With more than 70% of the companies in the S&P 500 reporting for the fourth quarter, earnings are, to use the technical term, fantastic.

I realize that’s not a precise analysis, so let’s look at the numbers. Earnings per share (EPS) for the companies in the S&P 500 are up 46% compared to the fourth quarter of 2015. This confirms the end of the earnings recession of the past five quarters, when the year-over-year (YOY) change in EPS was negative.

Since earnings drive the stock market, it’s easy to understand why stocks moved sideways for almost a year and a half before surging higher in November. History tells us that more gains are likely.

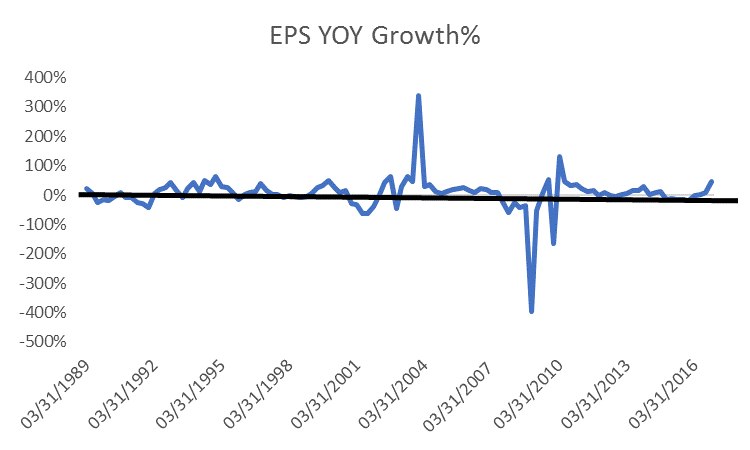

The chart shows the YOY changes in EPS in percentage terms. A horizontal line is drawn at zero, and the blue line shows the wild swings in earnings that are common.

The raw data can be difficult to read, so I’ve applied a smoothing technique in the next chart to reduce the impact of the big swings.

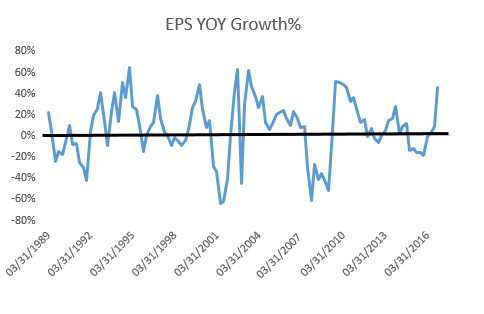

In this chart, extreme points are replaced by an average of the previous and subsequent data. Now a clear pattern emerges, and the recent earnings recession is visible.

Remember that earnings drive the market. When EPS growth shifts from negative to positive, we’re usually at the beginning of a bull market. This happened in 1992 as the market began a string of double-digit annual gains that ended in the Internet bubble, and in 2003 after the bubble crashed.

Earnings data confirms that the price move we’ve seen since November is likely to carry prices higher for months. There will be pullbacks along the way, but we should be looking to buy the dips to benefit from the new bull market.

Regards,

Michael Carr, CMT