Some call it highway robbery … but tyranny is more accurate.

And the worst part? Most people don’t even notice it happening.

I’m talking about management fees. This is the money that financial advisers take straight out of your account every time they sell stocks or mutual funds for you.

You see, many Americans turn to Wall Street advisers to grow their money. It seems like a smart thing to do.

I get it.

Most people of older generations expected to live off the interest from their retirement investments as they age. But with interest rates at nearly zero these days, being able to live off your interest is a distant memory. Putting your hard-earned dollars to work in a savings account, CDs or Treasury bonds no longer pays the bills.

Just think … a $100,000 retirement account used to pay $10,000 a year. Now, it only pays about $1,500. That’s an 85% pay cut!

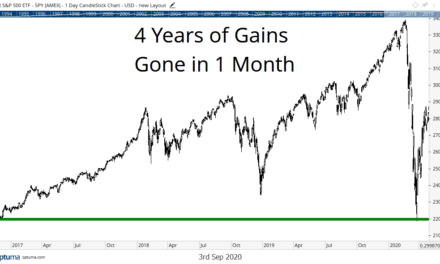

It’s no wonder most people now look to the stock market to make money. After all, the market goes up an average of 8% a year.

But the biggest mistake you can make is to trust Wall Street to help you get into stocks — because its fees will eat up your retirement.

Take Control of Your Own Financial Future

Many advisers charge a 2% fee for managing your invested assets. Now, a 2% management fee might not sound like a lot. But remember, the single greatest weapon in investing is time and patience.

And over time, that 2% sure adds up.

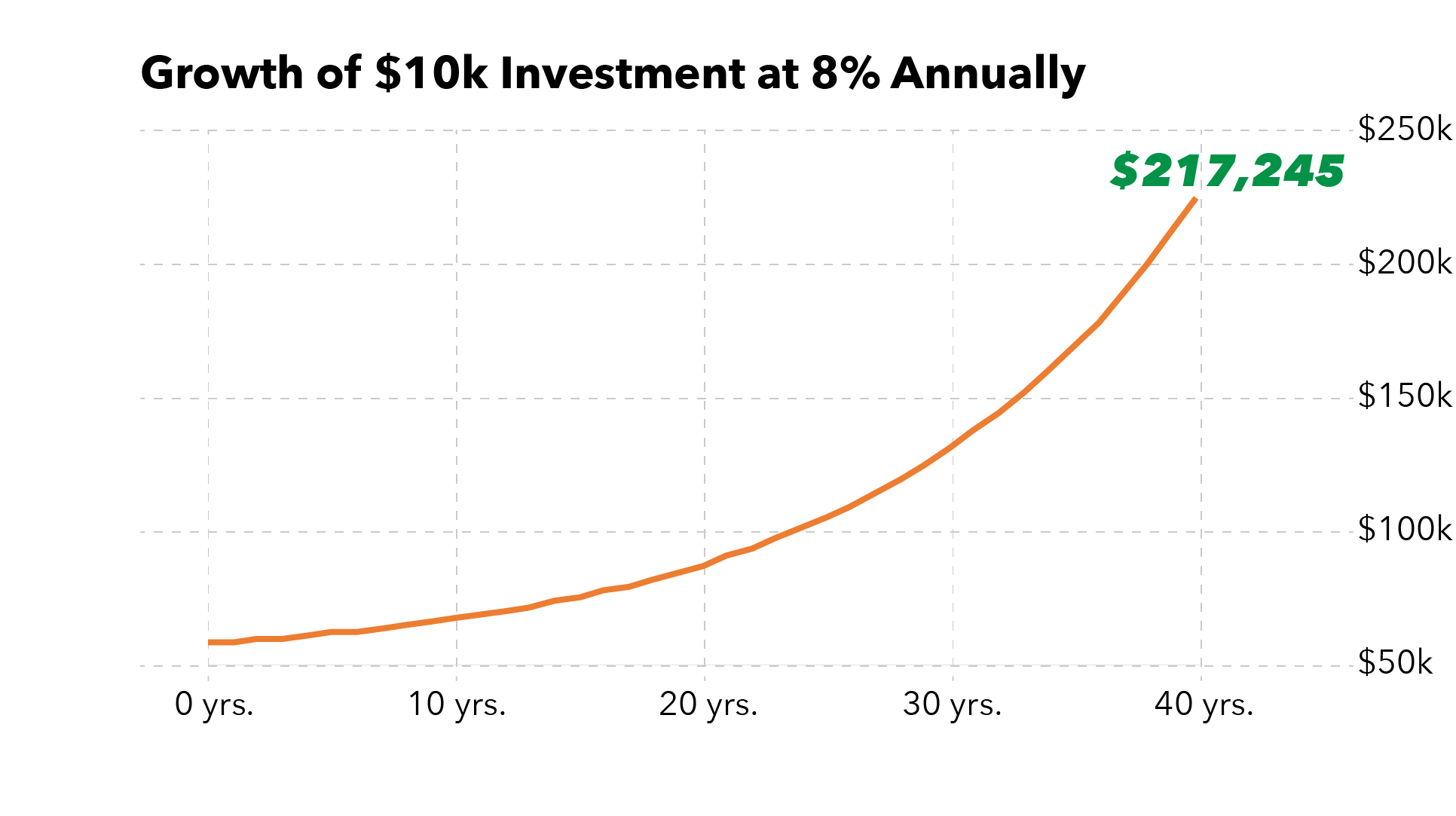

For example, let’s look at a $10,000 nest egg. Let’s say that money gets put in an index fund with gains reinvested for 40 years.

At an 8% annual return, it would turn into over $217,000:

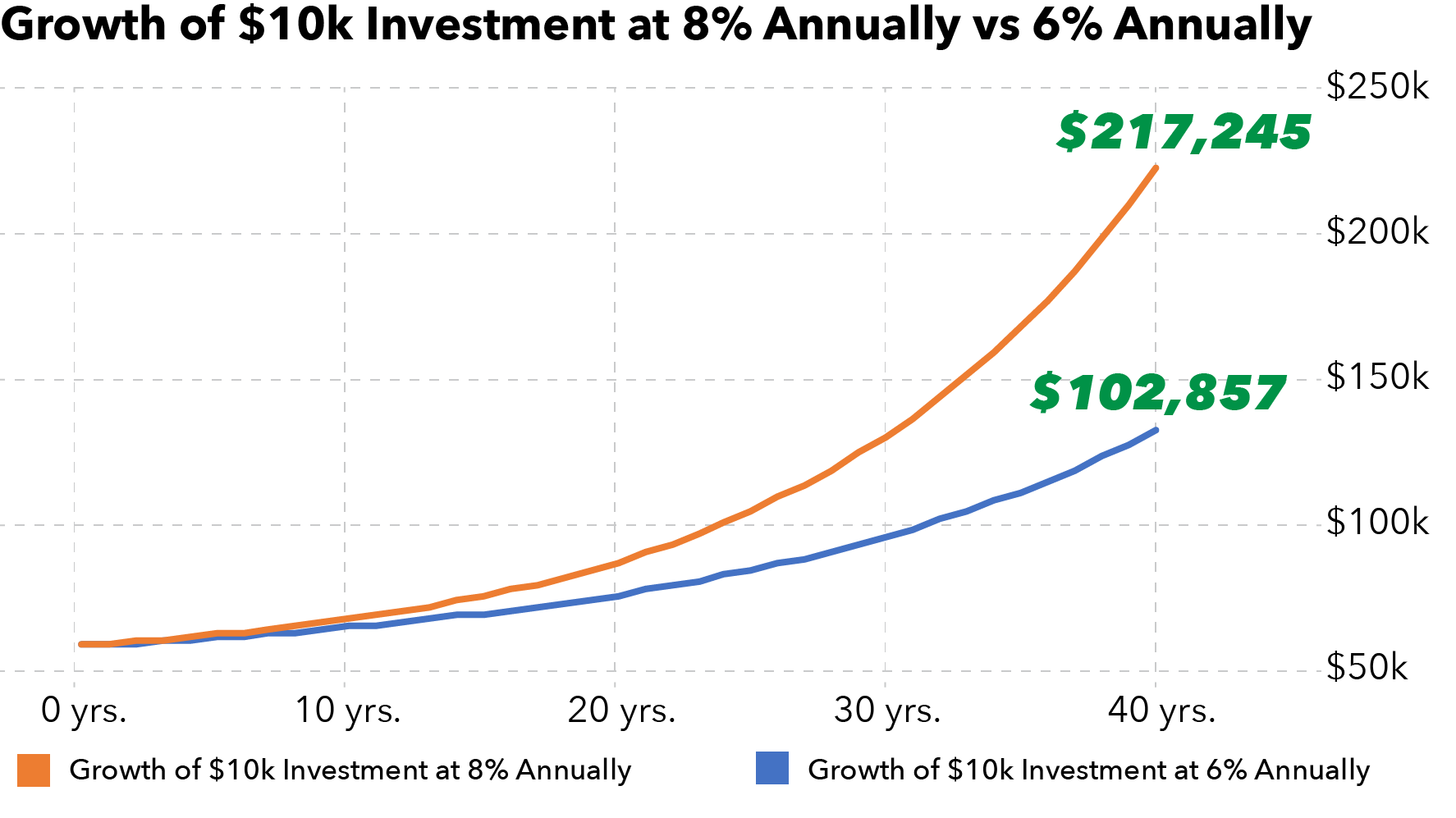

That’s not too shabby. But a 2% management fee means that 8% is cut down to just 6%. And over the same 40 years, that $10,000 will only turn into about $103,000:

So, over time, that 2% can easily cut your profits in half … or even more.

Like I said, Wall Street’s fees are basically robbery.

And Alpha Investor Editor Charles Mizrahi agrees. He used to work on Wall Street and he saw it firsthand. These days he’s using his experience to help average investors. And he believes fees like this are a direct threat to our financial freedom and our dreams of American prosperity.

Millions of Americans give sweat, work and dedication to their jobs and this nation. They deserve better. That’s why Charles is on a mission to give back to Main Street investors just like you — and help them make their financial dreams come true.

He knows that there’s a better way for hardworking Americans to grow their money. You see, he has an approach for finding the best stocks out there … without having to rely on Wall Street.

It’s his Alpha-3 Approach that he uses to identify the best companies trading at bargain prices. It makes investing simple, fun and profitable. And it can be your secret weapon to beating the market — and reclaiming your financial future from Wall Street.

So, on September 8, Charles is doing a deep dive on this approach and how it can help you rekindle your American dream. It’s an event called the American Prosperity Summit. Be sure to spread the word and stay tuned!

We’ll let you know as soon as it goes live.

Regards,

Managing Editor, Alpha Investor

P.S. Let us know what your American dream is. Tell us what you’d do with your nest egg profits by sending us an email at WinningInvestor@BanyanHill.com.