Latest Insights on CERN

Don’t Bottom Fish for Speculative Growth Stocks

Don’t Bottom Fish for Speculative Growth Stocks February 7, 2022 Big Picture. Big Profits., Investing, Investment Opportunities, Trading Strategies

In today’s Your Money Matters, Clint Lee gives you the lowdown on areas of the market that are starting to see steep falls from their highs. Does that mean it’s time to go bottom fishing and grab those opportunities? Before you get ahead of yourself, Clint says to take a step back and look at the big picture. Because yes, many speculative areas of the market are tempting and have already seen a 50% peak-to-trough decline, but it’s not what it seems. Clint guides you toward the sectors that have seen true carnage, trade at reasonable valuations and are seeing good expected earnings growth. He also gives you three solid stock picks. Options Arena: The More, the Merrier?

Options Arena: The More, the Merrier? February 6, 2022 Investing, Oil, Options Arena, Trading Strategies, True Options Masters

In today's Options Arena, our experts duke it out on a major movement happening right now: the push to "democratize" investing. The Signal From Junk

The Signal From Junk February 1, 2022 Big Picture. Big Profits., Economy, Investing

That happened fast. Just 15 trading days for the S&P 500 to hit correction territory (at least on an intraday basis) last week, making it one of the fastest in history to kick off a new year. That’s a bit concerning on the heels of a mostly calm 2021, where the S&P 500 barely registered a 5% decline. Does this sudden burst of volatility tell us something about the stock market? Are we now careening over the edge and staring into a bear market abyss? Before you assume that 2022’s bad start is about to turn into something worse, lean on history to guide you. Simmer-Down Sunday: Don’t PUNK With Meta’s Heart

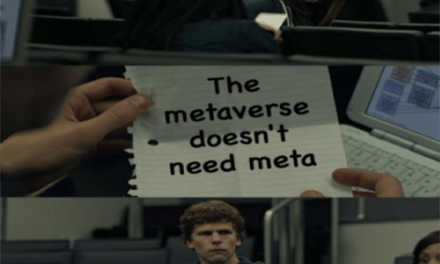

Simmer-Down Sunday: Don’t PUNK With Meta’s Heart January 30, 2022 Great Stuff

We Don’t Need No Meta Nation We don’t need no … Zuck control. Doo-ba-dee-dah … something something. Ahhh, must be Sunday morning again. Welcome! Glad you could join us. We’d never leave you out of the incessant nonsensical rambling. This is Great Stuff — no one gets left behind, right? But out in the metaverse? […] The Fed Kills the Momentum Trade

The Fed Kills the Momentum Trade January 28, 2022 Big Picture. Big Profits., Economy, Investing

In June 2020, Barstool Sports founder and wannabe investor Dave Portnoy infamously said that “stocks only go up.” In 2022? Sorry Dave. In today's video, Ted Bauman walks us through the consequences of the Fed's recent hawkish turn. Even after big declines since the beginning of the year, there's plenty of overvaluation in the market still. Ted reviews the history of stock performance in Fed tightening cycles, which is better than you might imagine. But there's one big fear hovering over the market … what if the Fed is tightening into a downturn? That would be bad and not just for momentum stocks.