Latest Insights on AFRI

What’s The Deal With The Super Bowl Indicator?

What’s The Deal With The Super Bowl Indicator? February 12, 2022 Great Stuff

What’s The Deal With The Super Bowl Indicator? The year was 1989. January 1989, to be precise. Ronald Regan was president. “Two Hearts” by Phil Collins topped the charts, and the original Nintendo Entertainment System (NES) was the most sought-after Christmas gift ever. I didn’t get an NES that year — much like the PlayStation […] The 1 Thing That Could Cause a Stock Market Collapse

The 1 Thing That Could Cause a Stock Market Collapse February 11, 2022 Big Picture. Big Profits., Education, Investing

“Collapse” is the most frightening word in any investor’s vocabulary. It refers to a steep and sudden decline in stock prices much larger than the standard -20% definition of a bear market. Fortunately, such collapses are rare. But they all have one thing in common: liquidity — the presence of willing buyers — evaporates. In today’s video , I explain how these dreaded events occur … and what to watch for when one threatens. What History Has to Say About a Russian Invasion

What History Has to Say About a Russian Invasion February 9, 2022 Investing, Trading Strategies, True Options Masters

Amber is following the Russian-Ukrainian crisis closely — and if the conflict moves beyond diplomatic circles, this is the trade to play it. Angry. Disillusioned. Doomed?

Angry. Disillusioned. Doomed? February 8, 2022 Big Picture. Big Profits., Economy, Investing

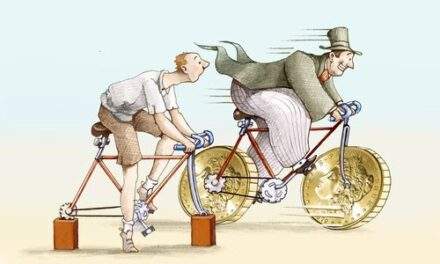

South Africa is drop-dead gorgeous. Its people are the salt of the earth. But it is one of the most unequal societies in the world, which makes it a challenging place to live … to put it mildly. One thing I've learned in my travels is that when inequality reaches extreme levels, dire consequences follow. So, when a new data set on inequality in the U.S. arrived in my inbox, I realized I had the makings of this week's Bauman Daily. If you doubt the relevance to growing and protecting your investments, read on… Don’t Bottom Fish for Speculative Growth Stocks

Don’t Bottom Fish for Speculative Growth Stocks February 7, 2022 Big Picture. Big Profits., Investing, Investment Opportunities, Trading Strategies

In today’s Your Money Matters, Clint Lee gives you the lowdown on areas of the market that are starting to see steep falls from their highs. Does that mean it’s time to go bottom fishing and grab those opportunities? Before you get ahead of yourself, Clint says to take a step back and look at the big picture. Because yes, many speculative areas of the market are tempting and have already seen a 50% peak-to-trough decline, but it’s not what it seems. Clint guides you toward the sectors that have seen true carnage, trade at reasonable valuations and are seeing good expected earnings growth. He also gives you three solid stock picks.