Latest Insights on O

Equifax Hack Revealed How Much You Can Lose During a Cyberattack November 15, 2017 Stocks For too long companies have not take their cybersecurity seriously, leaving them vulnerable to attack. But the recent Equifax crisis has changed everything.

Equifax Hack Revealed How Much You Can Lose During a Cyberattack November 15, 2017 Stocks For too long companies have not take their cybersecurity seriously, leaving them vulnerable to attack. But the recent Equifax crisis has changed everything. Saudi Stock Exchange Is an Undervalued Opportunity for American Investors November 15, 2017 Global Economy Recent arrest in Saudi Arabia have created turmoil in the area, but also carry the promise of a rebound in the region's market.

Saudi Stock Exchange Is an Undervalued Opportunity for American Investors November 15, 2017 Global Economy Recent arrest in Saudi Arabia have created turmoil in the area, but also carry the promise of a rebound in the region's market. The Federal Reserve’s Threat to the Market November 14, 2017 U.S. Economy The Federal Reserve has one major policy meeting left in 2017 and its decision regarding rates could be the catalyst that derails the market's rally.

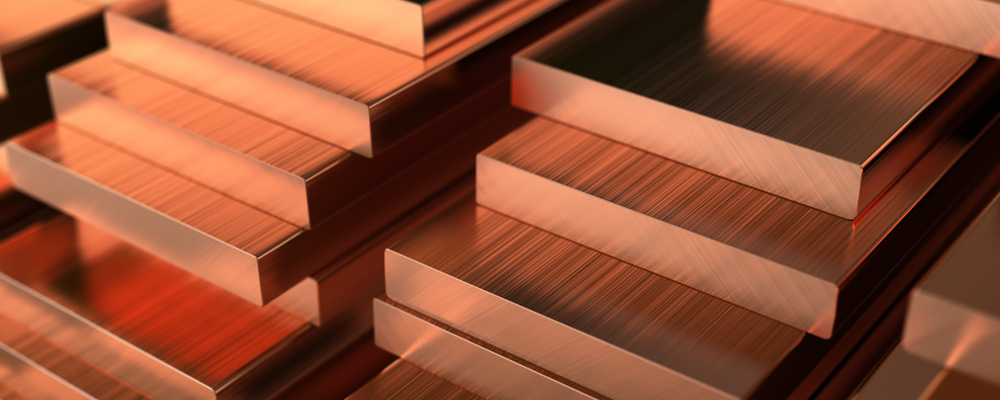

The Federal Reserve’s Threat to the Market November 14, 2017 U.S. Economy The Federal Reserve has one major policy meeting left in 2017 and its decision regarding rates could be the catalyst that derails the market's rally. Copper Is the One Metal You Can’t Ignore November 14, 2017 Hard Commodities Copper has enjoyed a stellar rally for more than a year, but its far from over as a rising new tech will increase demand for the metal.

Copper Is the One Metal You Can’t Ignore November 14, 2017 Hard Commodities Copper has enjoyed a stellar rally for more than a year, but its far from over as a rising new tech will increase demand for the metal. Retail: The Perfect Buy for Christmas November 14, 2017 Stocks While the financial media has the world convinced that retail is officially dead, big money has found a new use for the retail sector.

Retail: The Perfect Buy for Christmas November 14, 2017 Stocks While the financial media has the world convinced that retail is officially dead, big money has found a new use for the retail sector.