Imagine running a big business right now. Demand for your product is up. You need a new factory. Should you build now? Should you wait until next year? The year after?

That’s not really a hypothetical. Businesses all over the country face those questions. The only right answer is they shouldn’t build now.

That creates a potential problem.

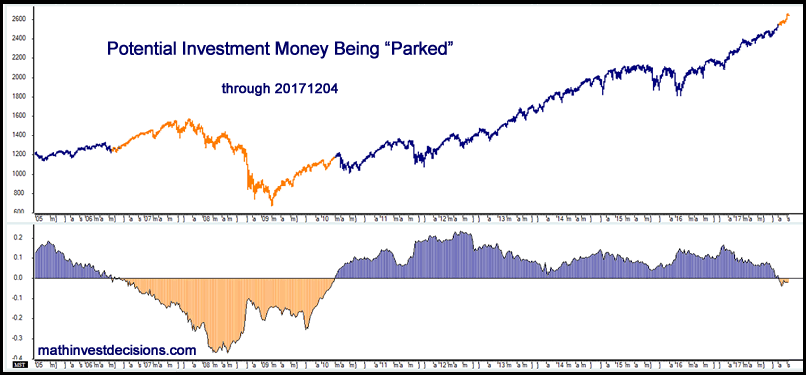

Talk of tax reform created uncertainty. Businesses make money by waiting to see if tax rules change next year, or in 2019 under the Senate’s plan. So, as the chart below shows, businesses are sitting on the sidelines for now. That’s bad for the stock market.

(Source: MathInvestDecisions.com)

This chart shows how much money large companies have available to invest in new factories and equipment. Low levels of investment result in negative values. That way the indicator is easy to interpret.

The chart includes the S&P 500 Index above the indicator. The last time the indicator went negative was during the credit crisis of 2008. Corporations hoarded cash at that time because they didn’t know if they could obtain credit to facilitate operations later.

This time, corporations are waiting for certainty on taxes. Discussions about tax reforms don’t include any new taxes on businesses. So, it makes sense to wait to see what happens.

The probability of a train wreck in the stock market increases as Congress debates tax reform.

One debate concerns when reforms will take effect. The House wants new rules next year. The Senate suggests waiting until 2019. If the Senate plan passes, corporations will continue building cash. And the market is at risk of a crash.

For now, William Rafter of MathInvest notes: “The data suggest corporations are pausing or reflecting rather than storming ahead.”

When the president finally signs tax reform, investors should be aggressive. Using call options to invest at that time can lead to triple-digit gains.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader