My uncle worked in oil refining for over 40 years. He taught me a lot about the nuances of crude oils — there are lots of variables that can affect refiners’ profits.

And oil refining is a terrible business. That’s because oil refiners are “price takers.” That means the prices of what they buy and sell are set by someone else. So, unlike Apple, which can set the price of an iPod at whatever the market will bear, refiners take what they get.

I followed this sector for years, watching as companies barely eked out profits. When oil prices soared in 2008, refiners did particularly poorly. As oil prices approached $140 per barrel, gasoline and other refined products’ prices didn’t keep pace.

As refiners paid more and more for the oil they needed, their profits narrowed. Two of the largest independent refiners in the U.S., Tesoro and Valero, saw their earnings margins sink. Tesoro’s fell from 9% in 2006 to 2% in 2009. Valero’s fell from 10% in 2006 to under 3% in 2009.

Those were the bad years. However, refining becomes very profitable at certain points in the cycle … like today.

A Gift to Refining

Falling oil prices are a gift to refining. In 2013, Tesoro and Valero’s earnings margins fell to 3% and 4%, respectively. In 2015, the margins grew to 12% and 10%.

That’s thanks primarily to lower oil prices. While exploration companies are getting pounded by the bear market, refiners are making money.

As we saw in my article on Tuesday, net weekly imports fell under 4 million barrels per day in April and again in May. That’s the lowest since we began keeping records in 1991. The net imports are determined by the total volume of imports of crude oil and refined products minus the total volume of exports.

The reason net imports are down so much is due to the massive export volume of refined products. Today we export an enormous volume of fuels and refined oils. Exports of refined products averaged 2.4 million barrels per day in 2011. They are over 4.8 million barrels per day so far this year.

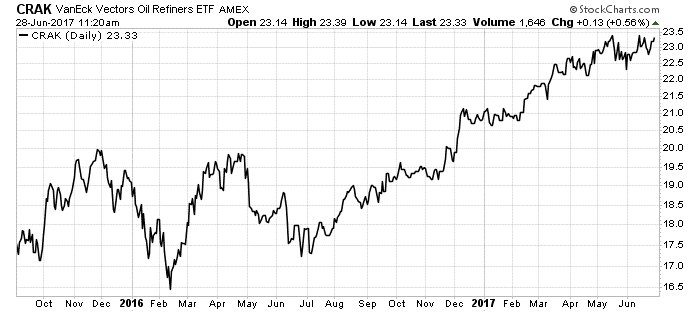

That’s the ticket to refiners’ performance today. The share prices reflect that too. Look at this chart of the VanEck Vectors Oil Refiners ETF (NYSE Arca: CRAK):

CRAK holds 30% of its capital in U.S. refiners and 70% in global refiners. Since low oil prices are global, refiners around the world are doing well.

U.S. refiners are running at maximum capacity right now. They processed 17.7 million barrels per day in May, a record volume. The industry only exceeded 17 million barrels per day 24 times since 1990, according to the Energy Information Administration.

Refiners are the hands-down winners of the oil sector with the low oil prices today.

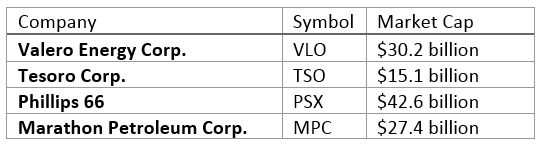

Investors who want to ride this trend higher have several options. The best is the CRAK exchange-traded fund because it offers exposure to many global refiners. There are also several independent U.S. refiners listed in the table below:

These companies will continue to make money while oil prices trend sideways, and they should continue to outperform exploration companies. However, these stocks could be volatile. If oil prices begin moving higher, it could hurt refiners. Always use trailing stops when speculating in these kinds of companies.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist

P.S. I’d like to extend a special invitation for you to join me and some of the world’s top financial and natural resource experts at the 2017 Sprott Natural Resource Symposium in Vancouver, Canada. We’ll be giving you the latest information on mining companies, resource stocks and precious metals, as well as sharing our best ideas about how you can profit from what may be the greatest buying opportunity of this decade. The event begins on July 25. Click here for all the details on how our group of experts can give you the best chance of locking in life-changing profits.