Editor’s Note: Welcome to our week-long special series! Our editors for both the Sovereign Investor Daily and Winning Investor Daily are looking ahead to 2018 and providing their insights into what they believe will be the big movers and shakers for the new year. They are also looking at critical steps you can take to preserve and grow your wealth. Happy reading! — Jocelynn Smith, Senior Managing Editor

Analysts attribute this year’s stock market gains to tax reform. I also believe tax reform will drive a rally in 2018. I showed the precedent of 1986 tax reform before. We are now halfway through the tax reform rally.

This tax reform package lowers the corporate tax rate. It might eliminate some loopholes. It’s still a work in progress, so we know nothing for sure.

We know one thing with certainty: Some companies are already searching for ways to benefit from the changes.

Now, past performance isn’t a guide to the future. But it’s likely companies that aggressively used tax shelters in the past will find new ones in the future. That means tax avoiders, or companies that show a talent for lowering their tax bills, could be among the biggest winners next year.

Smart Tax Planning and the Nike Stock Price

When thinking of tax avoiders, many investors think of Apple. The company is known for being aggressive.

The European Union, for example, claims Apple underpaid taxes by about $15 billion through an illegal deal with regulators in Ireland. Other tech companies have similar reputations.

Often overlooked is Nike Inc. (NYSE: NKE). It’s not a tech company, but it’s an aggressive tax avoider. Smart tax planning could make the Nike stock price one of next year’s top performers.

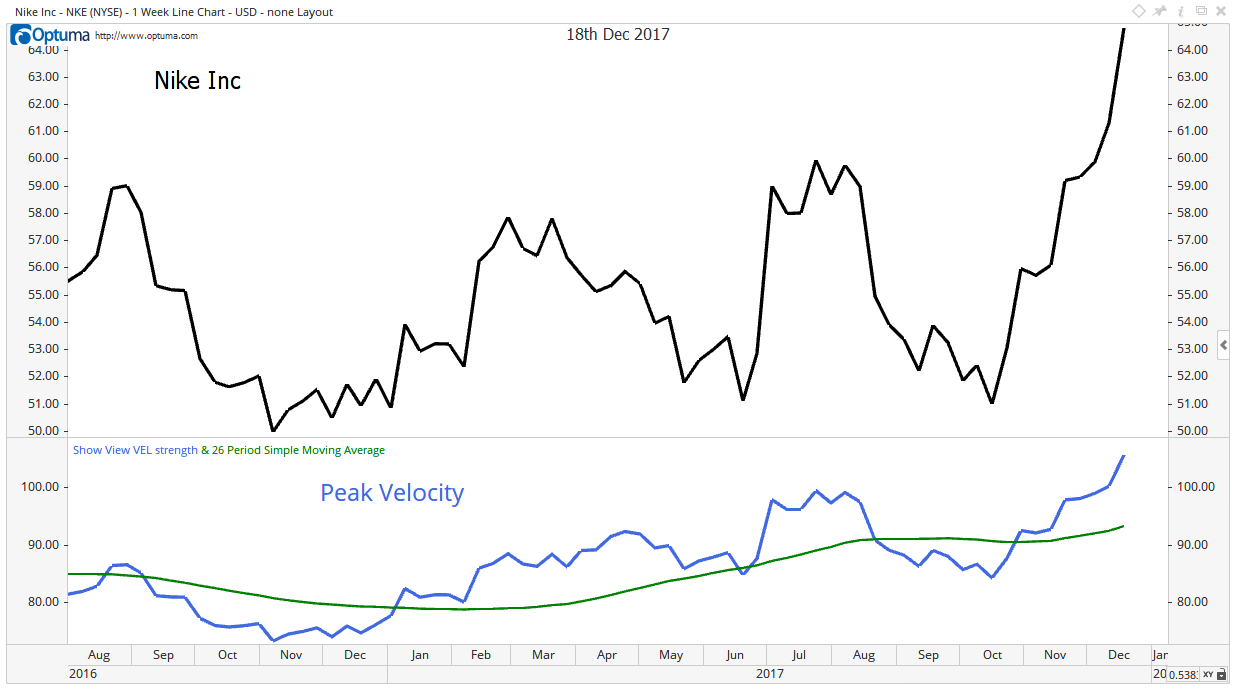

Taxes aren’t the only reason to buy Nike stock. From a purely technical perspective, Nike is in the strongest sector (consumer goods) and is a leader in that sector. The chart shows the Nike stock price is on a Peak Velocity buy signal.

Peak Velocity measures relative strength. It’s designed to find the market leaders, and Nike stock is a buy based on that indicator.

A History of Creativity

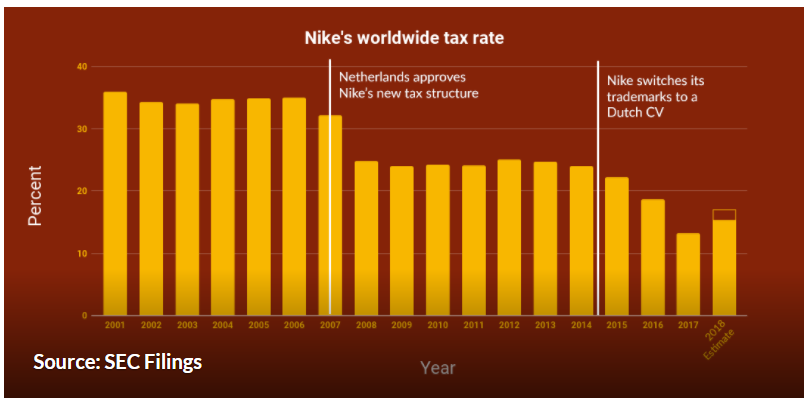

From a fundamental perspective, the company is likely to see earnings increase next year as it studies the tax code. Nike has a history of creativity in this area.

To lower taxes, the company created a subsidiary in Bermuda to own its Swoosh design and other trademarks to license for use outside the United States.

Under this arrangement, other subsidiaries paid royalty fees to use the trademark. This plan shifted billions of dollars of profit to tax-free Bermuda. The chart below shows the results: a lower tax rate and billions of dollars in profits.

(Source: International Consortium of Investigative Journalists)

Nike is a buy based on Peak Velocity, the strength of its sector and its proven ability to grow earnings with advanced tax strategies. For a company like that, tax reform could create new opportunities.

Based on those factors, it’s set up for big gains in 2018.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader