Latest Insights on DRI

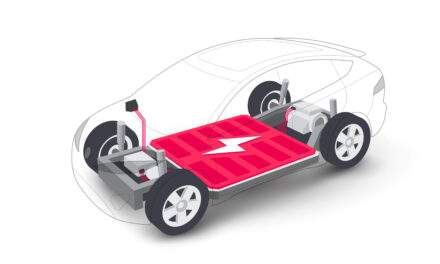

Why Tesla’s EV Batteries and Clean Energy Aren’t So Clean March 1, 2023 Banyan Edge, Electric Vehicles Electric vehicles are advertised as creating “zero emissions." But EV batteries and clean energy aren't as clean as you might think.

Why Tesla’s EV Batteries and Clean Energy Aren’t So Clean March 1, 2023 Banyan Edge, Electric Vehicles Electric vehicles are advertised as creating “zero emissions." But EV batteries and clean energy aren't as clean as you might think. 3 Ways Semiconductor Chips Will Create a Market Boom February 28, 2023 Banyan Edge, Economy, Government & Politics, Investment Opportunities Manufacturing semiconductor chips is like an arms race between China, Taiwan and the U.S. But 3 key factors will soon majorly disrupt this market.

3 Ways Semiconductor Chips Will Create a Market Boom February 28, 2023 Banyan Edge, Economy, Government & Politics, Investment Opportunities Manufacturing semiconductor chips is like an arms race between China, Taiwan and the U.S. But 3 key factors will soon majorly disrupt this market. The U.S. Is Putting China Out of Business February 26, 2023 Banyan Edge, Economy, Investing Uncle Sam is "firing" China, helping put an end to globalization, and bringing about a golden age of American manufacturing.

The U.S. Is Putting China Out of Business February 26, 2023 Banyan Edge, Economy, Investing Uncle Sam is "firing" China, helping put an end to globalization, and bringing about a golden age of American manufacturing. Value Stocks Will Outperform this Pricey Market February 24, 2023 Banyan Edge, Diversified Investments, Stocks What's the connection between "cheap" and "expensive" stocks? Value stocks will outperform the market over the next three years.

Value Stocks Will Outperform this Pricey Market February 24, 2023 Banyan Edge, Diversified Investments, Stocks What's the connection between "cheap" and "expensive" stocks? Value stocks will outperform the market over the next three years. Crypto Isn’t Dead: Blockchain, Web 3.0 & the Internet’s Future February 22, 2023 Banyan Edge, Cryptocurrency, Technology Despite what you may have heard, crypto's not dead. In fact, blockchain and Web 3.0 are ushering in the future of the internet!

Crypto Isn’t Dead: Blockchain, Web 3.0 & the Internet’s Future February 22, 2023 Banyan Edge, Cryptocurrency, Technology Despite what you may have heard, crypto's not dead. In fact, blockchain and Web 3.0 are ushering in the future of the internet!