Latest Insights on SEV

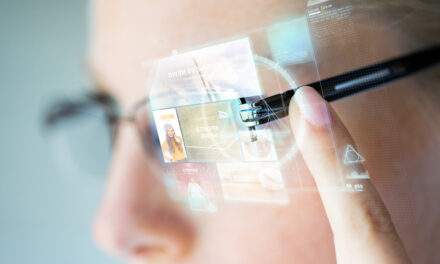

The Next Evolution in Computers Is Almost Here February 1, 2022 Technology, Winning Investor Daily A new way to interact with our computers and our world is right around the corner.

The Next Evolution in Computers Is Almost Here February 1, 2022 Technology, Winning Investor Daily A new way to interact with our computers and our world is right around the corner.  Invest in This $10 Trillion Tech Trend Now January 31, 2022 Investment Opportunities, Technology, Winning Investor Daily Investors and experts are sleeping on this tech trend and what it will unlock for the economy.

Invest in This $10 Trillion Tech Trend Now January 31, 2022 Investment Opportunities, Technology, Winning Investor Daily Investors and experts are sleeping on this tech trend and what it will unlock for the economy.  Time the Bounce for Profit January 31, 2022 Big Picture. Big Profits., Investment Opportunities, U.S. Economy In today's Your Money Matters, Clint Lee and Ted Bauman review the stock market's terrible start to 2022. But a bad start doesn't always mean a bad finish — just ask the tortoise about his race with the hare.

A big question, though, is how to know when the market has reached the short-term bottom.

If you can spot that, you can grab the opportunity to ride it back up to whatever level it's going to achieve later on.

Clint explains how you can identify that opportunity using easily accessible technical indicators … and why it's so important to wait for confirmation of a rebound before jumping in.

Time the Bounce for Profit January 31, 2022 Big Picture. Big Profits., Investment Opportunities, U.S. Economy In today's Your Money Matters, Clint Lee and Ted Bauman review the stock market's terrible start to 2022. But a bad start doesn't always mean a bad finish — just ask the tortoise about his race with the hare.

A big question, though, is how to know when the market has reached the short-term bottom.

If you can spot that, you can grab the opportunity to ride it back up to whatever level it's going to achieve later on.

Clint explains how you can identify that opportunity using easily accessible technical indicators … and why it's so important to wait for confirmation of a rebound before jumping in.  Market Fears, GE’s Fall From Grace and Charles’ Canine Companion January 28, 2022 Investing, Real Talk, Stocks (2-minute read) Market pullbacks are normal. In fact, most of the stock market’s returns have been concentrated in periods of the greatest fear — like right now…

Market Fears, GE’s Fall From Grace and Charles’ Canine Companion January 28, 2022 Investing, Real Talk, Stocks (2-minute read) Market pullbacks are normal. In fact, most of the stock market’s returns have been concentrated in periods of the greatest fear — like right now… Apple’s $124 Billion Cult of Personality, PLUG-ing Back in & An EV Road Trip January 28, 2022 Great Stuff Friday Feedback: The “$124 Billion Question” Edition Great Ones, I don’t cover Apple (Nasdaq: ) much at all. And there’s a reason for that… I don’t like Apple. I don’t like its walled garden App Store. I don’t like how Apple software and devices don’t play nice with my Windows-based laptops and PCs. I don’t […]

Apple’s $124 Billion Cult of Personality, PLUG-ing Back in & An EV Road Trip January 28, 2022 Great Stuff Friday Feedback: The “$124 Billion Question” Edition Great Ones, I don’t cover Apple (Nasdaq: ) much at all. And there’s a reason for that… I don’t like Apple. I don’t like its walled garden App Store. I don’t like how Apple software and devices don’t play nice with my Windows-based laptops and PCs. I don’t […]