Story Highlights

- One obscure market is starting to look a lot like it did before the 2008 financial crisis.

- Don’t allow the next recession to blindside you like the 2008 recession did to so many investors.

- Watch my presentation on Saturday to find out how to make money when the stock market goes down.

When I step on stage this Saturday at Banyan Hill’s Total Wealth Symposium, I’m going to talk about recession, interest rates … and how listeners can make money even when the stock market is going down.

You should prepare to protect yourself — and to profit — no matter what the market brings.

One obscure market looks like it did before the 2008 financial crisis, when the S&P 500 Index dropped 60% in 12 months.

Whether it’s foreshadowing a new crisis or not is irrelevant.

This is not a prediction about the financial system.

It’s a warning.

The global economy seems more fragile with each passing day. It’s more susceptible to a recession and even a systemic financial crisis.

That’s when financial trouble spreads between institutions and markets in a domino effect.

The Market That Foreshadows a Financial Crisis

The global financial system depends on a steady flow of capital between banks.

Without it, the banking system would be hamstrung in lending to the economy.

“Eurodollars” are short-term deposits that act like loans. The market of eurodollar deposits is the largest source of capital in the world.

Banks hold these deposits outside the United States. They can hold these short-term deposits at a bank in Europe, but they have nothing to do with the euro currency.

Deposits held at a bank in Japan or in The Bahamas are still called eurodollars.

It’s not like cash or gold changing hands. Eurodollar deposits are in U.S. dollars on digital ledgers. A digital ledger is a database that shares and records asset transactions across many sites and institutions.

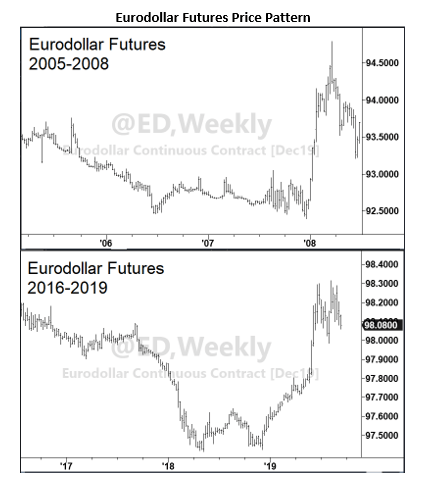

This chart looks at the price pattern in eurodollar futures leading into 2008 — and the last three years.

The price of eurodollar futures hinges on the three-month Libor. That’s the interest rate used in these deposits.

When eurodollar futures fall, interest rates go up. When they rise, interest rates go down.

Don’t miss the significance.

At the start of 2008, eurodollar futures surged. The world responded to economic headwinds: the U.S. Federal Reserve’s rate cuts.

After a pullback in the second quarter of that year, eurodollar futures soared again. Interest rate expectations sank.

Today, the Fed has already begun cutting rates to sustain the economic expansion. This could be the calm in the eye of the storm.

I won’t say we’re headed toward a financial crisis. I don’t want you to worry.

But I do want you to understand what the markets might bring. It is never too soon to prepare.

A Shortage of Collateral Preceded the 2008 Crisis

Eurodollar deposits fuel the global financial system.

There are differences between the financial system today and in early 2008. But a psychology of collapsing interest rates is a problem. It creates a nasty feedback loop.

The eurodollar market could be proof that it’s shaping up that way.

Interest rates are plunging because investors are piling into safe government bonds.

In other words, they’re hoarding high-quality collateral.

Short-term lending and borrowing makes the world go ’round. It needs that collateral.

If there’s a shortage of collateral, the system could seize up the way it did in 2008. A seized-up financial system makes economic pain worse.

Again, this is not a prediction.

But don’t ignore it.

The financial crisis blindsided the world in 2008.

I urge you: Don’t get blindsided when the next financial crisis hits.

Cut exposure to risky stocks or investments you can’t easily monitor.

And be proactive.

You can make money when the market is going down.

The Apex Profit Alert system helps you do that. It’s a system I developed with my colleague Matt Badiali. We use it to make triple-digit gains when stocks are going up or down.

As always, we’re watching for the indicator to trigger buy signals.

When stocks are set to fall, we get a signal that we call “buy on red,” and we can capitalize on these trades.

Click here to watch my presentation on Saturday and learn more about my system.

Good investing,

John Ross

Editor, Apex Profit Alert