President Donald Trump has recently touted the fact the United States is collecting billions in revenue from his tariffs.

He is using it as a positive, saying it will “make America rich again.”

But he is only partially correct.

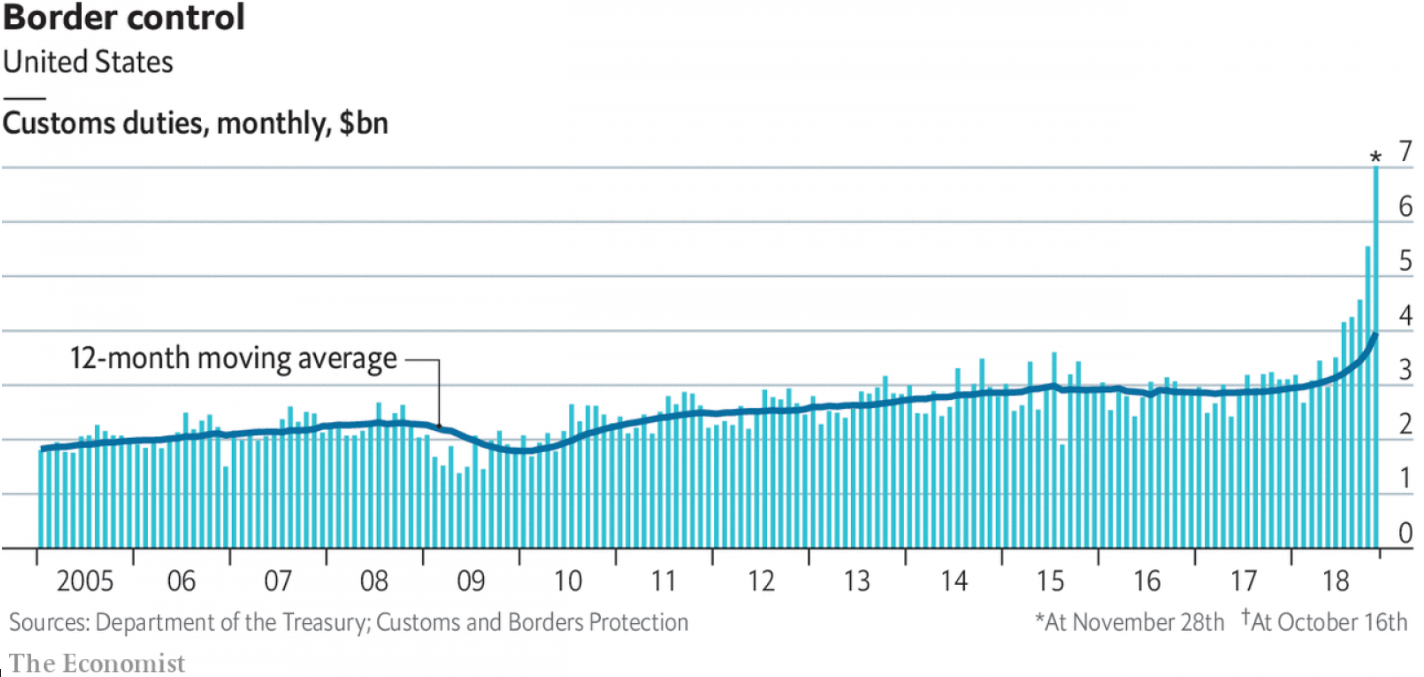

It is true that we are now collecting billions more than we were prior to his tariffs — about $4 billion more.

Historically, the United States has collected between $2 billion and $3 billion in revenue each month.

The latest reading from November was $7 billion.

Take a look:

That’s a significant jump in revenues, more than double the level it was at in November of 2017.

So, Trump is correct — America is collecting billions in revenue from tariffs.

But what he downplays is who is paying them.

It’s not China or any other country.

It’s Americans.

Tariffs are applied to goods that enter the United States from another country. Then, those companies pass that cost onto consumers in the form of higher prices.

In the short term, it’s positive news for us, as Trump is claiming. We’ll see more hiring, and wages will go up.

But international goods will still be the cheaper option even at elevated prices due to the tariffs. That’s because it simply costs more to do business in the U.S.

It’s a spiraling effect that will ultimately raise prices at a level that cancels out the benefits.

If China and the U.S. can’t find common ground on a trade deal, and the fallout of the talks brings fuel to the fire of a trade war, it’s “look out below” for the stock market.

It may not happen right away because of the short-term positives of the tariffs. But eventually the higher costs hurt consumers and our economy.

Within about a year or two of a renewed tariff war, the stock market will go through yet another crash.

The trade talks will be a key focus of mine in the coming months to determine how much longer this bull market can last.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert