Latest Insights on GOOG

Come To The Dark Side, We Have Robux! December 18, 2021 Great Stuff What’s The Deal With Roblox? Great Ones, talking about Roblox (NYSE: ) is not what I really wanted to do this fine Saturday morning. As I’ve said before, I don’t like RBLX stock and I really, really … really don’t like the company. If I’m being honest, I’d rather make synthetic hairballs for ceramic cats […]

Come To The Dark Side, We Have Robux! December 18, 2021 Great Stuff What’s The Deal With Roblox? Great Ones, talking about Roblox (NYSE: ) is not what I really wanted to do this fine Saturday morning. As I’ve said before, I don’t like RBLX stock and I really, really … really don’t like the company. If I’m being honest, I’d rather make synthetic hairballs for ceramic cats […] Nio’s Not The One, YouTube’s DISphoria & Speaking Meta-phorically December 15, 2021 Great Stuff Red Dawn: Chinese Edition The time has come, Great Ones, to talk of many things: Of batteries and chips and electric vehicles (EVs) … of cabbages and Xi Jinpings. And why China is boiling hot — and whether Chinese stocks have wings. Great Stuff Picks readers have probably already noticed that our Nio (NYSE: ) […]

Nio’s Not The One, YouTube’s DISphoria & Speaking Meta-phorically December 15, 2021 Great Stuff Red Dawn: Chinese Edition The time has come, Great Ones, to talk of many things: Of batteries and chips and electric vehicles (EVs) … of cabbages and Xi Jinpings. And why China is boiling hot — and whether Chinese stocks have wings. Great Stuff Picks readers have probably already noticed that our Nio (NYSE: ) […] Crypto Can Eliminate Internet Outages Forever December 15, 2021 Cryptocurrency, Technology, Winning Investor Daily Amazon’s historic nine-hour internet outage affected everything from Roombas to online test-taking platforms.

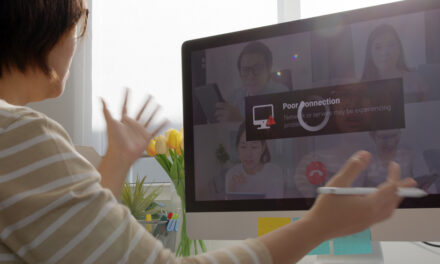

Crypto Can Eliminate Internet Outages Forever December 15, 2021 Cryptocurrency, Technology, Winning Investor Daily Amazon’s historic nine-hour internet outage affected everything from Roombas to online test-taking platforms. Time to Cash Out? December 15, 2021 Big Picture. Big Profits., Trading Strategies, U.S. Economy Break out the games! Every year, when my kids start their Christmas break, we tend to play a lot more games as a family to pass the cold winter days. We have our favorites. Cashing Out The world’s richest often make splashy headlines for their splurges. This time around, it’s about what they’re selling. That’s […]

Time to Cash Out? December 15, 2021 Big Picture. Big Profits., Trading Strategies, U.S. Economy Break out the games! Every year, when my kids start their Christmas break, we tend to play a lot more games as a family to pass the cold winter days. We have our favorites. Cashing Out The world’s richest often make splashy headlines for their splurges. This time around, it’s about what they’re selling. That’s […] Stock Market Jenga: Buy This ETF Before the Tower Crumbles December 14, 2021 Big Picture. Big Profits., Economy, Trading Strategies Good breadth is a sign of a high-quality market. And we just haven’t been seeing that lately. The bulk of the S&P’s gains have come from just five stocks: Tesla, Nvidia, Google, Microsoft and Apple. Meanwhile, more and more stocks keep declining. It’s like a dangerous game of stock market Jenga. The tower is still there, but pull out the wrong block, and it all comes tumbling down. Could a Fed interest-rate hike bring about the big downfall? Ted Bauman and Clint Lee talk about the best- and worst-case scenarios, which types of stocks would be hit the hardest once the Fed pulls back, industries that are likely to do well and the perfect defensive ETF.

Stock Market Jenga: Buy This ETF Before the Tower Crumbles December 14, 2021 Big Picture. Big Profits., Economy, Trading Strategies Good breadth is a sign of a high-quality market. And we just haven’t been seeing that lately. The bulk of the S&P’s gains have come from just five stocks: Tesla, Nvidia, Google, Microsoft and Apple. Meanwhile, more and more stocks keep declining. It’s like a dangerous game of stock market Jenga. The tower is still there, but pull out the wrong block, and it all comes tumbling down. Could a Fed interest-rate hike bring about the big downfall? Ted Bauman and Clint Lee talk about the best- and worst-case scenarios, which types of stocks would be hit the hardest once the Fed pulls back, industries that are likely to do well and the perfect defensive ETF.