Even though oil prices are falling, the oil industry continues to thrive.

U.S. net petroleum imports are at their lowest since we began keeping records in 1991. This number is determined by the total volume of imports of crude oil and refined products minus the total volume of exports.

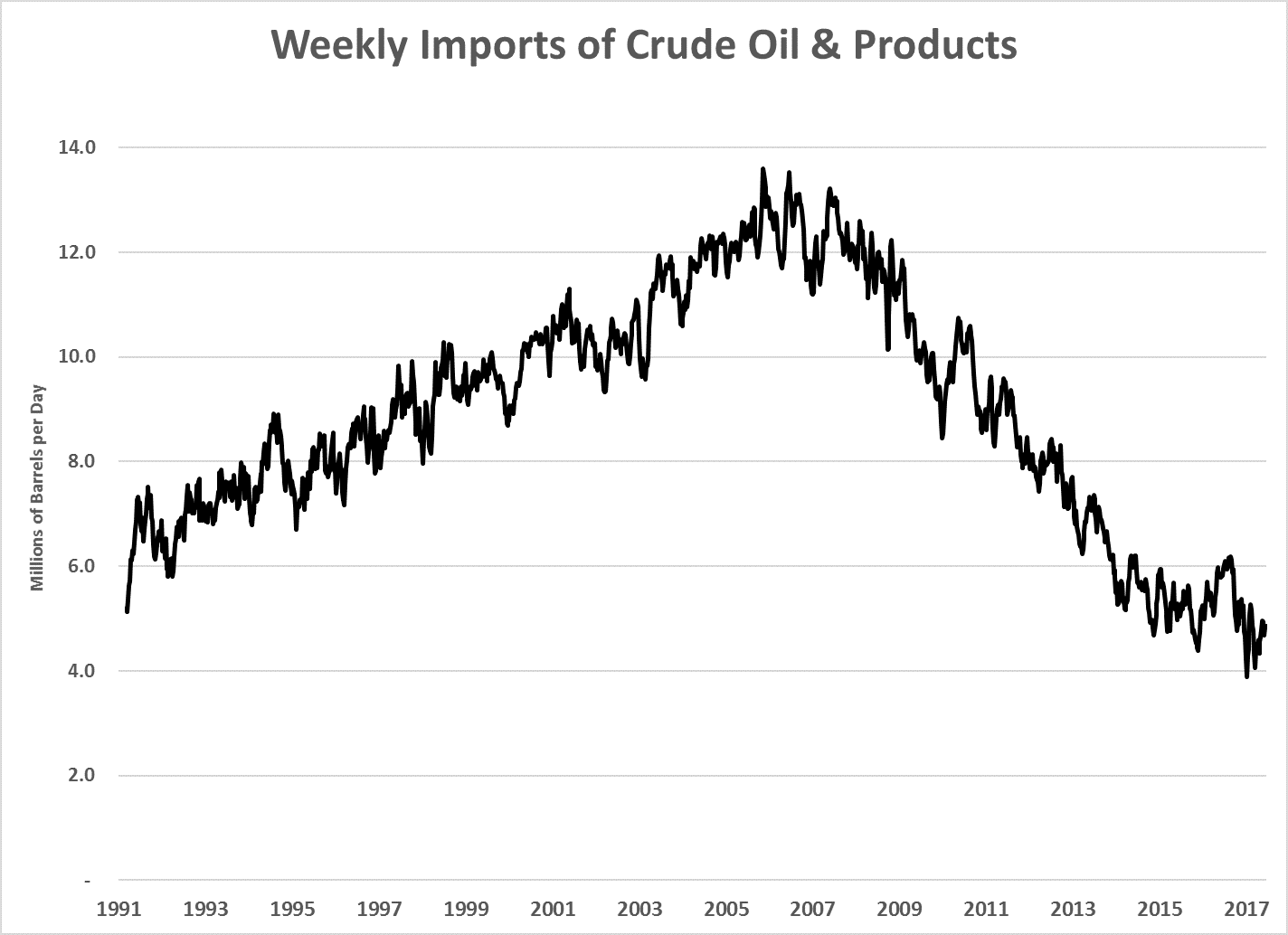

The chart below shows a four-week rolling average of net petroleum imports:

As you can see, weekly imports fell under 4 million barrels per day in April and again in May. That’s well below the 5.1 million barrel per day low we hit in 1991.

However, these data are skewed. Crude oil imports are actually on the rise again.

The boom in U.S. crude oil production over the last few years hasn’t eliminated crude oil imports. U.S. imports bottomed in 2015, when we averaged about 7.3 million barrels per day for the year. That slowly increased. In 2017, we average about 8.2 million barrels per day.

Most of that crude oil, about 43%, comes from Canada.

The reason net imports are down so much is due to the massive export volume of refined products. We export an enormous volume of fuels and refined oils.

U.S. refiners are running at maximum capacity right now. They processed 17.7 million barrels per day in May, a record volume. The industry only exceeded 17 million barrels per day 24 times since 1990, according to the Energy Information Administration.

The refining industry exploded into action as new oil production boomed in the U.S. Exports of refined products averaged 2.4 million barrels per day in 2011. They are over 4.8 million barrels per day so far this year.

Refiners are the hands-down winners of the oil sector with the low oil prices today.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist