When it comes to investing, “size” matters.

Listen, I get that buying mega-cap stocks like Apple, Microsoft, Visa, Berkshire Hathaway and so on seems like a low-risk, conservative way to make money in the stock market.

But you have to understand how much this limits your wealth runway.

Let’s take Apple Inc. (Nasdaq: AAPL) as an example. Apple is a $2.6 trillion-dollar company. It is the biggest stock you can buy.

If you’re going to double your money on AAPL at this point, it requires a scenario somewhere in the vicinity of monopolizing the global tech hardware market. Even with highly pessimistic inflation expectations.

I’d put the odds of that happening higher than zero … but not much higher.

And unless it happens in no less than 15 years, you’re looking at a growth rate hardly any better than boring old Treasury bills — while taking on quite a bit more risk.

That’s why — especially right now, with stock prices well off their highs — I implore you to avoid only investing in growth-limited mega caps under the false pretense of safety.

There is plenty of opportunity out there to double your money … and in far less than 15 years.

Heck, you can do it in far less than one year, if you find the right stock.

You just need to focus on the small-cap space. And to do that, you need to understand one of the most important aspects of my six-factor Stock Power Ratings system:

Size.

I’ve been aggressively recommending quality small- and mid-cap stocks to my Green Zone Fortunes and 10X Stocks subscribers recently because they present a growth prospect that’s impossible to ignore right now.

Are they volatile? Yes, they can be.

Do I worry about that? Not one bit.

Because while “size” is an important factor, it’s just one of six I use to separate the wheat from the chaff.

To show you just how much size matters when picking stocks, allow me to do a deep dive into why size made the cut in my proprietary Stock Power Ratings system…

The same system which has consistently forecast stocks that move 100% or more in the next six months.

Then, I’ll give you a sneak peek at my latest project — where I’ll reduce a pool of 300 stocks trading for less than $5 down to my top small-cap opportunities.

Size Benefit No. 1: Smaller Companies Fly Under the Radar

When looking for a new company to invest in, it’s natural to search for the largest companies because a huge market cap (current share price times the number of shares outstanding) means the company must be doing something right … right?!

But keep this in mind: A big, headline-grabbing company is not always your best bet, assuming you’re a shrewd investor seeking to maximize your profits.

With a recognizable name can come a cult following and “bandwagon buyers,” who tend to drive up the prices of mega-cap stocks to the point where they’re no longer a good value and at the expense of future returns.

You see, there are risks to buying the biggest companies.

In recent years, Big Tech — which dominates the mega-cap space — has come under increased scrutiny, triggering concerns over antitrust laws, heightened regulations and greater taxation.

In short, when a company gets too big, so does the size of the target on its back. Increased competition has knocked more than a few big dogs off their pedestals not long after they made it to the top.

Now, I do realize this is a difficult argument to make fresh off the “FAANG era.” Indeed, Facebook, Amazon, Apple, Netflix and Google are huge mega-cap companies, which, love ‘em or hate ‘em, have dominated for many years and made their investors a ton of money along the way.

Realize, I’m not saying that the “size factor” is powerful enough to put Amazon out of business just because the company got too big for its britches.

But smaller companies don’t have to worry as much about increased scrutiny from government entities, and can instead focus on delivering value to their shareholders.

Which leads to my next point…

Size Benefit No. 2: Smaller Companies Outperform

The academic research is clear: Small companies outperform large companies, in aggregate, over the long run.

This means that if an investor consistently buys a portfolio of the smallest half of all stocks in the market and simultaneously short sells a portfolio of the largest half of all stocks in the market … this investor will over time earn a positive return, thanks to the size factor.

The size premium was one of the first factors to be discovered. The famous “three-factor model” I’ve talked about in the past included market beta, size and value.

Given a choice between two stocks that rate equally on all other factors, we should prefer buying the smaller one.

Why the Size Factor Works

We can explain each of the six factors that drive market-beating returns by various “risk-based” or “behavioral-based” causes.

With momentum, for example, one behavioral-based explanation is simply that human beings tend to both under and overreact to information flow. These behaviors are persistent … they lead to the temporary mispricing of stocks … which allows momentum traders to make profits.

For the size factor, a number of risk-based reasons explain why investors who are willing to buy smaller companies can earn market-beating profits.

Essentially, the theory is that smaller companies are inherently riskier than larger companies because:

- They tend to employ greater financial leverage.

- They operate with a smaller capital base, restricting their ability to mitigate economic contractions.

- They have less access to credit.

- Their earnings tend to be more volatile, even “lumpy.”

- They have greater uncertainty of future cash flows.

- Their business model may be unproven.

- Their management team may be less experienced.

- Their shares are less liquid, making them more expensive to trade.

- Their shares may not qualify as “buyable” for large institutional investors with restrictive mandates.

- They garner less analyst attention and media coverage, decreasing transparency.

These are all fairly intuitive risk factors — if you ask me. It makes sense that smaller companies face challenges that the biggest companies don’t face. As such, buying the shares of smaller companies is not as much a sure bet as buying shares of a well-known blue-chip company.

But here’s the thing…

For one, investors in small companies get paid a “premium” to do so. And in the end, if you hold a diversified portfolio of small companies, you can make more money buying these somewhat riskier small-cap stocks than you can by piling into the big names. The research is crystal clear on that.

What’s more, you don’t have to buy the tiniest “micro-cap” stock that’s worth only $10 million, for example, to earn market-beating returns from the size factor.

I have personally seen countless examples of companies that land in the “Goldilocks” zone of just above the $250 million market cap that go on to join the billion-dollar club … and beyond.

And that is what the next few weeks are about.

I just put the finishing touches on a list of about 300 stocks that may hold this potential.

Each of them has passed my first “sniff test” of small caps worth taking a deeper dive into.

You can access the list right here. But we’re just getting started.

In the weeks to follow, I’ll walk you through my process for whittling these 300-ish names down to a short list of top stocks that I believe will return not 100%, but hundreds of percent…

And not in the next decade, but in the next year (or much, much faster).

I firmly believe that right now is the PERFECT time to add small-cap exposure to your portfolio.

As I shared recently in The Banyan Edge, small-cap stocks have a long history of absolutely smoking large-cap stocks in the aftermath of bear markets and recessions.

I’m not ready to say this bear market is over. But even if it carries on for longer than most expect, that won’t stop me from buying up quality small-cap names right now … fully confident that they’ll become the stars of the next bull market.

To good profits,

Adam O’DellChief Investment Strategist, Money & Markets

Adam O’DellChief Investment Strategist, Money & Markets

Part 2: Inflation & the U.S. Workforce (Teens to the Rescue?)

Yesterday, I covered Part 1 of my take on the U.S. inflation problem. Here’s Part 2, addressing two kinds of inflation, and why the Fed is having such a hard time fixing it.

Let’s start with this: Consumer price inflation dropped last month to an annualized 5%.

That’s still high, of course. But it continues to steadily march lower. Inflation really is coming down, little by little.

But remember, there are two primary drivers of inflation.

- There is demand-pull inflation.

This is, first and foremost, a monetary issue. When the Federal Reserve keeps rates artificially low, it aids in credit creation and juices demand. When the Fed raises rates, as it’s been doing, it saps demand.

- The second driver is supply-push inflation.

This is what happens when shortages cause prices to rise.

The best historical example is the 1970’s oil embargo, which caused the price of gasoline to go through the roof.

The semiconductor chip shortage immediately following the COVID pandemic is another good example. This caused the prices of cars, electronics and everything else that uses chips to spike.

The Fed can’t do too much about supply-push inflation because the Fed can’t drill an oil well, or build a chip fabrication plant.

And you know what else the Fed can’t do?

Create workers out of thin air.

If we fall into the recession I’ve been expecting later this year, the slowdown in economic activity will ease the labor shortage … slightly.

But the underlying problem isn’t going away. A shortage of workers is pushing labor costs higher, which is contributing to inflation.

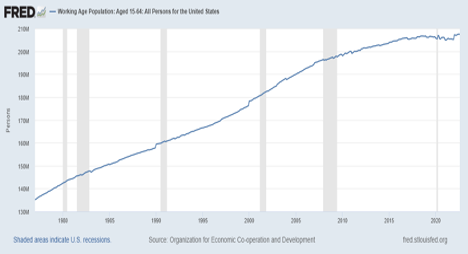

Consider that the working age population has barely budged since 2015. The pool of Americans available to work isn’t really growing.

The truth is, some people who are of working age are choosing not to work. Whether they’re retiring, or possibly a stay-at-home parent, there are legitimate reasons.

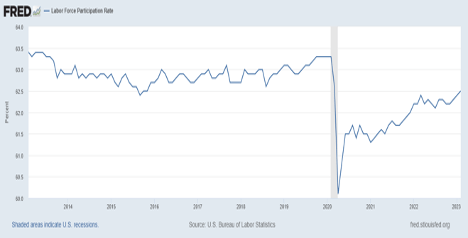

Meanwhile, 62.5% of the labor force is already employed or looking for employment. The average before the pandemic bounced between 62.5% and 63.5%. So there’s not a lot of low-hanging fruit there either.

Immigration could help, of course. But in this political climate, do you really see a major surge in immigration being likely?

Yeah, me neither.

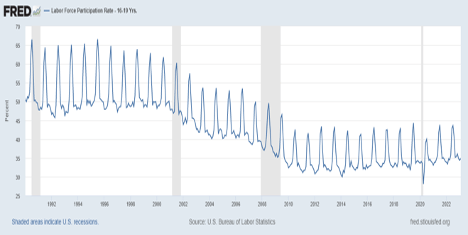

If there is one source of optimism, it would actually be … teenagers! Here’s the labor force participation rate in the U.S., now among 16- to 19-year-olds.

I had jobs as a high school kid. I took tickets at the movie theater, waited tables and even mowed lawns. They were awful jobs, but they did teach me basic life skills and a healthy dose of humility. When you clean vomit off the floor of a movie theater, you learn how not to be a spoiled prima donna.

At any rate, the number of teenagers employed dropped like a rock throughout the 2000s. But it’s been inching higher since about 2014.

However, the increasing teenage workforce won’t solve our labor problem.

By definition, these are going to be inexperienced workers. A 16-year-old kid is not going to replace the productivity (and the experience) of a retiring 65-year-old. At least not for several years. But they do have the potential to at least partly ease the pressure.

In the long term, the solution to the labor shortage is technology. Artificial intelligence, automation and robotics technology will squeeze more productivity out of each worker.

As Ian King (our resident tech expert) would tell you, technological advancements like AI and robotics automation will continue to streamline processes in companies, making them more efficient.

If you want to learn more about investing in AI, for example, Ian wrote about his #1 stock pick for artificial intelligence in his Strategic Fortunes newsletter. If you want the full write-up (and the stock ticker), click here!

And in the meantime, we’ll take what we can get when it comes to improving our labor force, and lowering inflation.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge