Latest Insights on PAR

Trump Must Deliver on Taxes

Trump Must Deliver on Taxes February 21, 2017 U.S. Economy

It seems that there could be significant consequences if President Donald Trump fails to deliver after lifting spirits and stock prices so much. Supercharge Your Portfolio

Supercharge Your Portfolio February 20, 2017 Investment Opportunities

While you may not have seriously considered owning a Tesla car, you should definitely consider owning or investing in Tesla stock, and here’s why… The Party’s Just Getting Started

The Party’s Just Getting Started February 20, 2017 U.S. Economy

With more than 70% of the companies in the S&P 500 reporting for the fourth quarter, earnings are, to use the technical term, fantastic. The IRS Retirement Loophole: HSA Savings Account

The IRS Retirement Loophole: HSA Savings Account February 20, 2017 Retirement

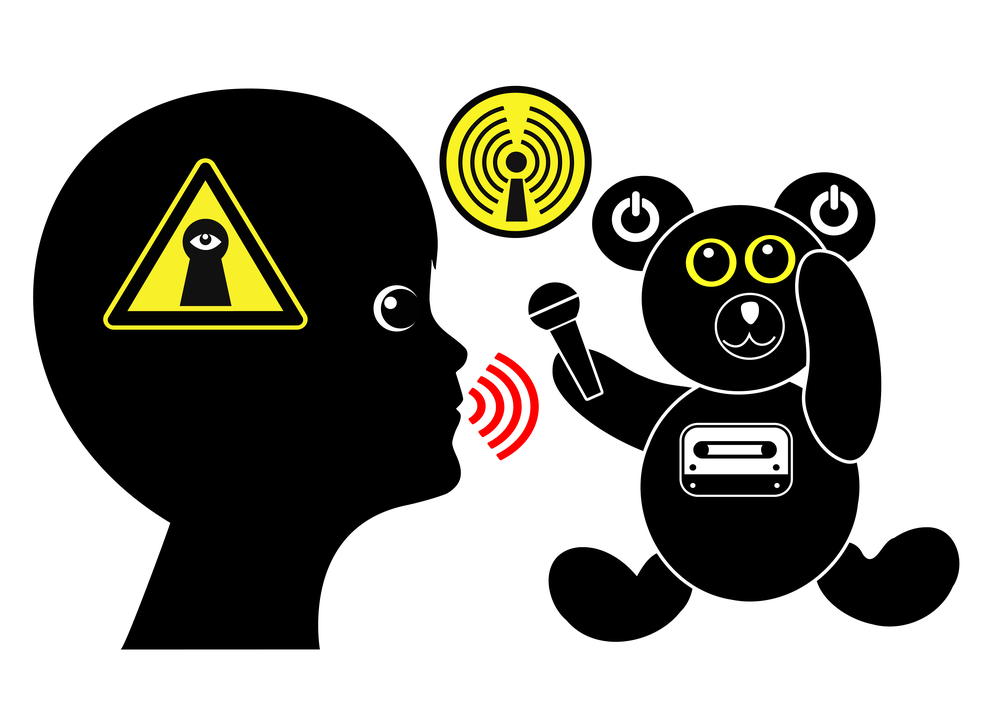

Retirement for many is not a pretty picture, especially if you add in health care. Fortunately, there’s a “hack” you can apply to existing tax regulations that might allow you to escape a poverty-stricken retirement. The Spy Already in Your Home

The Spy Already in Your Home February 18, 2017 Privacy Invasion

Toy Story got a few things right. OK, your childhood toys probably aren’t going on adventures, but some toys, like the Vizio smart TVs I mentioned last week, can spy on you.