Traders keep ignoring bad news in the stock market. A recent example was the Commerce Department’s durable goods report.

Durable goods are items expected to last at least three years. That includes kitchen appliances and cars. Trends in durable goods orders reflect consumer confidence.

Consumers make big purchases when they’re optimistic about the future. That’s especially true for financed buys. Financing shows confidence in the ability to make payments.

Pessimistic consumers delay purchases. Think of your own household. If you’re worried about losing your job, you probably avoid new debt.

This idea applies to the larger economy. Millions of households behave that way.

Those patterns make orders for durable goods a leading economic indicator.

This indicator also forecasts trends in the stock market.

A Simple Strategy

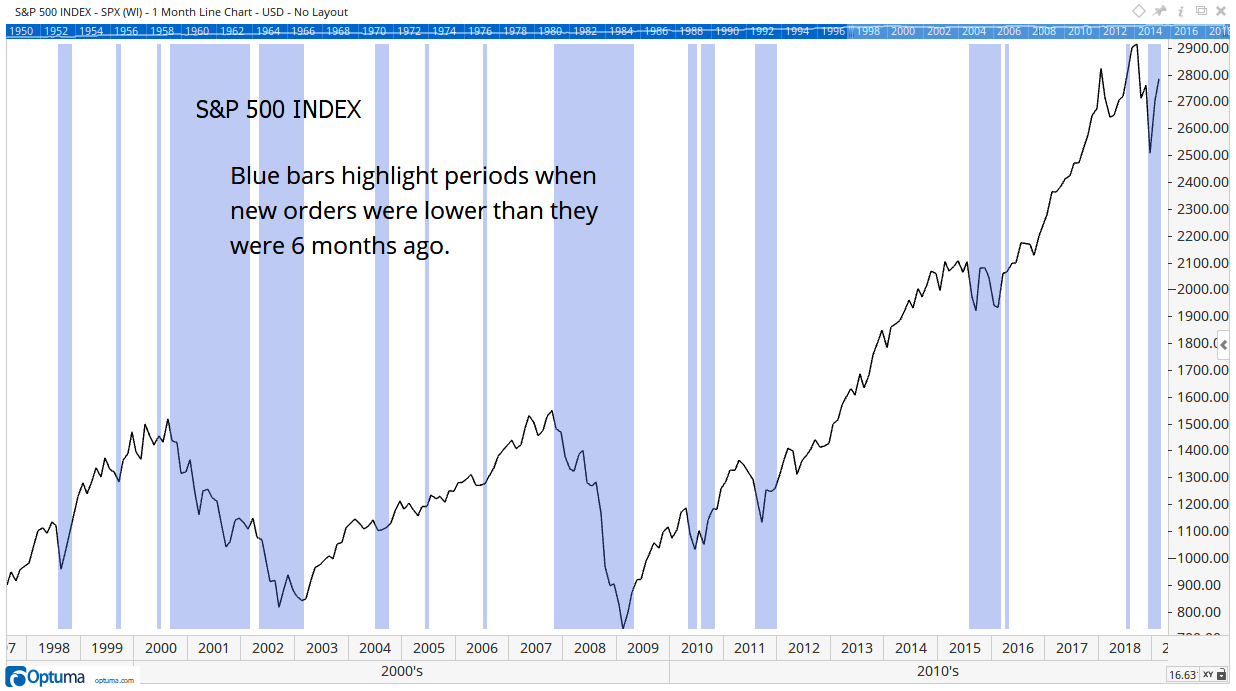

To find signals, we compare orders for new goods to the level six months ago.

We buy when new orders are higher than they were six months ago. We sell when new orders drop.

That simple strategy makes about twice as much money as a buy-and-hold strategy.

The Commerce Department began publishing this data in 1992. That sell signal avoided every bear market since then.

The chart below shows the sell signals. Blue bars show times when orders were down. The S&P 500 Index, the black line, generally declined at those times.

With this in mind, let’s look at the most recent report.

The data covered December. Last month, the report showed orders dropped 0.7%. Economists expected a 0.2% increase.

The report revised November’s data. Orders dropped 1% that month. The initial reports showed a 0.6% decline.

The Outlook Turns Bearish

Economists expect trends to continue. After uptrends, they project more gains. Lower revisions are bearish because they show a trend change that economists overlooked.

It’s important to note the latest results were also below analysts’ expectations.

Like economists, we tend to see analysts are overly optimistic at important turning points. That confirms a bearish outlook for the economy and the stock market.

Back testing shows the value of the new orders indicator.

Back testing involves looking at how stocks performed in the past after the signal. This process uses historical data and assumes we place a trade after each signal.

In this case, the test assumes we sell when the signal occurs. That strategy would avoid significant losses. In the three months after the signal, the S&P 500 lost an average of 3.36%.

Back tested results require context. We can compare the performance of the signal to a typical three-month holding period.

On average, over three months, the S&P 500 gains 3.4%. That tells us the decline after a weak new orders report is important to consider.

Durable Goods Data Signals a Bear Market

No market timing strategy is perfect. But the durable goods number was useful in the past.

Over the years, I’ve tested dozens of economic indicators. I test their correlation to stock prices. And I’ve found that new orders data is the most reliable government report.

Its track record covers more than 25 years. That shows durable goods orders should continue providing useful signals in the future.

The current signal is bearish. This signal adds to the weight of the evidence that the stock market is vulnerable to a decline.

Regards,

Michael Carr, CMT, CFTe

Editor, Peak Velocity Trader