In June 2020, Barstool Sports founder and wannabe investor Dave Portnoy infamously said that “stocks only go up.”

In 2022?

Sorry, Dave.

In today’s video, I walk us through the consequences of the Federal Reserve’s recent hawkish turn. Even after big declines since the beginning of the year, there’s plenty of overvaluation in the market still. I review the history of stock performance in Fed tightening cycles, which is better than you might imagine.

But there’s one big fear hovering over the market … what if the Fed is tightening into a downturn? That would be bad and not just for momentum stocks.

Transcript

Hello everyone. It’s Ted Bauman here, editor of the Bauman Daily, with your Friday video. I’ll be leaving for South Africa on Sunday. I’m going to be there for three weeks and I will be continuing to send you my daily emails and recording these videos, albeit with a slightly different background. Hopefully I’ll get some outdoor filming. You’ll be able to see the mountains next to my house there by the beach in Cape town. Looking forward to it.

Today the big news is that the Fed has finally dropped the bomb as they say. Let’s look at what markets have done. The Fed basically announced right around 2 p.m. when the meeting ended, they came out and said, “Well, we’re going to do exactly what you expected us to do.” But for some reason the markets didn’t trust their judgment and decided that they didn’t like what the market said, even though they knew it was going to happen.

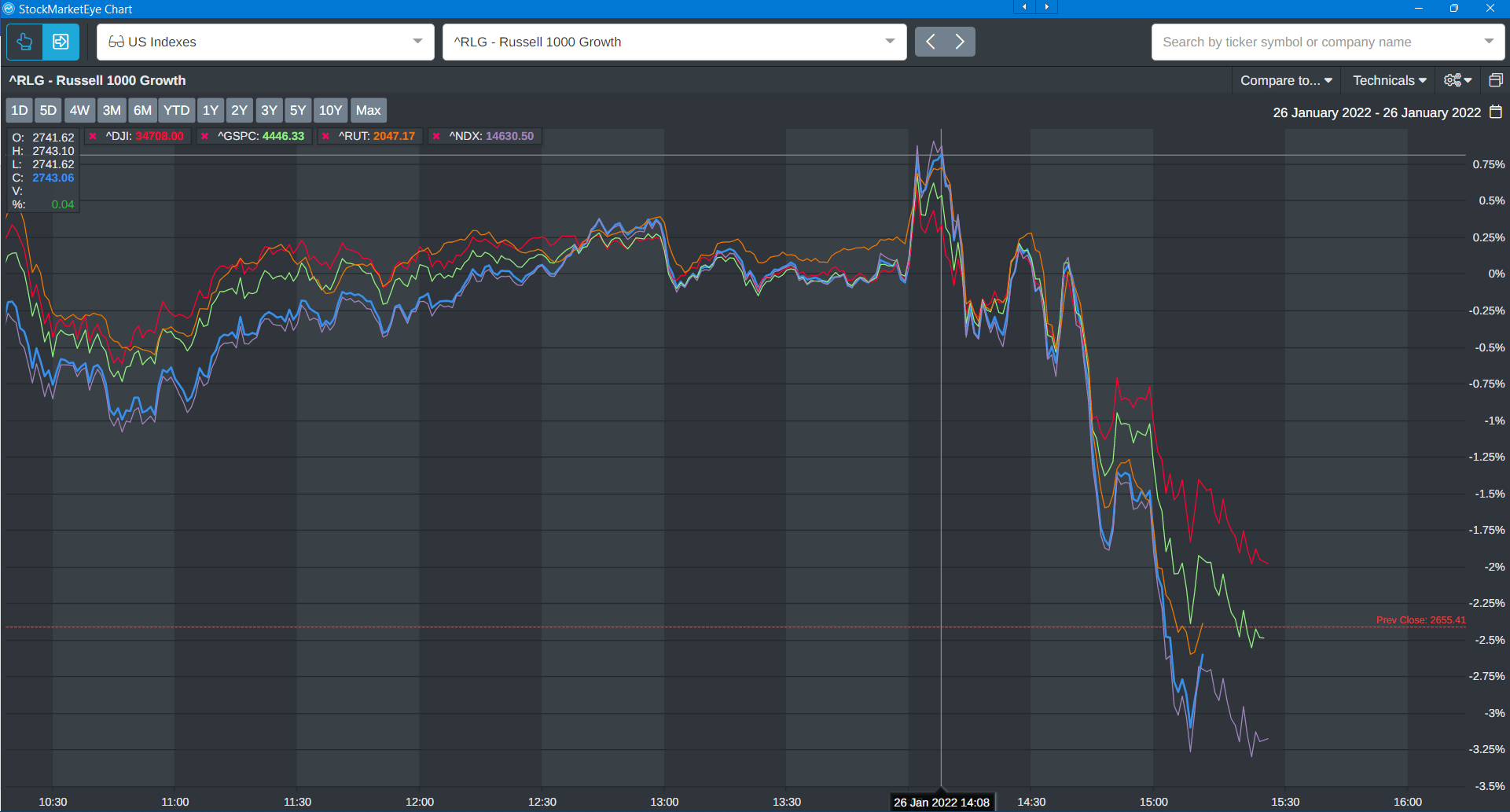

So here’s a chart that shows the Russell 1000 growth, the Dow, the S&P 500, Russell 2000 and the Nasdaq 100, which includes all the big boys, the Microsofts, the Alphabets, the Metas and so on:

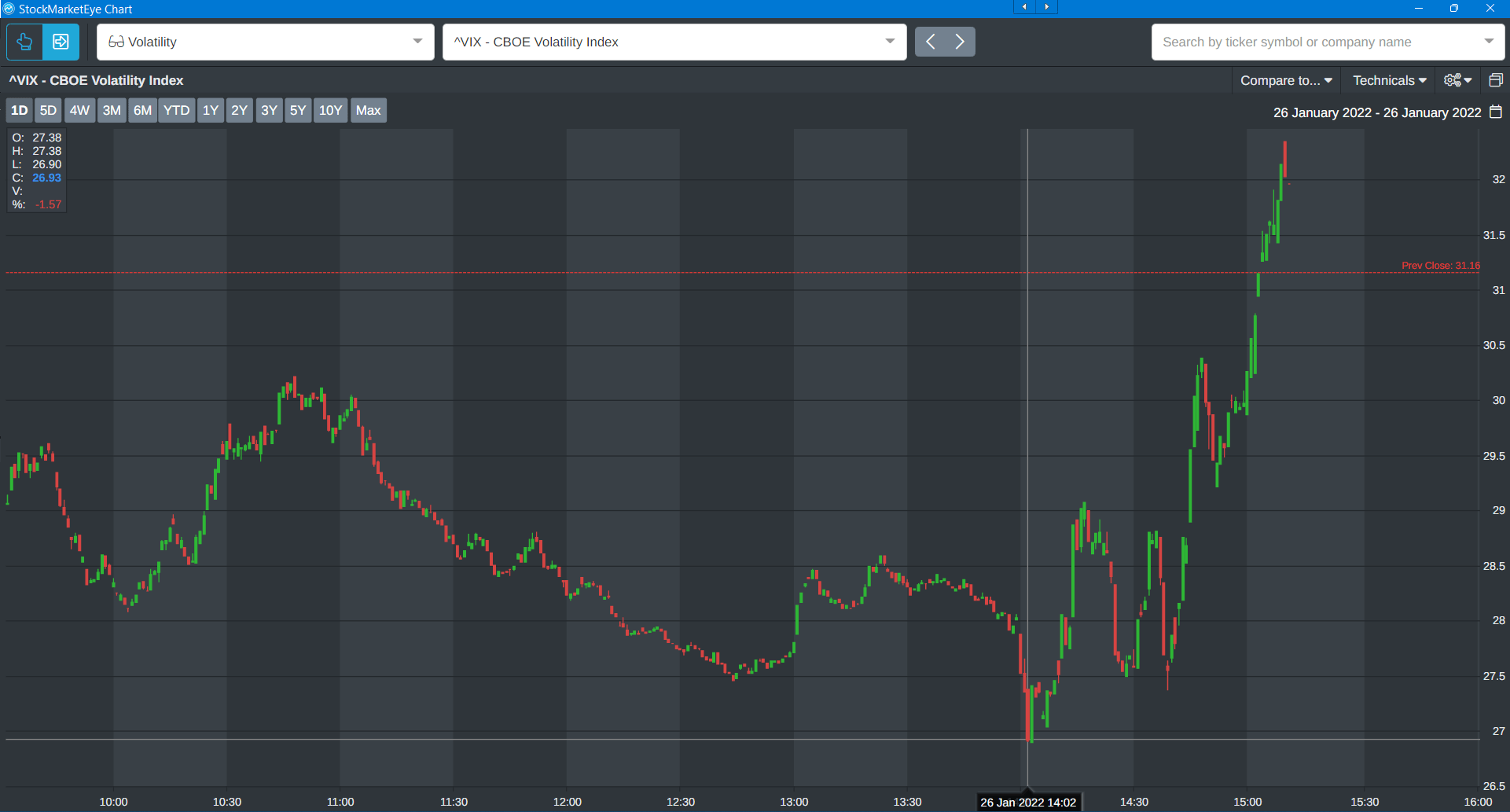

Look at that. They fell off a cliff. Soon as the Fed started reporting on the meeting, as soon as they released the results. Should have seen it coming. I think a lot of people did, but yesterday and today it seemed like a lot of dip buyers got suckered into trying to grab some of the high momentum names that are being pulled back. Here’s the Volatility Index:

The VIX now comfortably above 30. You don’t want to see it just stay above 30, but it’s way above 30 now and you can see again that I’ve highlighted right around 2 p.m., volatility went high.

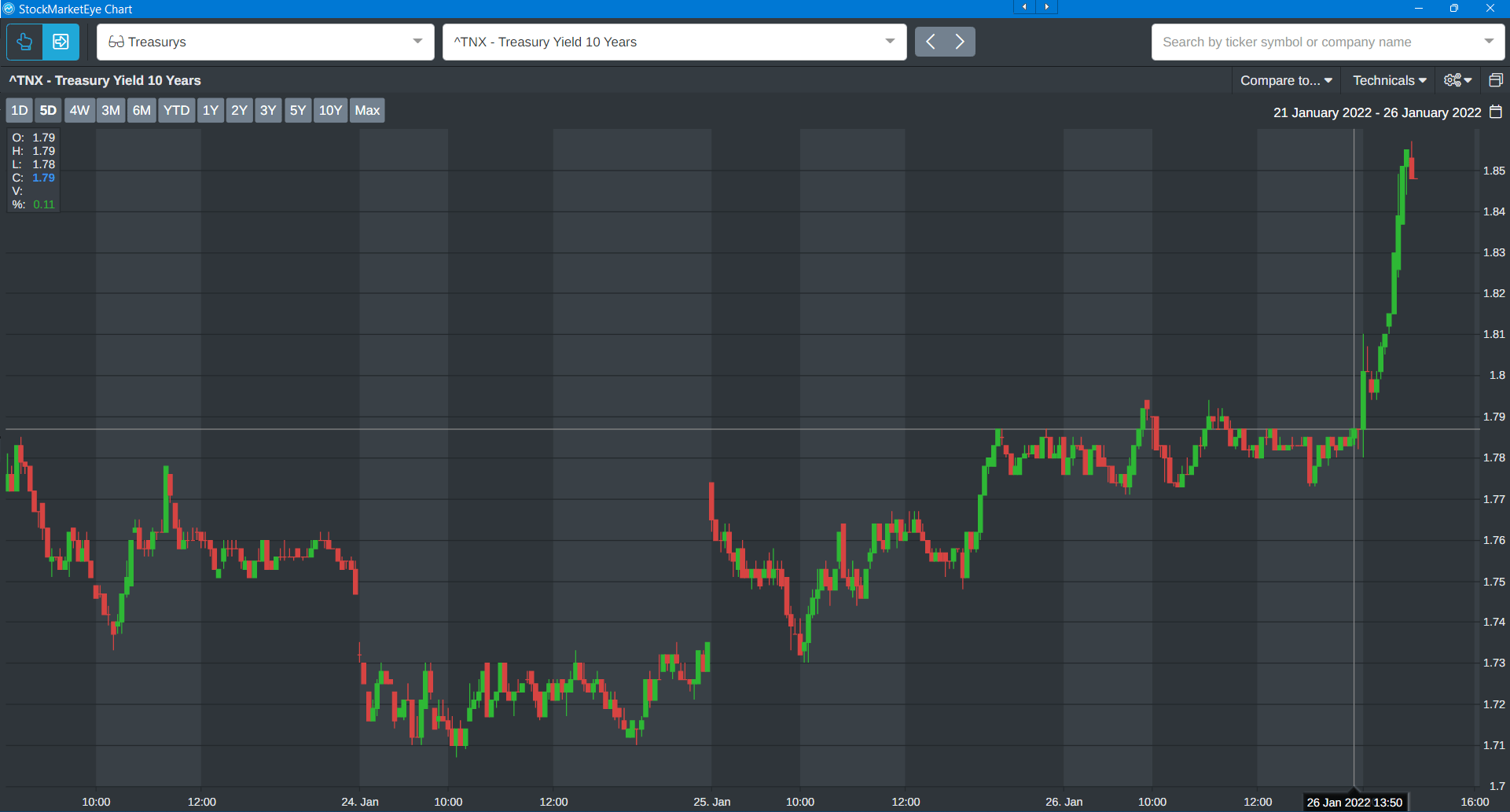

Here’s the Treasury yield again:

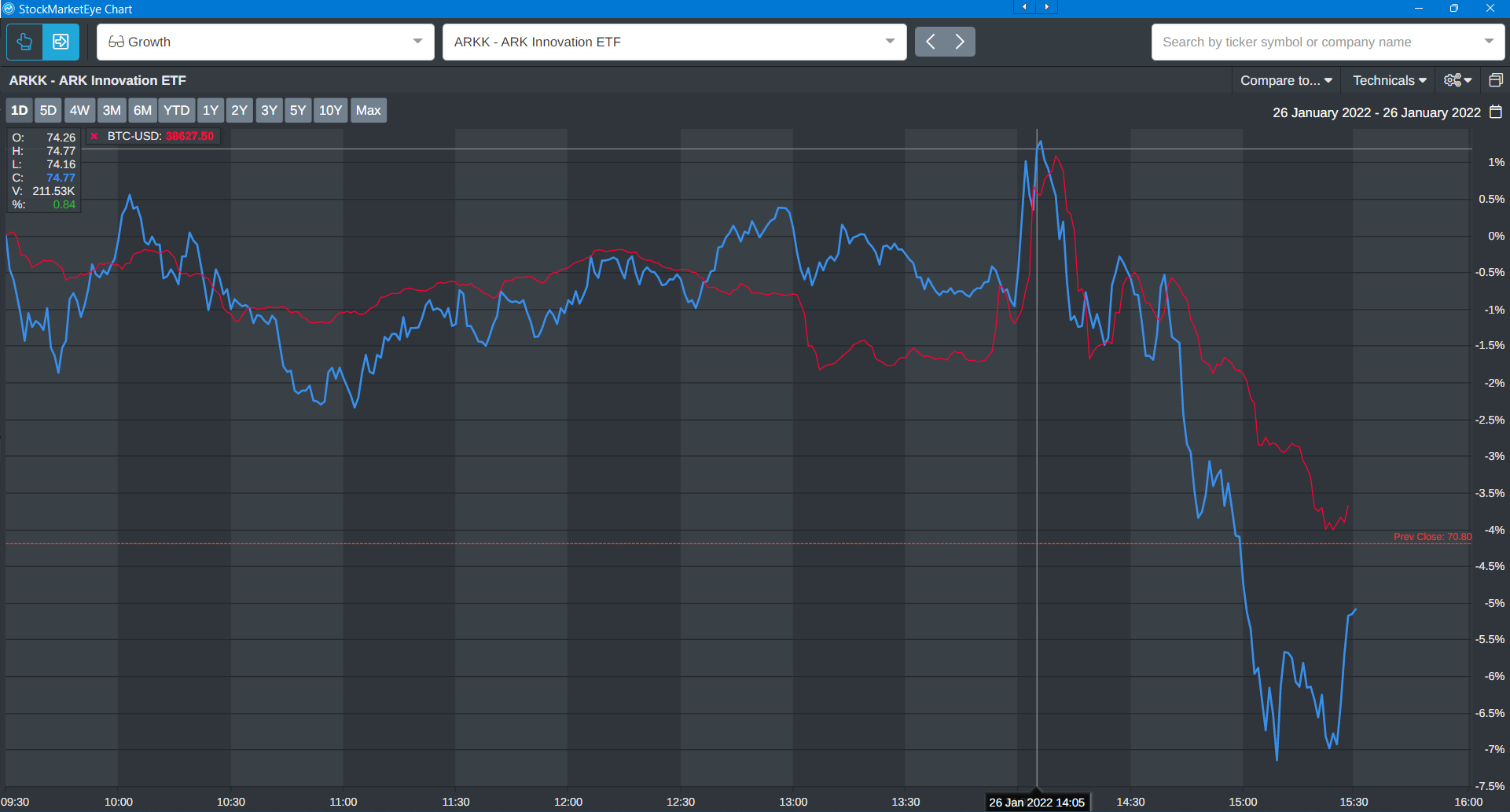

Kind of hard to see why bond markets didn’t see this coming, but now we’re back up into territory that’s pushing up against one point or 2% yield, which is still negative in real terms, but that would scare the bejeesus out of the momentum trade. And just to prove, sorry to keep picking on ARKK, but basically the reason I show this chart is because I want to just point out that bitcoin is not going to be spared here because there are some people who believe (for no reason I can understand) that Bitcoin is a non-correlated asset or it should be digital gold. So it should rise when there’s trouble in the markets. It’s not, it is a speculative asset. Here it is charted against the ARK Innovation ETF again, pinpointing 2 p.m. on Wednesday and you can see it’s also down big time:

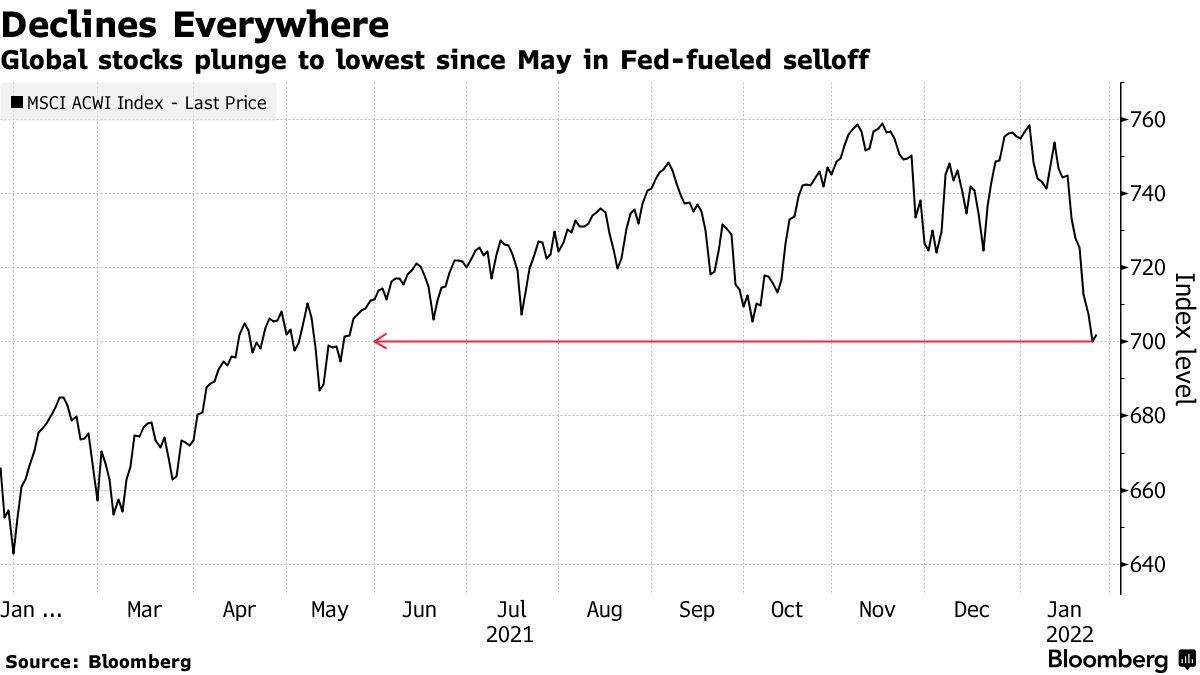

So, what that means to me is that the thesis that I’ve been pushing for a while, that basically the speculative momentum (duration, trade inequities and other assets) is on life support, if not dead at least as far as this year is concerned. But it’s not just the U.S. Here’s a chart that shows that right now:

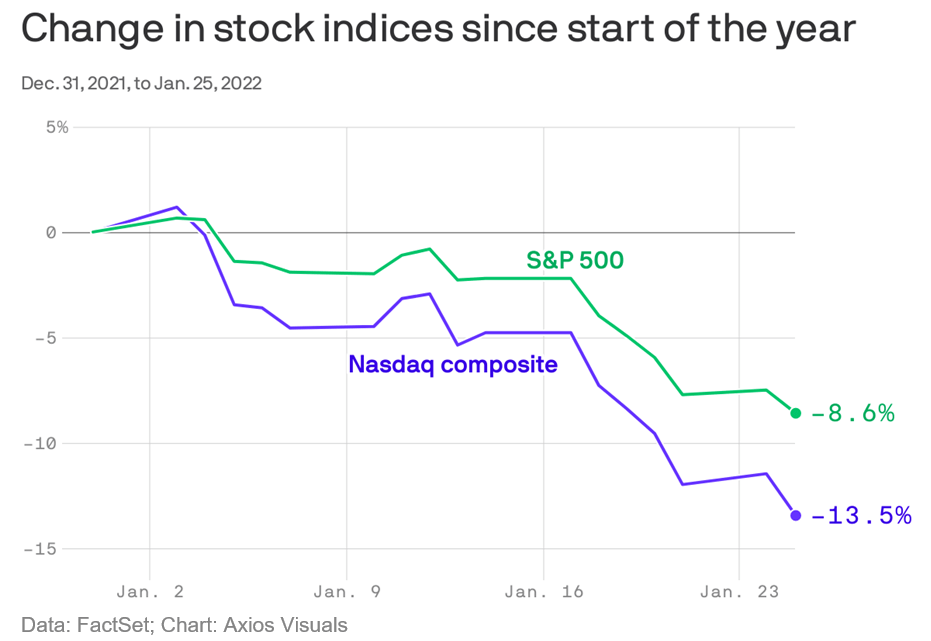

The global index of all stocks is down back to where it was about nine months ago, back in May. So this is a pretty big deal. It’s a pretty big pull off just to remind us of where we were. This is actually on the 25th which was yesterday that the S&P 500 and the Nasdaq composite were both down big time. They’re down by more now:

So, what’s the issue here?

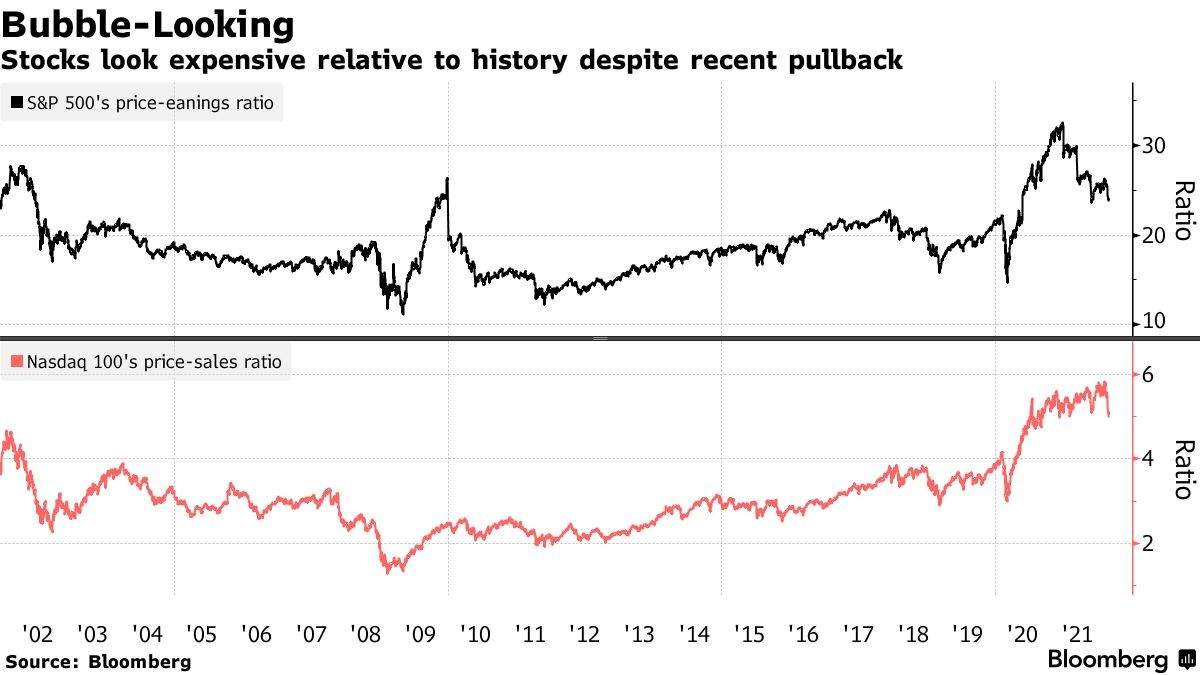

Well, the issue here is that we haven’t reached the bottom. Here’s a chart that shows the S&P’s price-to-earnings ratio and the Nasdaq 100’s price-to-sales.

Remember the Nasdaq 100 is the top 100 firms, which includes things like the big boys, the ones that everybody depends on. Now, you can see that despite having pulled back from highs a little while ago we’re still above long-term trend comfortably. We’re still about 20% higher than the 10 year average in terms of price-to-earnings. We’re still in the territory where we were before dot-com and before the subprime bubble popped in terms of price-to-sales. Nasdaq’s price-to-sales is still elevated, and it still has a long way to fall.

Now, it can fall one of two ways, either by revenues rising and prices not, or by prices falling and revenue staying the same, or actually a third way that you could have them both happen. Both could fall. My money is on prices stagnating and trading sideways, while revenue catches up to these valuations, which will lead to a fallen that ratio, which at this point is basically way above where it’s ever been before. So it’s got to correct.

So the risks of holding stocks like, let’s just take Microsoft for example, you can see Microsoft fell 5% after delivering a brilliant earnings report in the first quarter on Tuesday night, and then it bounced back. I’m going to quickly call up its price now because it’s been moving around all day, but it started off the day having recovered almost a 5% and then it’s lost half of those gains during the course of trading today. Again, all because of the Fed.

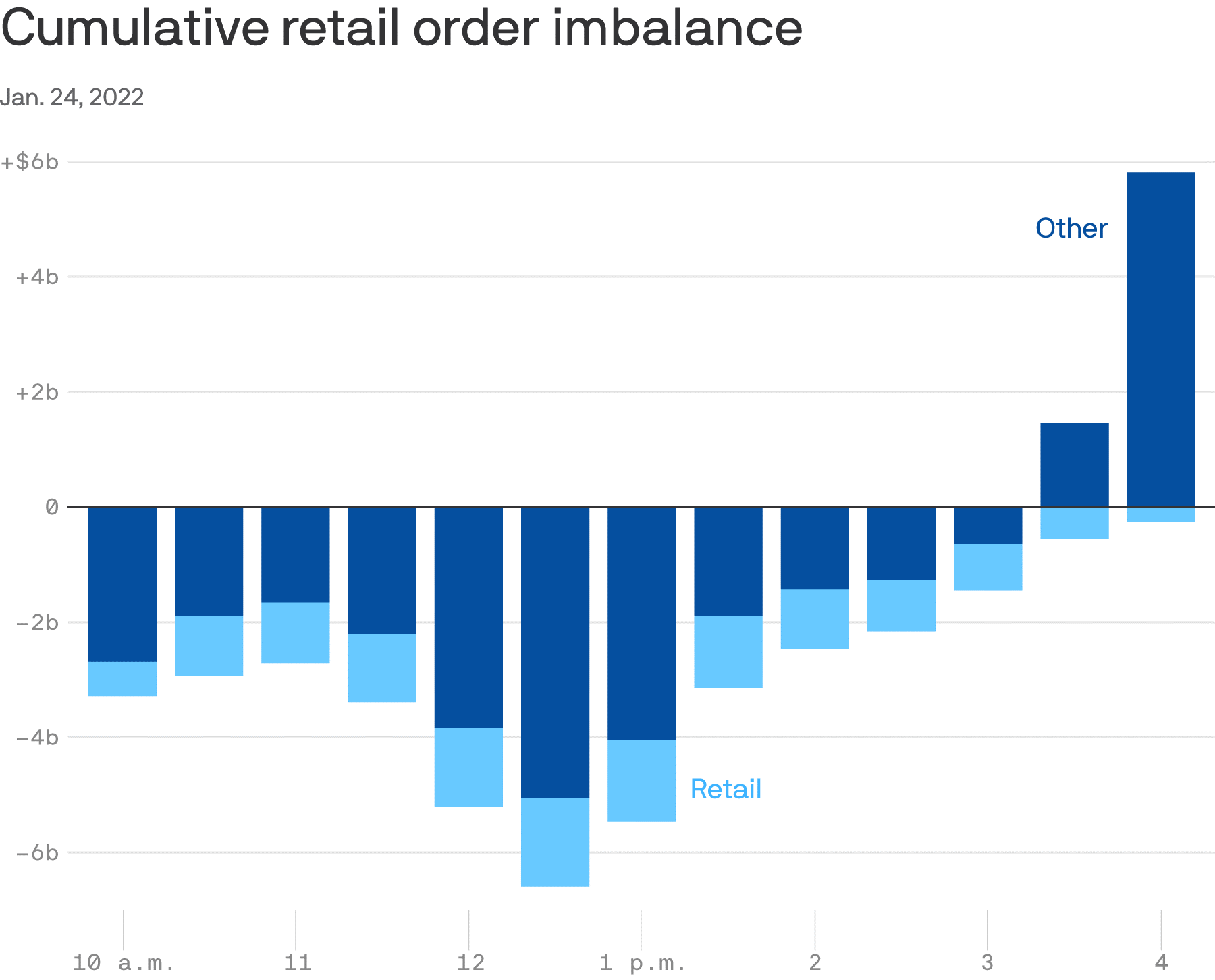

Now, the other thing that we’re seeing is a lot of turmoil on the retail market. Here’s a chart that shows what you call “retail order imbalance,” which is sellers versus buyers:

On Tuesday, they sold about 1.5 billion dollars’ worth of stocks by the peak of trading in that day, which peaked around 12:30 p.m., just after lunch. And at that point, institutional investors started coming back in and gobbling up those stocks. So, what we’re seeing is the classic maneuver where the dumb money sells and the smart money buys, but the big question is which stocks were those that the retail of institutional money buying? What causes those big blue bars on the right-hand side? We’re going to see in a minute. But the thing is, we can’t really say that things are that bad under the hood.

