Trade wars take a toll on every country involved. There really are no winners. But there could be a country that loses less.

As the trade war with China starts, that country is likely to lose more than the U.S. That means this could be a quick war, with China probably already looking for an exit strategy.

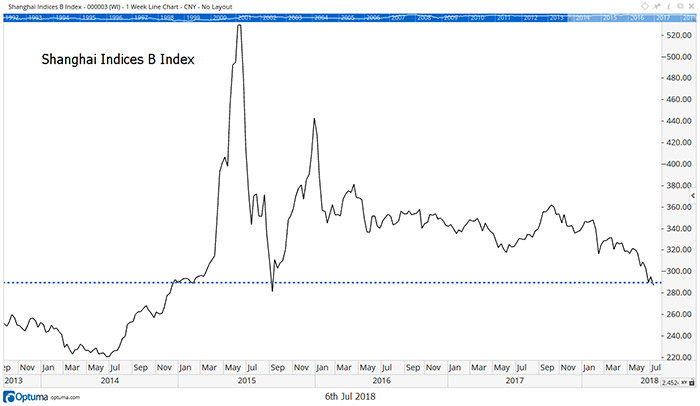

Chinese stocks point to the country’s economic weakness. Just three years ago, stocks in Shanghai were in a bubble. Prices are now at the crash low, and a decisive break of that level is near.

The chart above shows the Shanghai Index, Class B shares. The B shares are available to foreign investors. Class A shares are only available to investors in China. The chart of A shares is more bearish and shows prices broke the 2015 low.

This is important because the stock market shows what investors think of the economy. The breakdown in Chinese stocks shows investors expect weakness. A trade war will make that weakness worse. That’s especially true since traders never recovered from the bubble.

The Shanghai Index is 46% below its 2015 high. That’s a bear market. Companies have problems financing operations in a bear market. That’s one negative for the Chinese economy.

China also has a debt crisis, with billions in bad loans causing concerns of a banking crisis.

In short, this isn’t a good time for a trade war. That means the trade war won’t last long.

Look for China to blink first. There will be some concessions that allow both sides to claim victory. And that will clear the way for a rally in Chinese stocks.

When the trade war ends, you should buy the iShares China Large-Cap ETF (NYSE: FXI). This is an exchange-traded fund offering access to Chinese stocks. It’s the easiest way for investors to benefit from the eventual rebound in China.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader