Gold vs. Bitcoin?

Lots of people have been asking: gold vs. bitcoin? Which should I add to my portfolio? And how much of it should I have?

This is no small wonder. Bitcoin is the boom speculation of 2017.

We have crowds on Wall Street shouting for it to march straight to $20,000 and beyond. Other crowds are shouting that it’s a bubble ready to pop.

We have the Winklevoss twins hailed as the first bitcoin billionaires.

CME Group and CBOE Global Markets are chomping at the bit to offer bitcoin futures.

And the IRS is gunning for its cut of the bitcoin gains.

If the media headlines are anything to go by, bitcoin has become a holiday party and an “end of the world” party all rolled into one. All the attendees are drunk and exuberant … and sure their outlook for cryptocurrency is the right one.

But I want to take a step back from the party to talk about where bitcoin belongs in your portfolio…

Don’t Call Bitcoin a Safe Haven

I’ve heard the chatter. “Bitcoin is going to replace gold.”

I want to call hogwash on that, but I’m going to bite my tongue. Is bitcoin going to replace gold as the safe haven investment for your portfolio? No, not right now.

The cryptocurrency lacks the stability and reliability needed to attain the crown of safe haven. Bitcoin has rallied from $758.81 to $12,921.52 over the past year. A stunning gain of 1,601%.

We saw it drop 21% from November 8 through November 12.

And bitcoin doesn’t produce anything. Its price is based purely on what other people want to pay for it. And when people aren’t willing to pay that next price hike — and we will finally reach that point — bitcoin’s price will tumble.

At its heart, bitcoin is a speculation. It’s a bet. It’s a chance to risk a sum of money on the belief that something will happen.

You see that? Speculation. Bet. Risk.

Those aren’t words that you’d normally associate with a safe haven investment.

The goal of a safe haven investment is to serve as a place to store your wealth so that it retains its value and potentially even grows in value during times of market, economic and/or geopolitical turmoil.

Bitcoin is still too new to know how it’s going to fare in the next market crash. The next recession. The next massive bubble popping.

But there is an alternative for your wealth when the market collapses…

Gold Is The Shining Beacon for Your Portfolio

I’m not even finished writing this article and I can hear the groans…

She’s gonna talk about gold again.

Gold is a safe haven, and it has had that illustrious status for thousands of years. The yellow metal has proven time and again that in times of turmoil, it retains and gains in value. Investors, and even noninvestors, load up on gold when they are uncertain about the future.

Gold is tangible. You can own and store gold coins, bars and jewelry.

Where bitcoin is a series of ones and zeroes on a computer. It only becomes a tangible thing when you convert it into another currency and withdraw that money.

And when the market is collapsing, there will be a psychological reassurance in possessing that physical gold.

The metal certainly hasn’t been abandoned by investors despite the rush into bitcoin. Gold is up nearly 10% since the start of 2017. That’s not bad at all considering that the Dow Jones and Nasdaq Composite are both up more than 20%.

Investors are still adding gold to their portfolio.

And if you haven’t already, now is a great time to do the same.

Ride the Gold Wave Higher

The mood is starting to shift toward the yellow metal on Wall Street.

JPMorgan recently released its outlook for 2018 and stated it expects gold to average around $1,340 an ounce by the second half of 2018 while spending the first half around $1,295.

Hedge fund traders have started to move back into gold. The latest Commitment of Traders report ending November 28 from the Commodity Futures Trading Commission showed that Comex gold futures increased by 21,226 contracts as traders added long bets, while short bets dropped by 4,159 contracts.

