Everywhere you look in the headlines these days, you see the same name over and over…

China.

It’s easy to place blame. Maybe it’s China’s fault for sending spy balloons over the U.S. Or President Biden’s fault for shooting them down too late (or too soon or at all, etc.).

Or China’s choice to potentially sell weapons to Russia…

Or to threaten to invade Taiwan…

I’ve never liked playing the blame game, personally. Because the fact is, certain things are out of our control.

But that doesn’t mean we have to sit idly by, twiddling our thumbs as the rest of the mainstream media squawk over the implications.

We can fight back.

As investors, we can take what we see in these headlines … and find ways to improve our lives through smart investments.

This “tech war” sounds scary…

But it’s lining up with an economic event I’ve seen before — actually three times before — which led to massively profitable stock mega trends.

It’s called a convergence. And as three specific factors line up, savvy investors have the potential to make incredible gains over the next five years.

Here’s how…

3 Factors, 3 Convergences

A convergence happens when three seemingly unrelated factors merge to fuel an economic boom.

Over my life, I’ve seen and traded three:

- The American shale boom.

- Green energy.

- Biotech.

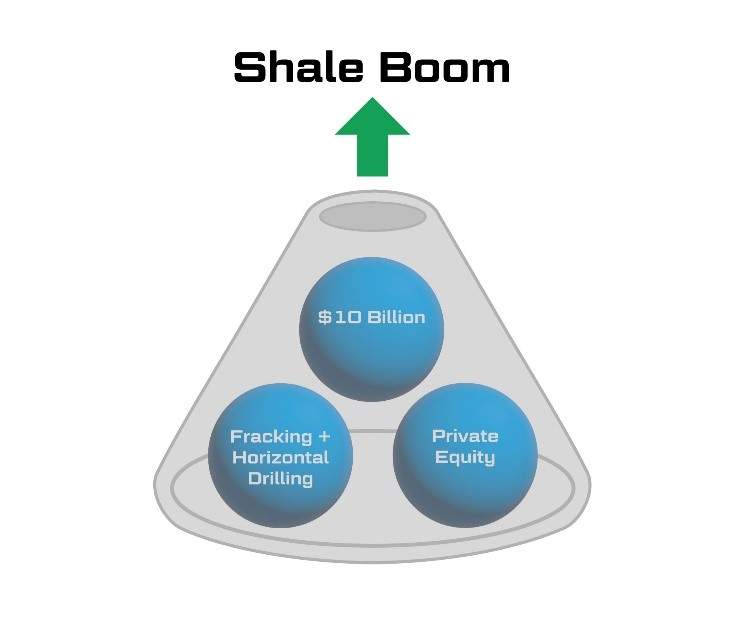

In these convergences, three factors meld together to fuel massive stock market gains: government funding, innovation and private investment.

Let’s look at the American shale boom as an example.

For decades, America’s superpower status was at risk because we had to rely on hostile foreign countries for oil. (Sound familiar?)

We hit peak oil production in the 1970s, and then spent 35 years slipping. By the early 2000s, America’s daily oil production was cut in half.

That left us beholden to Venezuela, Saudi Arabia and Russia for oil. I think you’d agree that it’s not a great place to be.

So that’s when the first factor emerged: government funding.

The U.S. government stepped in. We finally realized America was sitting on an ocean of untapped shale reserves.

There was one issue, though. It was way too expensive to get the oil and natural gas out of the ground.

So, the government started doling out subsidies and tax breaks for research and development — $10 billion worth by 2002.

That’s one of the big secrets of the shale boom. It simply could not have happened without the hand of the government airdropping cash all over the oil fields.

So, with more money available, innovation came rushing in. That’s the second factor behind every major convergence.

For shale, it was oilman George Mitchell combining fracking and horizontal drilling — two things which had been around since the ‘70s — and making it actually work to get oil out of the ground cheaply.

This innovation unlocked oil and gas which had been trapped in the dense shale formations across America.

And once everyone saw this innovation, private investment came rushing in.

Equity firm KKR brought $312 million to the table. Exxon announced a $30 billion investment plan.

Halliburton injected billions. Royal Dutch Shell rushed in with $4.7 billion.

To review: You have government — which lays the foundation.

That makes way for innovation.

And when private equity sees the opportunity, it piles in and takes it to the next level.

It’s a textbook convergence. The shale oil boom followed.

It created more than 2 million jobs, lifted our GDP (gross domestic product) by more than 10% and eventually made the United States energy independent.

And the gains are mind-boggling.

Within five years…

Pioneer Natural Resources soared 1,700%.

CVR Energy exploded 3,000%.

Cheniere Energy ran 4,500%.

But that’s just one convergence.

I’ve seen it happen in green energy, too.

First, there was government funding. Over the past 10 years, the government has poured $500 billion into green energy.

That spurred innovation. Everything from electric vehicles to energy storage and beyond.

That’s when private investment jumped in.

Over the past decade, the private sector poured in a record $105 billion into clean energy. Firms like BlackRock funneled $150 billion into green energy.

In fact, my Strategic Fortunes readers were able to profit off the green energy trend.

Tesla dominated the electric vehicle industry thanks to the green energy convergence — allowing my readers to lock in an average gain of 735% across two half positions in just over a year.

Then came biotech.

At the height of the COVID pandemic, the government worked to combat the spread of the virus. Congress appropriated nearly $10 billion to do so. (There it is again — government funding.)

The next step — innovation — came shortly after. With the research and technology already there, a COVID vaccine was prepared within months.

And the last step — private equity — couldn’t pour in fast enough. Media outlet Devex tracked over a TRILLION dollars in funding from the private sector, governments and philanthropic organizations.

You know what happened next — huge profits rolled in.

Moderna shot up 2,000%; BioNTech soared 1,154%; and Oramed Pharmaceuticals roared 836% higher.

All of this shows that when economic convergences come along, they typically mean massive investment opportunities are on the horizon.

And that’s what I’m seeing right now with China.

The Fourth Convergence: Semiconductor Chips

If you’ve been following me for a while, you you know I believe China’s days as the manufacturing king of the world are numbered.

And a new convergence has just begun to emerge that will knock China down a peg or two.

It all comes down to semiconductor chips.

Right now, 92% of all semiconductor chips are manufactured in Taiwan — virtually a hop, skip and a jump away from China.

But the U.S. is about to change that.

Back in August 2022, with the CHIPS Act, the government poured billions into bringing semiconductor chip manufacturing home. We followed that up in October by restricting certain exports to Chinese semiconductor manufacturers.

And now the U.S. may sanction China.

Here’s the thing: It’s not that we don’t want China to have microchips for their phones. It’s that we don’t want them to have chips for their weapons.

That’s one reason the U.S. is racing to re-shore semiconductor chip manufacturing. And it’s a huge investment opportunity.

We’re already seeing the tell-tale signs of the Fourth Convergence emerging:

- Government funding: The government dumped in $250 billion via the CHIPS Act to bring chip manufacturing home.

- Innovation: A new semiconductor manufacturing technology, called ion implantation, has recently emerged. With this process, chips are more conductive and production is more precise and efficient. This could lead to higher profit margins for semiconductor companies and better products for users.

- Private equity — The private capital being poured into microchips is insane. Warren Buffett alone has invested $5 billion. Ray Dalio’s Bridgewater Capital has nearly $200 million invested in microchip companies now. All told, hedge funds have pumped more than $46 billion into semiconductor chips…

The last three times we saw a convergence like this, stocks participating in these trends rode as high as 1,000%, 2,500% and even 5,000%.

And now we are on the eve of the Fourth Convergence. And there’s one company in particular I believe could deliver over 1,000% over the next five years.

It’s right in the middle of the new technology I mentioned before — ion implantation. Soon, I believe it’s going to be absolutely crucial to manufacturing semiconductor chips.

If you’d like the full details on this company — including its name, ticker symbol and action to take — I’ve put all the details in my brand-new research report called The Fourth Convergence: America’s Next 1,000% Wave.

This single volume includes everything you need to know about this Fourth Convergence and the company leading the charge…

You’ll get my recommended buy range for the company, the full breakdown of how its technology works, my targets for gains over the next few years … and much, much more.

To learn how you can get your copy today, click right here now.

Regards, Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

Read Strategic Fortunes reviews from real subscribers here.

“Firing China” Means Short-Term Pain and Long-Term Gain

As I mentioned in Monday’s podcast, Ian’s Banyan Edge piece on “Firing China” back in December really struck a chord with our readers. (It’s been close to three months, and we still get folks writing in about it. Check out their emails here.)

Make no mistake, China is getting fired. And not just for national security reasons.

After the experience of the pandemic, no American company will risk their suppliers getting shut down by government decree. Over three years later, we’re still trying to untangle the supply chain mess left behind.

So, they’re bringing their production closer to home, investing in new American capacity.

This needed to happen, and it will happen.

But there will be a cost … and it comes in the form of inflation.

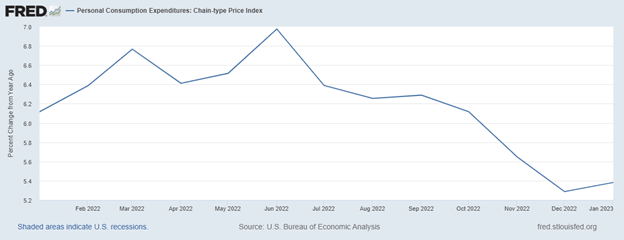

As I mentioned over the weekend, it’s trending higher again.

The Fed is mostly to blame for the high inflation we have today, but not entirely. The reversal of half a century of globalization is also playing a role here.

China opened to Western markets in 1978. And just a few years after that, the “Great Disinflation” of the 1980s started … and then continued for the next four and a half decades. The entrance of hundreds of millions of low-wage Chinese workers into the global workforce was the most disinflationary force since the onset of the Industrial Revolution in the late 1700s.

But as Ian mentioned in the podcast, Chinese wages have risen by a factor of 10 and China is no longer as cheap as it once was. This means that companies aren’t sacrificing as much by moving their production elsewhere.

You might have noticed … but there are still a lot of “help wanted” signs in virtually every storefront in America these days. We don’t exactly have a surplus of workers to handle the production moving over from China. So, we’re automating it with robotics and artificial intelligence.

We like to think of AI as a “software story,” but it’s really not. It’s a hardware story.

No matter how good your coding is, it doesn’t matter if your hardware isn’t strong enough to run it. And this is why we’re seeing hundreds of billions of dollars of new investment in chip manufacturing here in the United States.

Ultimately — as in years from now — all of this will be wildly disinflationary … even deflationary! Technology massively reduces costs by making industry more efficient.

But in the meantime, as we grapple with the effects of deglobalization and take on the expense of building out this new technology infrastructure at home, expect inflation to stay annoyingly high!

What’s a good way to combat inflation? Well, you probably already know, but … invest in stocks that will outpace it!

Ian King just happens to know of a great stock that’s perfectly suited for the deglobalization trend. Like he mentioned earlier, he believes it will return 1,000% within the next five years (I’ll save you from doing the math there that beats inflation handily!)

You can go right here for more details from Ian on this company, and everything you need to do to start putting your money to work in it today.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge