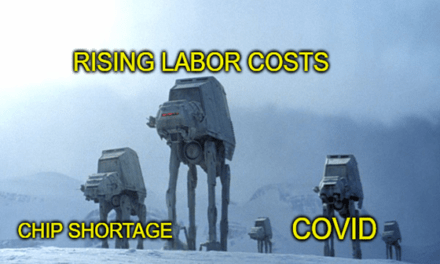

Simmer-Down Sunday: On Labor Debaters & Earnings Capers January 23, 2022 Great Stuff The Earnings Strike Back Well, well, look what the banking cats dragged in this week… Earnings season’s back, and it’s, well, just the same as it ever was. All your favorite excuses for corporate shortcomings were on show this week. The chip shortage, COVID costs, supply chain kerfuffles — all of the greatest hits to […]

Simmer-Down Sunday: On Labor Debaters & Earnings Capers January 23, 2022 Great Stuff The Earnings Strike Back Well, well, look what the banking cats dragged in this week… Earnings season’s back, and it’s, well, just the same as it ever was. All your favorite excuses for corporate shortcomings were on show this week. The chip shortage, COVID costs, supply chain kerfuffles — all of the greatest hits to […] Ted’s Plan to Profit From Sector Rotation January 21, 2022 Big Picture. Big Profits., Trading Strategies, U.S. Economy In today's video, Ted shows how rapidly rising interest rate expectations are driving massive rotations in the stock market. He explains the concept of “duration” and predicts the magnitude of these shifts. But the news is not all bad. Every rotation has an upside as well. By adopting a simple Big Picture-based trading system, Ted shows how you can make Big Profits in 2022.

Ted’s Plan to Profit From Sector Rotation January 21, 2022 Big Picture. Big Profits., Trading Strategies, U.S. Economy In today's video, Ted shows how rapidly rising interest rate expectations are driving massive rotations in the stock market. He explains the concept of “duration” and predicts the magnitude of these shifts. But the news is not all bad. Every rotation has an upside as well. By adopting a simple Big Picture-based trading system, Ted shows how you can make Big Profits in 2022. The 5 Key Indicators That Say “Buy” or “Stay Away” January 18, 2022 Big Picture. Big Profits., Investing Investors have rediscovered stock market “fundamentals.” At least that’s how it seems from my email inbox. I got many positive responses to last week’s article, in which I applied fundamental metrics to the Ark Innovation ETF (NYSE: ARKK). I elaborated on this in Friday’s YouTube video. “Fundamentals” measure a company’s performance, as opposed to its […]

The 5 Key Indicators That Say “Buy” or “Stay Away” January 18, 2022 Big Picture. Big Profits., Investing Investors have rediscovered stock market “fundamentals.” At least that’s how it seems from my email inbox. I got many positive responses to last week’s article, in which I applied fundamental metrics to the Ark Innovation ETF (NYSE: ARKK). I elaborated on this in Friday’s YouTube video. “Fundamentals” measure a company’s performance, as opposed to its […] Ted vs. ARKK January 14, 2022 Big Picture. Big Profits., Investing, Trading Strategies One of the hallmarks of an asset bubble is that investors increasingly rely on “faith and love” to justify their decisions. Indeed, hanging on to promising stocks when they’re down is critical to long-term returns. That’s why I always remind Bauman Letter readers to stay smart and tough. But the smart part is critical. In today’s video, I look at recent market performance in the context of rapidly rising interest rate expectations to identify the stocks that justify faith and love … and those that don’t.

Ted vs. ARKK January 14, 2022 Big Picture. Big Profits., Investing, Trading Strategies One of the hallmarks of an asset bubble is that investors increasingly rely on “faith and love” to justify their decisions. Indeed, hanging on to promising stocks when they’re down is critical to long-term returns. That’s why I always remind Bauman Letter readers to stay smart and tough. But the smart part is critical. In today’s video, I look at recent market performance in the context of rapidly rising interest rate expectations to identify the stocks that justify faith and love … and those that don’t. Get Ready for 2022’s “Big Short” January 11, 2022 Big Picture. Big Profits., Economy, Investing Originators handed out adjustable-rate mortgages (ARMs) like Halloween candy. Big banks packed them into MBS. They bribed agencies for AAA ratings. Then they sold them to unsuspecting investors. The shorts predicted that when ARMs began to reset in the second quarter of 2007, the MBS market would collapse like a Jenga tower .That’s exactly what it did. Their short bets earned them billions. The rest of the financial system collapsed. All through the movie, I kept asking myself one question … where’s the opportunity for today’s Big Short?

Get Ready for 2022’s “Big Short” January 11, 2022 Big Picture. Big Profits., Economy, Investing Originators handed out adjustable-rate mortgages (ARMs) like Halloween candy. Big banks packed them into MBS. They bribed agencies for AAA ratings. Then they sold them to unsuspecting investors. The shorts predicted that when ARMs began to reset in the second quarter of 2007, the MBS market would collapse like a Jenga tower .That’s exactly what it did. Their short bets earned them billions. The rest of the financial system collapsed. All through the movie, I kept asking myself one question … where’s the opportunity for today’s Big Short?