I’m sure you’ve seen the headlines about the Russian invasion in Ukraine.

They’ve mostly been about the armed invasion. But Russian hackers are also targeting the Ukrainian government.

These cyberattacks aren’t just a threat to Ukraine, but to the entire world.

That’s why I recommend you invest in the ETFMG Prime Cyber Security ETF (NYSE: HACK).

In today’s video, I discuss HACK and why it’s the perfect ETF to buy right now.

(If you’d prefer to read a transcript, click here.)

Hey everyone. Steve Fernandez here with this week’s edition of Market Insights.

Today, I want to talk to you about why I think it’s a great time to buy the HACK ETF.

It’s a cybersecurity ETF. And I don’t think that there’s been a better time to buy it when you look at what’s going on over in Russia with the conflict it’s having with Ukraine.

That’s coming in the form of an armed invasion, but also on the cyber front. It’s deploying software right now in Ukraine that’s disrupting their systems.

So, before we get started, I ask that if you haven’t already subscribed and you’re tuning in regularly, definitely subscribe to our channel. And if you like this video, hit the like button, it helps us show our channel to more people.

How Are The Cyberattacks Effecting ETFs?

So, as I mentioned, I think that it’s a great time to buy the HACK ETF.

I’m sure you’ve seen these headlines floating around about the invasion going on in Ukraine. Most have been headlines about the armed invasion. But you may have seen articles about how Russia is deploying software that’s wiping data from several Ukrainian government entities’ websites.

This can potentially be a systemic threat when you think about any country or company that does business with Ukraine. Once Russia infiltrates Ukraine systems, it can potentially use that to pivot to other countries’ and companies’ systems.

And Russia has had a precedent of cybercrime in the past, even here in the U.S., which I’ll cover here in a bit.

So, you’ve probably seen as well that the market has been getting hammered on this news. We’ve seen tech stocks especially, and the entire market for that matter, dropped over the last couple of weeks.

But on this official invasion news, we’re actually seeing cybersecurity stocks rally. They were up about 4% on Thursday. But that’s not true for the rest of the market.

You can see here in this chart

that the Fear & Greed Index, measured by CNN, hit its lowest point since March 2020, back in that COVID panic selling that we saw.

So, it just goes to show that the market is really in peak fear, and sometimes that actually creates the best buying opportunities across the board.

Cybersecurity in particular is doing well. Obviously, that ties into the headlines that we’re seeing about Russia’s cybercrime. But it’s likely the market is gearing up for a systemic spread of cybercrime to other countries, and in particular the U.S.

So, Russians have made cyberattacks on the U.S. — two major ones, for that matter — in the last couple of years. The first being SolarWinds in 2020.

How that worked was Russians hacked into SolarWinds, which is a provider of cybersecurity for companies and government entities, and they planted malicious code. So, when SolarWinds went to push out its software to its customers, it transferred that malicious code unknowingly to its customers.

By doing that, it opened its customers up to data breaches. And that malicious code also allowed Russians to spy on these customers and even plant new software.

It really opened the door, kind of like a spiral effect, to what Russia was able to do in terms of cybercrime. So, we always have to be on the lookout. Businesses know that this is a threat, and it really adds demand for cybersecurity across the board.

The next cyberattack happened last year, in 2021. It was back in May. One of America’s largest fuel pipelines was shut down for five days. This created a huge shortage of fuel across 11 states.

I saw that at one point in North Carolina, 65% of its gas stations didn’t have fuel. You can imagine how this would disrupt our way of life. We use fuel daily, and that can be a disruption that people don’t think about.

And you could take that threat a step further. What if a foreign entity or cybercrime organization was able to shut down our power grid or our wireless system? We won’t be able to communicate with each other.

Those are things that may not seem like, you know, wartime threats, or conflict-type behavior. But as society evolves and becomes more digital, the magnitude of these threats and their consequences are amplified.

U.S. companies know this. The U.S. government knows this. We saw an FBI official earlier this week warn businesses and government organizations about potential ransomware deployment by Russia.

Ransomware is malicious software that aims to steal data for the hackers’ own interest or even create a situation where systems are entirely disrupted. And they generally want some sort of ransom.

Why It’s a Great Time To Buy Into Cybersecurity Stock!

The Russia situation aside, I think that there has never been a better time, at least in the last couple of years, to buy into cybersecurity stocks.

When you look at valuations across the board, they’ve contracted a lot. And a lot of this was just due to selling across the board and in the financial markets.

We saw the Nasdaq practically touch a 20% drawdown this week, which would have been a bear market. It didn’t exactly touch 20%, but it came close. But cybersecurity stocks did touch a 20% drawdown, and that’s officially a bear market.

I think we’re going to see a bounce from this point. With valuations lower and demand likely higher, you’ve got to think that cybersecurity stocks are an attractive buy right now.

As I mentioned before, I think one of the best ways to gain exposure to cybersecurity stocks is with the HACK ETF.

So, the HACK ETF is the ETFMG Prime Cyber Security ETF (NYSE: HACK).

It’s a great way to get exposure to a basket of U.S. cybersecurity companies.

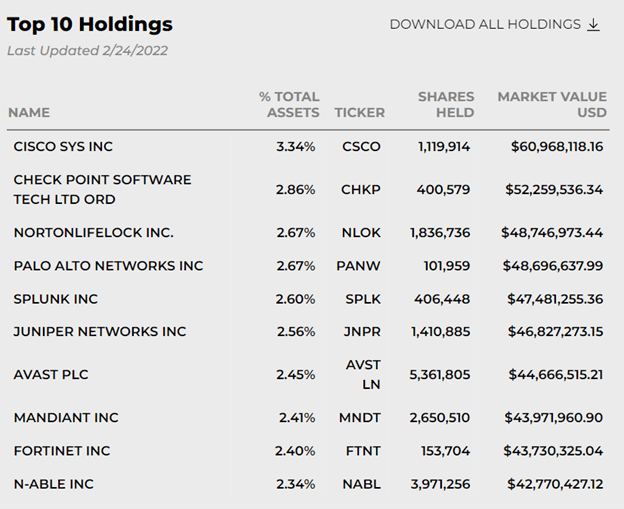

If you look at this table here, you can see the top 10 holdings as of Thursday, February 24. These are some of the bigger cybersecurity companies. You’ve probably heard of some of them.

Now, most of these companies are going to be business facing. They offer cybersecurity solutions for businesses. But there are also some consumer-facing brands mixed in. You can see NortonLifeLock, for example. A lot of people probably know about that one.

But, all in all, I really think that you have to take a look at cybersecurity stocks. This ETF will give you that exposure.

I want to stress that we never want to see conflict between any organization or any country. And you have to just wish and hope for the well-being of people.

But sometimes you have to use these opportunities and deploy your money in a way that protects you and helps you make money. And I think cybersecurity stocks give you that opportunity right now.

So, thanks for tuning in to this week’s edition of Market Insights.

Again, if you made it this far and you’re watching our videos, definitely subscribe. If you like this video, hit the like button. And tune in to next week’s edition.

Regards,

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

Inspirato Inc. (Nasdaq: ISPO) operates as a subscription-based luxury travel company. The stock is up 71% with no significant news to report. Rather, it is continuing the very volatile trading pattern it has seen since it went public last week.

Farfetch Ltd. (NYSE: FTCH) provides an online marketplace for luxury fashion goods. It is up 39% this morning after several analyst firms reiterated their strong buy rating on the stock following its fourth-quarter earnings beat.

KAR Auction Services Inc. (NYSE: KAR) provides used-vehicle auctions and related vehicle remarketing services for the automotive industry. The stock is up 39% on the news that Carvana will acquire the company’s ADESA U.S. physical auction business for $2.2 billion.

CarGurus Inc. (Nasdaq: CARG) operates an online automotive marketplace connecting buyers and sellers of new and used cars. It is up 37% after the company posted fourth-quarter earnings that exceeded expectations and issued strong first-quarter guidance.

IronNet Inc. (NYSE: IRNT) designs and develops solutions for cyberattacks. It is up 33% as part of the continuing momentum in cybersecurity stocks in anticipation of Russian state-led cyberattacks following the invasion of Ukraine.

Aerie Pharmaceuticals Inc. (Nasdaq: AERI) discovers and develops therapies for the treatment of retinal diseases. The stock is up 27% after reported strong fourth-quarter results that were driven by sales of its glaucoma treatment products.

Public Joint Stock Co. Mining and Metallurgical Co. Norilsk Nickel (OTC: NILSY) is a Russian metals and mining company that is up 31% this morning. It is one of the Russian stocks on a rebound today after Russia signaled the possibility of diplomatic solutions.

Block Inc. (NYSE: SQ) is a digital payments processor and fintech company that is up 24% this morning. The move came after the company reported strong fourth-quarter earnings and gave an unexpectedly positive outlook for 2022.

Paramount Group Inc. (NYSE: PGRE) is a real estate investment trust that owns, operates, manages, acquires and redevelops Class A office properties. It is up 21% after it received a $2.2 billion buyout bid from private-equity firm Monarch Alternative Capital.

Schrödinger Inc. (Nasdaq: SDGR) provides a physics-based software platform that enables discovery of novel molecules for drug development and materials applications. The stock is up 21% after it reported results for the fourth quarter and issued a strong outlook for 2022 as the adoption of its platform grows.