Editor’s note: Today, we’re bringing you one of our readers’ favorite articles of 2020. It’s timeless wisdom from Alpha Investor Assistant Managing Editor Nicole Zdzieba. She walks you through exactly why readers should ignore the noise in the markets.

Don’t pay attention to the hype — it’s patient investors who make the real profits.

She will show you how with a real-world example. Read on… — Annie Stevenson, Managing Editor, American Investor Today

“The stock market is a device for transferring money from the impatient to the patient.”

In just one sentence, Warren Buffett summed up the single greatest advantage of the Main Street investor over Wall Street.

Buffett is the greatest investor of all time. He’s known as the “Oracle of Omaha” and is one of the richest people on the planet.

When he speaks, we listen. He knows what he’s talking about.

So, what did he mean by that quote?

Well, he made his fortunes by knowing when to invest and when to stand on the side.

To put it simply: Patient investors — those who invest over the long term rather than the short term — are the ones who make the real money.

And one can only have patience in the market if they appreciate the power of time.

You see, the big wigs on Wall Street need to show performance.

They don’t have the patience to invest over the long term. They need to outperform the S&P 500 Index over shorter periods or they’ll lose clients. And they often miss out on great opportunities because of it.

Main Street investors, on the other hand, don’t have to rush. We have patience. We can tune out the noise and have confidence in our investments.

And that is what gives us an edge over Wall Street every time.

Taking Advantage of Your Edge

When it comes to the volatile market we invest in, incredible long-term opportunities come up all the time. These are the ones that Wall Street passes up in fear of short-term volatility.

For example, back in 2011, Microsoft Corp. (Nasdaq: MSFT) was tossed in Wall Street’s unloved and unwanted pile.

Analysts had doubts about it moving its services to the cloud.

But that same year, Charles Mizrahi — a Wall Street veteran — recommended it to readers in a service he published at the time.

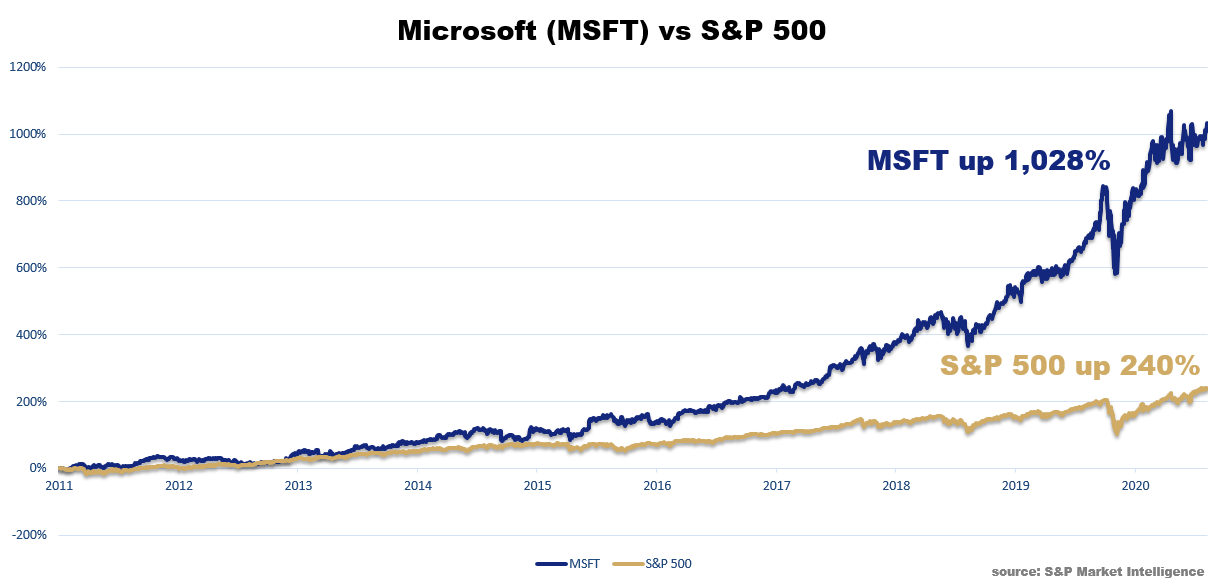

If you’d gotten in back then … you’d be up about 800% when he recommended selling it. And you’d be up 1,028% today!

