Latest Insights on PAY

The Nasdaq’s 16% Drop Is a Rare Buying Opportunity January 27, 2022 Investment Opportunities, Winning Investor Daily The Nasdaq fell 16% from its all-time high, and some investors are panic-selling. Here’s why that’s a mistake…

The Nasdaq’s 16% Drop Is a Rare Buying Opportunity January 27, 2022 Investment Opportunities, Winning Investor Daily The Nasdaq fell 16% from its all-time high, and some investors are panic-selling. Here’s why that’s a mistake… A Very Mean Reversion January 26, 2022 Big Picture. Big Profits., Trading Strategies, U.S. Economy Many people believe stock market prices are usually “correct. ”The Efficient Market Hypothesis (EMH) says that, since everybody has access to the same information about a company’s performance, its stock price shouldn’t remain over- or underpriced for long. Try telling that to someone who bought a high momentum stock in late January last year.

A Very Mean Reversion January 26, 2022 Big Picture. Big Profits., Trading Strategies, U.S. Economy Many people believe stock market prices are usually “correct. ”The Efficient Market Hypothesis (EMH) says that, since everybody has access to the same information about a company’s performance, its stock price shouldn’t remain over- or underpriced for long. Try telling that to someone who bought a high momentum stock in late January last year. 10 Days to Never Miss in the Stock Market January 24, 2022 Investing, Investment Opportunities, Real Talk, Trading Strategies (3-minute read) Stock prices are falling, and most investors are hiding under their desks freaking out. But we aren’t because of this…

10 Days to Never Miss in the Stock Market January 24, 2022 Investing, Investment Opportunities, Real Talk, Trading Strategies (3-minute read) Stock prices are falling, and most investors are hiding under their desks freaking out. But we aren’t because of this… 4 ETFs to Maximize on This Market Rotation January 24, 2022 Big Picture. Big Profits., Economy, Investment Opportunities Last week, growth stocks dropped into correction territory as investors scrambled to reposition themselves for a Fed-dominated year. Many analysts and the talking heads are saying now is the perfect time to buy the dip. This is true, but only if you do it smartly. That's why, in today's installment of Your Money Matters, Ted Bauman and Clint Lee evaluate the market metrics to help you make the most profitable decision. They consider what sectors stand to make the most. That's where you want to go fishing. And they discuss if there is a universal method you can apply to all sectors. Finally, they give you the details of four ETFs to invest in to maximize this market rotation.

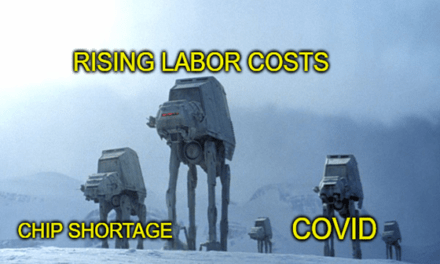

4 ETFs to Maximize on This Market Rotation January 24, 2022 Big Picture. Big Profits., Economy, Investment Opportunities Last week, growth stocks dropped into correction territory as investors scrambled to reposition themselves for a Fed-dominated year. Many analysts and the talking heads are saying now is the perfect time to buy the dip. This is true, but only if you do it smartly. That's why, in today's installment of Your Money Matters, Ted Bauman and Clint Lee evaluate the market metrics to help you make the most profitable decision. They consider what sectors stand to make the most. That's where you want to go fishing. And they discuss if there is a universal method you can apply to all sectors. Finally, they give you the details of four ETFs to invest in to maximize this market rotation. Simmer-Down Sunday: On Labor Debaters & Earnings Capers January 23, 2022 Great Stuff The Earnings Strike Back Well, well, look what the banking cats dragged in this week… Earnings season’s back, and it’s, well, just the same as it ever was. All your favorite excuses for corporate shortcomings were on show this week. The chip shortage, COVID costs, supply chain kerfuffles — all of the greatest hits to […]

Simmer-Down Sunday: On Labor Debaters & Earnings Capers January 23, 2022 Great Stuff The Earnings Strike Back Well, well, look what the banking cats dragged in this week… Earnings season’s back, and it’s, well, just the same as it ever was. All your favorite excuses for corporate shortcomings were on show this week. The chip shortage, COVID costs, supply chain kerfuffles — all of the greatest hits to […]