It feels like every few weeks there’s a new reason to sell your stocks.

And worries over rising rates are the latest development getting investors to sell perfectly fine shares of stock.

Wall Street analysts are pointing to rising interest rates as the reason we’re seeing growth-oriented stocks fall while more value stocks rise.

You’re likely seeing a lot of red in your portfolio. The talking heads in financial media think that interest rates are the main reason. But the truth is that these corrections are natural after high run-ups.

If you’ve been investing for a while, you’ve probably noticed Wall Street’s hype machine is always trying to shake you out of your stocks for cheap … only for you to see those stocks bounce back over the next few weeks.

Don’t give the market what it wants, that would be buying high and selling low. These dips of 5%, 10% or even 20% are healthy pullbacks for these stocks.

I’m expecting the stocks that have fallen over the past few weeks to come roaring back.

Last week, I talked about how strong earnings throughout 2021 will help propel the markets higher.

Consumers are also getting another stimulus check this week to spur spending.

All of this is good news for stocks.

But if you are worried about rising rates, then you are looking in the wrong direction.

The truth is that the one interest rate that matters is signaling something totally different. It’s good news for us as investors. And we have an exchange-traded fund (ETF) that will reap the benefits…

It’s Not Time to Think About a Crash

Everyone that is talking about rising rates is referring to the 10-year Treasury yield, which has moved from 0.5% in August 2020 to around 1.5% today.

Yes, that’s a big move in a short amount of time. But think back … the 10-year yield has only been at this level three times before: July 2012, July 2016 and October 2019.

Do those dates ring a bell for a massive crash?

Nope.

Now, that’s partially because interest rates were falling to those levels. Rates dipped even lower during the pandemic, and are bouncing back.

But rates are still historically low considering the 10-year yield never fell below 3% until the 2008 crisis. And the small rise we’ve seen over the past few months is by no means a sign of concern.

But if you’re looking to interest rates as a signal for what’s going to happen next, the 10-year Treasury rate is the wrong one to look at.

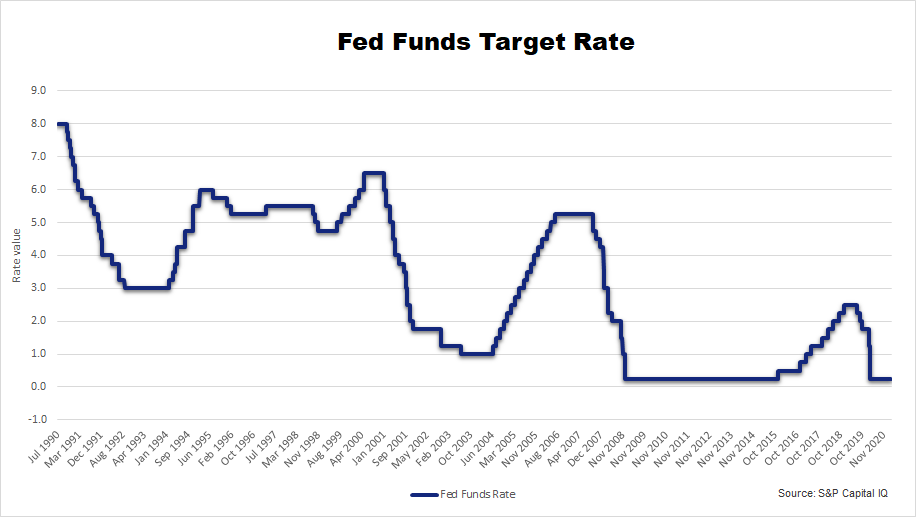

The only rate that matters is the Fed Funds Target Rate.

The Federal Reserve sets the benchmark overnight rates at which commercial banks can borrow and lend their excess reserves.

This is what the Federal Reserve uses to stimulate the economy. With low rates, banks are encouraged to lend more money cheaply, which in turn allows businesses to lower their costs and grow their sales.

The current target rate of 0.25% is extremely low and it’s supporting economic growth.

And the last time the target rate dropped to 0.25% was December 2008. Take a look:

The interest rate cut in 2008 helped spur the economic recovery we saw for the next decade.

And just a year ago, in the midst of the pandemic, the Fed cut rates once again to 0.25%. Today, there’s no indication the Fed is going to raise rates for at least the next two years.

By looking at the Fed Funds Target Rate, we know the Federal Reserve is still looking to stimulate the economy. And that means we’ll likely see higher stock prices from here. It’s not the time to think about a crash.

And even better, even when the Fed was raising rates from 2016 through 2019 and we saw some volatility, buying on those dips paid big bucks — the S&P 500 Index suffered its first 20% correction in a decade only to post a 30% rise in 2019.

In short, rising interest rates are not going to kill this bull market.

And the only one we care about is still sitting at next to nothing.

How You Can Take Advantage

The market is likely to rebound over the next few weeks.

That’s why I recommend buying the dip right now.

The Dow Jones Industrial Average is roaring to record highs practically every day, while the S&P 500 is already back to all-time highs after a brief 5% dip. But the tech-heavy Nasdaq 100 Index is still down more than 5% after an 11% drop.

And those tech stocks are starting to bounce back as I write this, which means it’s time to jump in.

Last week I mentioned the VanEck Vectors Semiconductor ETF being a great spot to look.

This week, we turn to the popular Invesco QQQ Trust (Nasdaq: QQQ). This fund was designed to mirror the Nasdaq with a large focus on the tech industry. Again, the Nasdaq is the only major index failing to make record highs right now.

We’ll look for that index to be one of the strongest performers over the coming months as investors build up an appetite for these beaten-down tech stocks. We can expect to see a 7% rally as it catches up with the other indexes and gets to an all-time high. And I think it will run higher from there.

But we can do even better…

If you are looking for even faster gains than a 7% gain in a few months, then you need to take a look at options. They give you the potential to turn a modest 7% move into gains of more than 70%. And a 20% move can grow to a 200% gain when you use options.

They are a powerful investment tool that works great in volatile times like these — especially after stocks have been beaten down.

I host a free weekly letter walking you through options trading every single week.

Click here to join today and begin using options to grow your portfolio.

Regards,

Editor, Quick Hit Profits