Latest Insights on COIN

The Next Evolution in Computers Is Almost Here February 1, 2022 Technology, Winning Investor Daily A new way to interact with our computers and our world is right around the corner.

The Next Evolution in Computers Is Almost Here February 1, 2022 Technology, Winning Investor Daily A new way to interact with our computers and our world is right around the corner.  Robinhood? More Like Robber Baron February 1, 2022 Investing, Trading Strategies, True Options Masters Mike spent his weekend brushing up on market history — and realized Robinhood bears an uncanny resemblance to this notorious robber baron....

Robinhood? More Like Robber Baron February 1, 2022 Investing, Trading Strategies, True Options Masters Mike spent his weekend brushing up on market history — and realized Robinhood bears an uncanny resemblance to this notorious robber baron.... Time the Bounce for Profit January 31, 2022 Big Picture. Big Profits., Investment Opportunities, U.S. Economy In today's Your Money Matters, Clint Lee and Ted Bauman review the stock market's terrible start to 2022. But a bad start doesn't always mean a bad finish — just ask the tortoise about his race with the hare.

A big question, though, is how to know when the market has reached the short-term bottom.

If you can spot that, you can grab the opportunity to ride it back up to whatever level it's going to achieve later on.

Clint explains how you can identify that opportunity using easily accessible technical indicators … and why it's so important to wait for confirmation of a rebound before jumping in.

Time the Bounce for Profit January 31, 2022 Big Picture. Big Profits., Investment Opportunities, U.S. Economy In today's Your Money Matters, Clint Lee and Ted Bauman review the stock market's terrible start to 2022. But a bad start doesn't always mean a bad finish — just ask the tortoise about his race with the hare.

A big question, though, is how to know when the market has reached the short-term bottom.

If you can spot that, you can grab the opportunity to ride it back up to whatever level it's going to achieve later on.

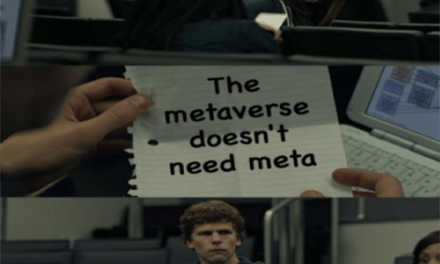

Clint explains how you can identify that opportunity using easily accessible technical indicators … and why it's so important to wait for confirmation of a rebound before jumping in.  Simmer-Down Sunday: Don’t PUNK With Meta’s Heart January 30, 2022 Great Stuff We Don’t Need No Meta Nation We don’t need no … Zuck control. Doo-ba-dee-dah … something something. Ahhh, must be Sunday morning again. Welcome! Glad you could join us. We’d never leave you out of the incessant nonsensical rambling. This is Great Stuff — no one gets left behind, right? But out in the metaverse? […]

Simmer-Down Sunday: Don’t PUNK With Meta’s Heart January 30, 2022 Great Stuff We Don’t Need No Meta Nation We don’t need no … Zuck control. Doo-ba-dee-dah … something something. Ahhh, must be Sunday morning again. Welcome! Glad you could join us. We’d never leave you out of the incessant nonsensical rambling. This is Great Stuff — no one gets left behind, right? But out in the metaverse? […] The Fed Kills the Momentum Trade January 28, 2022 Big Picture. Big Profits., Economy, Investing In June 2020, Barstool Sports founder and wannabe investor Dave Portnoy infamously said that “stocks only go up.” In 2022? Sorry Dave. In today's video, Ted Bauman walks us through the consequences of the Fed's recent hawkish turn. Even after big declines since the beginning of the year, there's plenty of overvaluation in the market still. Ted reviews the history of stock performance in Fed tightening cycles, which is better than you might imagine. But there's one big fear hovering over the market … what if the Fed is tightening into a downturn? That would be bad and not just for momentum stocks.

The Fed Kills the Momentum Trade January 28, 2022 Big Picture. Big Profits., Economy, Investing In June 2020, Barstool Sports founder and wannabe investor Dave Portnoy infamously said that “stocks only go up.” In 2022? Sorry Dave. In today's video, Ted Bauman walks us through the consequences of the Fed's recent hawkish turn. Even after big declines since the beginning of the year, there's plenty of overvaluation in the market still. Ted reviews the history of stock performance in Fed tightening cycles, which is better than you might imagine. But there's one big fear hovering over the market … what if the Fed is tightening into a downturn? That would be bad and not just for momentum stocks.