Latest Insights on MAT

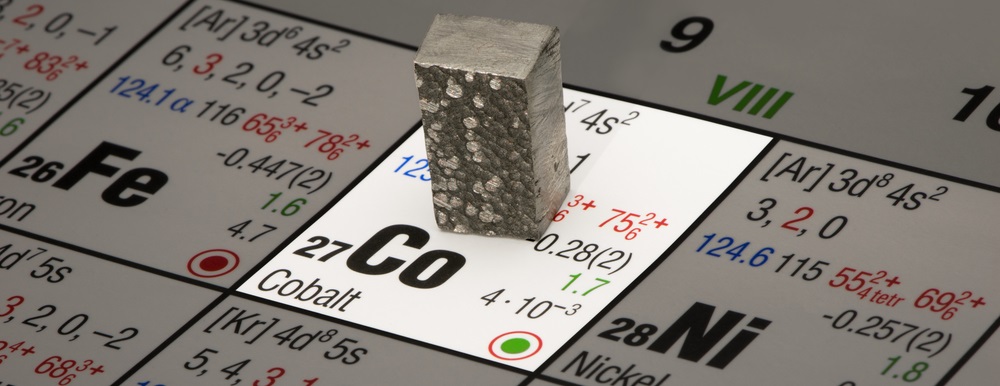

Cobalt Soared 70% – The Metal to Invest in Now May 6, 2017 Precious Metals Commodities provide a path for investing that can offer significant gains if you’re correct about the direction and timing.

Cobalt Soared 70% – The Metal to Invest in Now May 6, 2017 Precious Metals Commodities provide a path for investing that can offer significant gains if you’re correct about the direction and timing. The Massive Tax Credit You’re Missing May 5, 2017 Taxes There's a tax credit that could substantially lower your tax bill … as well as another bill that’s just as hard to avoid.

The Massive Tax Credit You’re Missing May 5, 2017 Taxes There's a tax credit that could substantially lower your tax bill … as well as another bill that’s just as hard to avoid. Mining Mania May 5, 2017 Precious Metals In 2010, a wave of greed ripped through the mining investment community. Every stock tout in the business began crowing about a coming boom.

Mining Mania May 5, 2017 Precious Metals In 2010, a wave of greed ripped through the mining investment community. Every stock tout in the business began crowing about a coming boom. Is the Trump Rally Over? May 5, 2017 Global Economy Stocks soared after the U.S. election, but that pace of growth has slowed during 2017. So is the Trump rally over, or is there another run higher?

Is the Trump Rally Over? May 5, 2017 Global Economy Stocks soared after the U.S. election, but that pace of growth has slowed during 2017. So is the Trump rally over, or is there another run higher? The Fed’s Caution Is a Boost for Gold May 3, 2017 Gold There is a natural hedge for a falling U.S. dollar, and, if you haven’t already, it’s high time you took a closer look at investing in gold.

The Fed’s Caution Is a Boost for Gold May 3, 2017 Gold There is a natural hedge for a falling U.S. dollar, and, if you haven’t already, it’s high time you took a closer look at investing in gold.