You see, Wall Streeters couldn’t afford to be patient and see how it would play out. So, they sold.

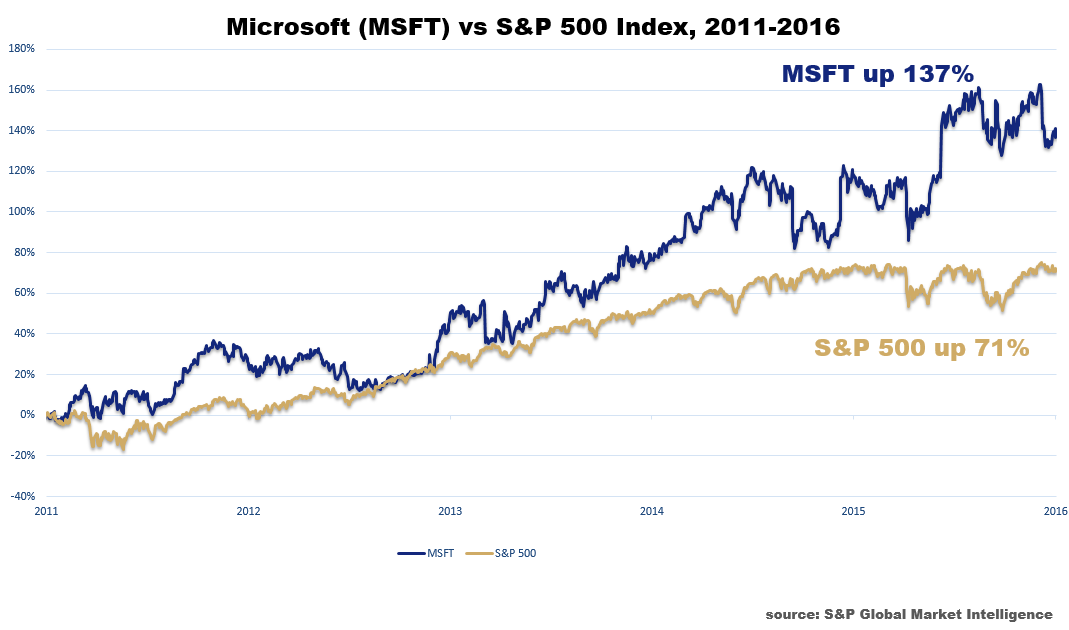

But you didn’t have to hold on to Microsoft for nearly a decade to see profits from your patience. If you’d bought in 2011 and been patient for just five years, you still would have nearly doubled the gain of the market. You’d be up over 130%:

There will be downturns. But as Wall Street sells, you can hold. Along the way, there will be dips and valleys. Wall Street traded in and out the whole time. But investors with patience made real money. And they did it without stress.

Charles wasn’t concerned about the falling stock price back in 2011. It made Microsoft an even greater bargain.

And he takes this same attitude with every selection he makes in his Alpha Investor research service.

Because he knows that with any stock that fulfills the criteria of his tried-and-true Alpha-3 Approach, it’s only a matter of time:

- 1: Alpha Market. He looks for businesses that will profit from riding tailwinds of mega trends in major industries.

- 2: Alpha Manager. He looks for businesses with rock star CEOs at the helm — managers with excellent performance history.

- 3: Alpha Money. He looks for stocks that are trading way below the underlying worth of their businesses.

Once you buy a stock that passes all three of these filters, there’s only one thing left for you to do: wait.

While Wall Street priced Microsoft based on where it was at the moment, Charles priced the company based on where it was headed. And that made all the difference.

Remember, patience is your edge.

So don’t let the short-term noise shake you out of a long-term position. Just sit back and wait for Wall Street to transfer profits from the impatient to you.

In fact, it’s this kind of patience that’s allowed members of Alpha Investor to see gains up over 30% in 16 months, 50% in 11 months and 100% in 19 months.

And with the opportunities Charles is setting up, you could see even better returns.

For a chance at this — and for access to his entire model portfolio — all you have to do is subscribe to his Alpha Investor research service.

Don’t miss out on this!

Regards,

Nicole Zdzieba

Assistant Managing Editor, Alpha Investor