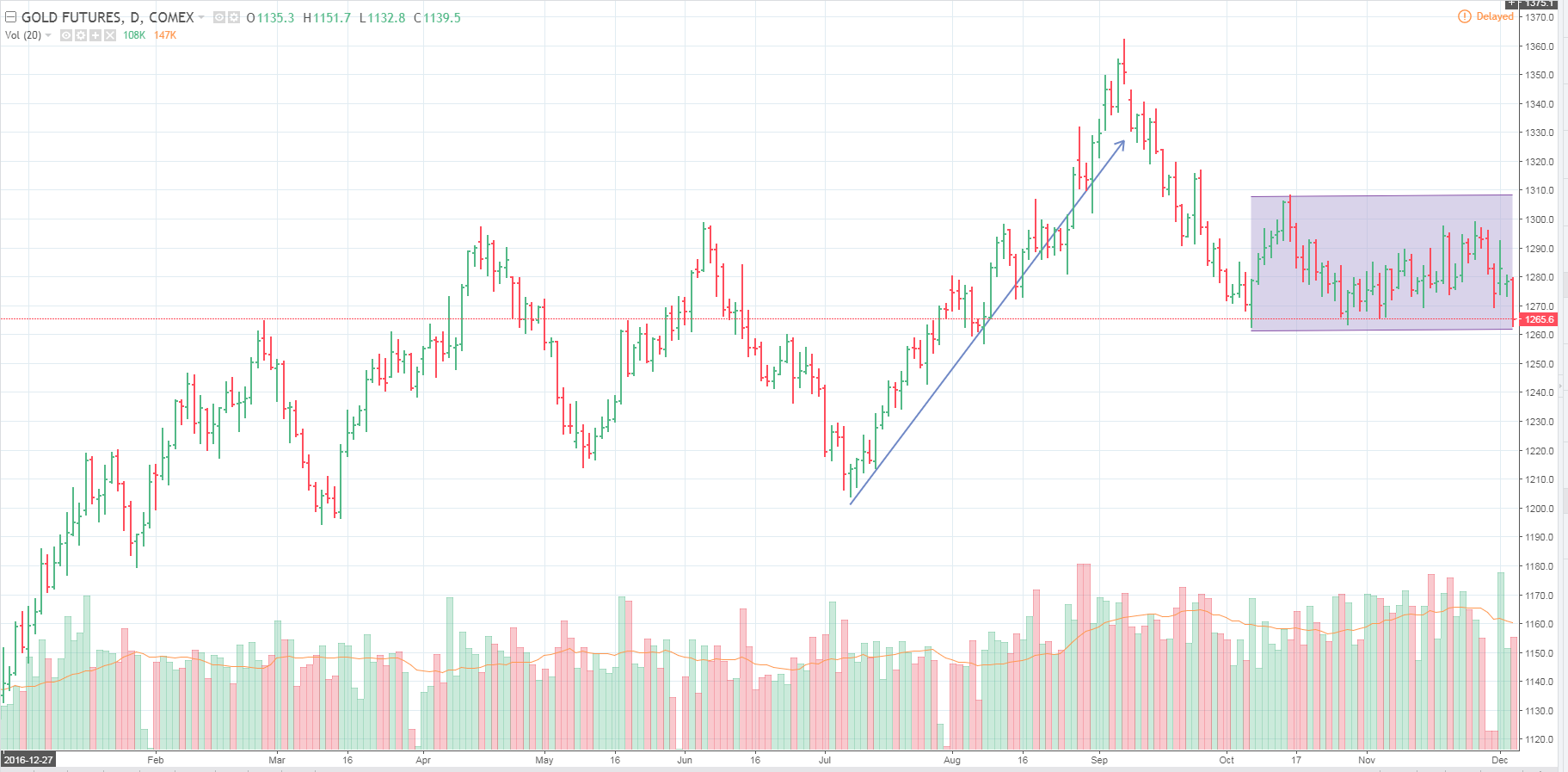

And looking at a chart of gold futures, we find after gold rallied from its July low to its September peak, it has consolidated along support in the $1,265 level. That would mark a 50% retracement from its low to its peak. In short, sturdy support from which to launch a new rally.

Gold Futures

When it comes to making sure that your portfolio is properly balanced, you need to limit your speculative ventures — such as bitcoin or other aggressive trades that aim for big wins — so that you can rely on your safe haven in the event that the market can’t continue on its upward course.

And gold is that safe haven.

So gold vs. bitcoin? Even if you have some speculative investment in bitcoin, adding physical gold bullion to your portfolio isn’t hard, and it will smooth out the rough patches that inevitably come down the road.

Regards,

Jocelynn Smith

Sr. Managing Editor, Sovereign Investor Daily

P.S. Physical gold offers a safe haven for investors, but if you’re looking to add more exposure to the natural resources sector, look no farther than expert Matt Badiali. In his latest special report, Matt has identified five amazing investments that not only produce a steady stream of income, but offer great growth prospects as well. To get your copy of the report, click here.