How was your Presidents Day?

The weather was beautiful here in sunny South Florida.

So, I took advantage of my time off to plant a lemon tree in my backyard.

Of course, that meant taking a trip to Home Depot to buy soil and fertilizer.

As I went to check out, I saw a sign that’s all too familiar these days: “Help Wanted.”

And that reminded me: I saw a similar sign when I picked up takeout at an Indian restaurant a few days earlier.

Even the garbage truck that drove by my house this morning had “We’re hiring” posted on its side.

It seems like everyone is hiring. You’ve probably noticed it too.

The so-called “Great Resignation” has created tons of job openings.

Everyone seems to have a different opinion on why companies can’t find workers.

But one high-tech startup may actually have a solution to the labor shortage…

The Amazing Burger-Flipping Robot

Last year, my colleague Andrew Prince wrote about an incredible kitchen robot called Flippy.

Miso Robotics, a startup based in Pasadena, California, created Flippy.

The robot can flip burgers, make french fries and more.

(Source: Miso Robotics.)

You can see Flippy in action by watching this short YouTube video.

The robot is super efficient. It cooks twice as fast as a human, and it can make 30% more food at one time.

Plus, Flippy is the perfect “employee.”

It doesn’t get tired or take breaks. It can’t get injured or catch COVID-19. And it doesn’t need a salary or benefits.

Also, note that Flippy has a starting cost of only $3,000 a month.

Assuming it works 24/7, that’s less than $5 an hour.

It’s much cheaper than even the $7.25 federal minimum wage.

And 60% of states have a higher minimum wage than that.

The Service Robot Boom Has Already Started

Until recently, Flippy was mainly just an innovative concept.

But earlier this week, burger chain White Castle announced it plans to “hire” Flippy at 100 of its locations.

White Castle gave Flippy a test run at its Chicago restaurant in 2020.

It was so satisfied with the results that it decided to make robots a part of its business.

The company’s COO, Jeff Carper, said Flippy “keeps us on a path to achieve big goals.”

And Flippy isn’t the only fast-food automaton around.

BurgerFi is testing out Patty, a robot that serves meals to customers, at its Jupiter, Florida location.

(Source: BurgerFi.)

Patty can also interact with customers and bring empty trays back to the kitchen.

It’s not a perfect substitute for human servers. But Patty can be a welcome addition to understaffed restaurants.

“By integrating automation with human operations, we give our employees the support they need and our guests the experience they crave,” said BurgerFi Chief Technology Officer Karl Goodhew.

Goodhew added: “It’s also a way that maybe we can attract an employee to work because it’s different, it’s exciting, it’s something new versus the restaurant next door.”

But this is just a glimpse into what’s ahead for the fast-food industry.

Soon, robots will be commonplace in restaurants, as well as other kinds of businesses.

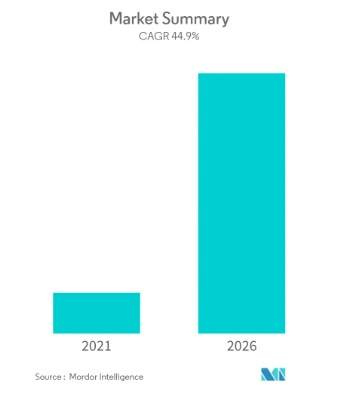

Research firm Mordor Intelligence estimates that the global service robot market will grow from $24 billion in 2021 to $213 billion in 2026.

That’s nearly 10X growth in just five years!

Global Service Robot Market Growth: 2021-2026

(Source: Mordor Intelligence.)

This fast-growing industry includes robots that are designed for cleaning, entertainment and elder care.

It’s the Perfect Time to Invest in Robots

The Robo Global Robotics and Automation Index ETF (NYSE: ROBO) is a simple way to profit from the robotics industry’s growth.

Right now, the ETF is down over 20% from its all-time high in November.

So this might be the ideal time to grab shares while they’re cheap.

Another great way to play the robotics boom is to invest in sensor companies.

Robots like Flippy rely on thermal sensors, 3D sensors, lidar and other technologies.

And according to Ian King, one company’s sensors could be in the majority of robots by the end of this decade.

He has more details about this huge opportunity in his special presentation.

Regards,

Assistant Managing Editor, Banyan Hill Publishing

Morning Movers

From open till noon Eastern time.

South Jersey Industries Inc. (NYSE: SJI) is a natural gas utility and clean energy development company. The stock is up 40% on the news that it is being acquired by JPMorgan Chase’s Infrastructure Investments Fund for $8.1 billion.

Lantheus Holdings Inc. (Nasdaq: LNTH) develops diagnostic and therapeutic products that assist clinicians in the diagnosis and treatment of various diseases. It is up 34% after reporting great results for the fourth quarter and issuing better-than-expected guidance for 2022.

WM Technology Inc. (Nasdaq: MAPS) operates a marketplace that offers consumers information regarding cannabis retailers and brands in their area. The stock is up 23% after the company reported fourth-quarter results showing the largest quarterly revenue in company history.

TransMedics Group Inc. (Nasdaq: TMDX) is a medical technology company that improves organ transplant therapy for end-stage organ failure patients. The stock rose 23% after it reported results for 2021 showing that the company met all of its major regulatory milestones.

Tellurian Inc. (NYSE: TELL) is a liquified natural gas producer. It is up 17% after the company reported results for 2021 showing strong progress in developing its natural gas properties.

Zeta Global Holdings Corp. (NYSE: ZETA) operates a data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software. The stock is up 17% after the company posted record results for the fourth quarter driven by demand for data-driven, identity-based marketing.

Surgutneftegas Public Joint Stock Co. (OTC: SGTZY) is a Russian oil and gas company that is up 16% this morning. The move comes as a result of a spike in oil prices and geopolitical uncertainties following Russia’s invasion of Ukraine.

Evolent Health Inc. (NYSE: EVH) provides health care delivery and payment solutions. The stock is up 15% after the company posted better-than-expected financials for the fourth quarter and set 2022 guidance above analyst expectations.

Offerpad Solutions Inc. (NYSE: OPAD) operates a tech-enabled platform for buying and selling residential real estate. The stock is up 15% after the company reported great results for the fourth quarter, capping off a strong year for real estate.

Telos Corp. (Nasdaq: TLS) provides information technology solutions and services worldwide. It is up 14% as part of a broader rise in cybersecurity stocks in anticipation of Russian state-led cyberattacks following the invasion of Ukraine.