Latest Insights on REV

How to Day Trade for a Living January 14, 2026 Tim Sykes Daily Day trading is a fast-paced, high-risk, high-reward form of trading where traders buy and sell stocks within a single trading day. The goal? To profit from short-term price fluctuations. With the right strategies and discipline, it can be a profitable venture.

How to Day Trade for a Living January 14, 2026 Tim Sykes Daily Day trading is a fast-paced, high-risk, high-reward form of trading where traders buy and sell stocks within a single trading day. The goal? To profit from short-term price fluctuations. With the right strategies and discipline, it can be a profitable venture. A New White House Initiative: Billions In Cash January 13, 2026 Tim Sykes Daily Every month, there’s a new sector spike due to an institutional catalyst from the White House. Since the sweeping tariffs began in 2025, we’ve seen non-stop White House-related volatility. Whether you like Trump or hate him … These trade opportunities are worth their weight in gold.

A New White House Initiative: Billions In Cash January 13, 2026 Tim Sykes Daily Every month, there’s a new sector spike due to an institutional catalyst from the White House. Since the sweeping tariffs began in 2025, we’ve seen non-stop White House-related volatility. Whether you like Trump or hate him … These trade opportunities are worth their weight in gold. What I Saw at CES Changed the Timeline for Robots January 12, 2026 Daily Disruptor, Technology Ian King attended the Hyundai Motor Group and Boston Dynamics keynote at CES. What he saw changes the timeline for humanoid robots.

What I Saw at CES Changed the Timeline for Robots January 12, 2026 Daily Disruptor, Technology Ian King attended the Hyundai Motor Group and Boston Dynamics keynote at CES. What he saw changes the timeline for humanoid robots.  This Trade Setup Turned Him Into A Millionaire January 12, 2026 Tim Sykes Daily He sat, staring at his laptop, wondering if he made a huge mistake. The market was open. The stock’s candles flashed on the screen, red, green, then red again. Order numbers flew by on the tape. It came down to $10,000. That’s all he had. Money that he saved skipping dinners out, tirelessly working his […]

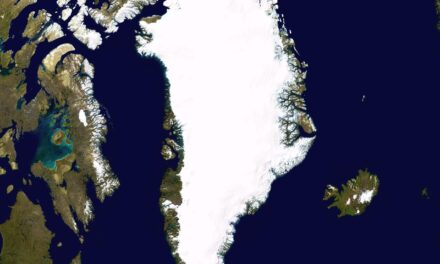

This Trade Setup Turned Him Into A Millionaire January 12, 2026 Tim Sykes Daily He sat, staring at his laptop, wondering if he made a huge mistake. The market was open. The stock’s candles flashed on the screen, red, green, then red again. Order numbers flew by on the tape. It came down to $10,000. That’s all he had. Money that he saved skipping dinners out, tirelessly working his […] Is Greenland Next? January 9, 2026 Daily Disruptor, Economy Ian doesn't see Venezuela as an isolated event. He sees it as the first domino to fall. And he predicted the next domino to fall last year.

Is Greenland Next? January 9, 2026 Daily Disruptor, Economy Ian doesn't see Venezuela as an isolated event. He sees it as the first domino to fall. And he predicted the next domino to fall last year.