It’s not a secret: The country is polarized.

So, everything creates controversy. Without polarization, tax cuts should be popular. But, today, lower taxes are a cause of concern.

Lower taxes are typical of many debates. We want something for ourselves, but want to punish others.

Most of us want our taxes cut. But some of us want taxes increased for other people. In the latter group, some are angry about reductions in corporate rates.

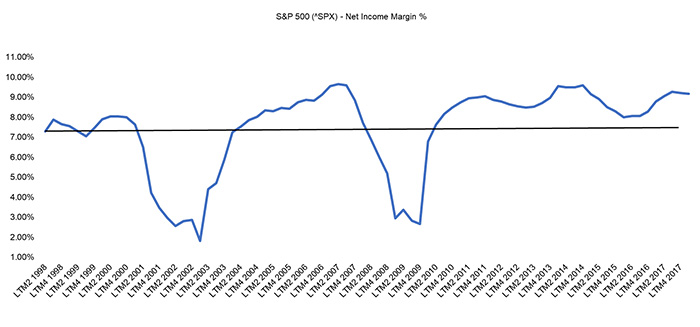

They argue corporations are seeing record profits because of the cuts. But the chart below shows corporations are not really making record levels of profit.

(Source: Standard & Poor’s)

This is the net profit margin of the companies in the S&P 500 Index. The net profit margin is the percent of profit on every dollar of sales.

Tax Reform Windfalls

The first quarter of 2018 is the first quarter under new tax rules. Analysts expect a net margin of 9.16%. That is the lowest level in three quarters.

The horizontal line in the chart is the long-term average of 7.45%. But the average is misleading. It’s low because of the deep dips during recessions.

Since the recession ended in 2009, the average profit margin has been 8.85%. That’s close to the current level.

Remember, the net profit margin shows how much companies make after subtracting all costs, including taxes. Higher raw materials and labor costs more than offset the lower tax rate last quarter.

Now, back to that idea of record-high profits. That is true. But it’s a sign of economic growth.

The economy is larger than it ever was. That means sales are higher than ever, in dollar terms, and so are profits.

But net margins are well below record levels. This is a sign that companies aren’t raising prices to offset costs. Companies are absorbing the cost, reasoning that it’s better to receive a smaller profit margin on a higher volume of sales.

When we see higher net margins, it could be time to review corporate citizenship. But, for now, companies are doing their best to maintain low prices in the face of rising inflation.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader