Latest Insights on BILI

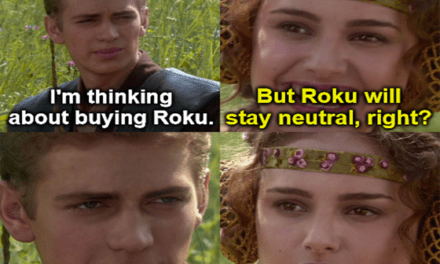

Netflix Needs Roku, Thor’s Lightning Strikes & Campbell’s Cans Can June 8, 2022 Great Stuff Roku’s Superunknown Great Ones, there’s some big news brewing for Great Stuff Picks holding Roku (Nasdaq: ). According to a Business Insider report, Netflix (Nasdaq: ) might possibly have offered a potential takeover bid for Roku. It’s one of those “My best friend’s sister’s boyfriend’s brother’s girlfriend heard from this guy who knows this kid […]

Netflix Needs Roku, Thor’s Lightning Strikes & Campbell’s Cans Can June 8, 2022 Great Stuff Roku’s Superunknown Great Ones, there’s some big news brewing for Great Stuff Picks holding Roku (Nasdaq: ). According to a Business Insider report, Netflix (Nasdaq: ) might possibly have offered a potential takeover bid for Roku. It’s one of those “My best friend’s sister’s boyfriend’s brother’s girlfriend heard from this guy who knows this kid […] Bitcoin vs. Ethereum: Battle of the Cryptos June 7, 2022 Cryptocurrency, Winning Investor Daily By the end of the decade, one crypto could leave the other in the dust.

Bitcoin vs. Ethereum: Battle of the Cryptos June 7, 2022 Cryptocurrency, Winning Investor Daily By the end of the decade, one crypto could leave the other in the dust. How You Can Escape the Fed’s “Teddy Bear Picnic” June 7, 2022 Big Picture. Big Profits., Investment Opportunities, Trading Strategies, U.S. Economy Last week, I wrote that in its quest to defeat inflation, the Federal Reserve wants to make investors like us poorer. The “wealth effect” says happy and bullish investors tend to spend more money than sad and bearish ones. So, as far as the Fed is concerned, plummeting portfolio values are a good thing. But that’s only part of the story...

How You Can Escape the Fed’s “Teddy Bear Picnic” June 7, 2022 Big Picture. Big Profits., Investment Opportunities, Trading Strategies, U.S. Economy Last week, I wrote that in its quest to defeat inflation, the Federal Reserve wants to make investors like us poorer. The “wealth effect” says happy and bullish investors tend to spend more money than sad and bearish ones. So, as far as the Fed is concerned, plummeting portfolio values are a good thing. But that’s only part of the story... The $450 Billion Elephant in the Room June 6, 2022 Big Picture. Big Profits., News, U.S. Economy Regardless of whether the stock market goes up or down, regardless of whether you’ve ever bought or sold options, it’s still crucial to keep an eye on this massive market. More and more investors are keeping an eye on options experts (like our own Clint Lee) to stay informed and one step ahead.

Because today’s options trades could potentially dictate how your stocks trade tomorrow.

The $450 Billion Elephant in the Room June 6, 2022 Big Picture. Big Profits., News, U.S. Economy Regardless of whether the stock market goes up or down, regardless of whether you’ve ever bought or sold options, it’s still crucial to keep an eye on this massive market. More and more investors are keeping an eye on options experts (like our own Clint Lee) to stay informed and one step ahead.

Because today’s options trades could potentially dictate how your stocks trade tomorrow. Capitulation Signals Fed’s Next Big Move? June 3, 2022 Big Picture. Big Profits., U.S. Economy Capitulation is a signal of mass panic among investors. It’s the ultimate washout and tends to precede some of the biggest gains in stock market history. But we just aren't seeing it yet. Instead, since May 20 (after two consecutive months of losses for the major indices) … we’ve seen the complete opposite. Investors are ravenously buying the dip in the latest bear market rally. Yet, as Clint explains in today’s video, you should still keep your eyes out for capitulation. Because when it does come knocking, it will have a massive impact on the Fed's next move.

Capitulation Signals Fed’s Next Big Move? June 3, 2022 Big Picture. Big Profits., U.S. Economy Capitulation is a signal of mass panic among investors. It’s the ultimate washout and tends to precede some of the biggest gains in stock market history. But we just aren't seeing it yet. Instead, since May 20 (after two consecutive months of losses for the major indices) … we’ve seen the complete opposite. Investors are ravenously buying the dip in the latest bear market rally. Yet, as Clint explains in today’s video, you should still keep your eyes out for capitulation. Because when it does come knocking, it will have a massive impact on the Fed's next move.