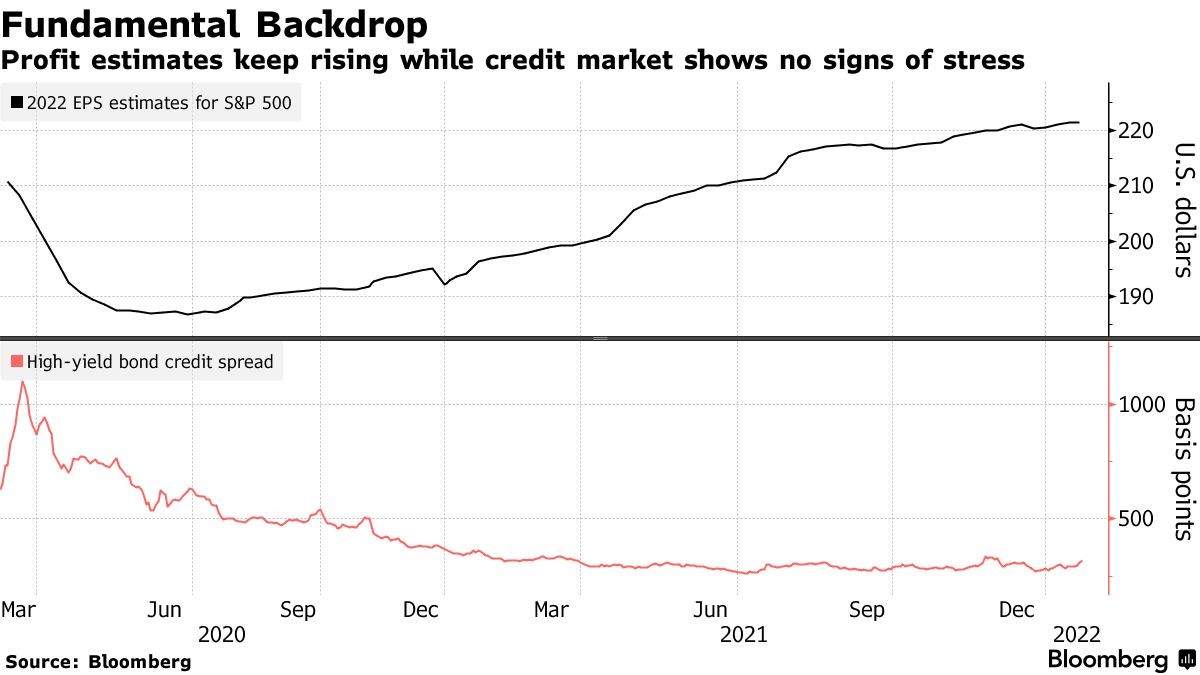

Here’s a chart that shows profit estimates, which are continuing to rise for 2022:

Basically, they’ve picked up since mid-2020 and they’ve increased substantially. Those estimates have risen at a smaller rate since the third quarter of last year, but they’re still rising, which means that we expect earnings per share will be better, then worse. And so, the question is which of the stocks are going to enjoy that. On the other hand, high yield bonds on the bottom panel, not really worrying too much. So we’re not yet in a situation where the market’s likely to panic because of the rising rates.

So let’s look at the previous example we have of something like this, the dot-com bust. I don’t believe we’re in that circumstance and here’s why. First of all, the dot-com boom was purely speculative. Everybody knew that most of these stocks had no earnings at all, let alone strong earnings and yet they were chasing them upward in a purely speculative momentum trade.

I mean, if you were willing to buy Pets.com with no revenues and drive them up to insane levels, you were doing it because everybody else was doing it and earnings didn’t matter. Now, we’ve seen that a lot lately, but the Nasdaq 100, where all the big companies reside, even though it’s at a high valuation, it’s dominated by very profitable companies that are at the heart of the economy. So I don’t think we’re going to see a collapse like we saw in the dot-com period. The other thing is that these companies are in great financial health. The S&P 500 companies had about 2.4 trillion dollars in cash on their balance sheets at the end of the third quarter last year, compared with 1.6 trillion at the same time in 2019. That’s a 163% increase. So these guys are swimming in cash.

You can see a pullback in growth earnings. They can handle it. That wasn’t the case at the dot-com period. The ratio of Net Debt-to-EBITDA, which is a crucial measure of earnings and profitability, was barely above 1 for the S&P 500 at the end of 2021. In 2007, it was at 4.25 and before the subprime crisis, it was 3.88. So basically I think the critical issue here is that we’re not anywhere near the same circumstances because the companies that collapsed during the dot-com have bounced back and the survivors have accumulated huge cash positions, which means that they can survive a lot before they lose.

So it means they’re going to try probably trade sideways. And the third thing, of course, is that because they have so much money and access to cheap credit, they can buy their own shares if they fall too much, which means that instead of what somebody… You would talk about the Fed put supporting markets. Now we have what some people call the Chief Financial Officer put the CFO put, which means they’re going to probably jump in and buy their own stocks, which will help to put a floor into their prices. In other cases, they’re going to embark on acquisitions, just like Microsoft’s purchase of Activision Blizzard. There’s going to be more of that coming. What about the cons? I mean, there’s always going to be some cons. So the question is, what are they?

Well, the first thing is that there’s some dissonance now between inflation concerns, which leads to higher economic or interest rates and weaker economic growth projections, which would say lower interest rates. Some people are starting to worry that the Fed might not or not to worry, but they’re starting to think that because growth expectations are falling and I’m going to talk about why that’s the case in a minute, that they might be able to not increase rates by as much.

I’m on record as having said, “I think they are” because I think they don’t just want to grain in inflation. They want to deflate overly speculative markets, but they want to do it in an orderly way and because they know that the top stocks like the Nasdaq 100 can handle a rate-hiking cycle. They’re willing to let the ones that can’t handle it suffer. And I think that’s why investors have got to be careful. There’s a possibility that we could see rate hiking into a weakening economy and declining earnings, but I think the Fed will be very alive to that possibility and be very careful not to let that happen. Now, I think that if you accept my thesis that the Fed itself is not responsible for inflation, but rather fiscal stimulus is, then I think basically you will probably accept that the Fed is going to raise rates basically in order to try to reassert control over the market narrative rather than just to cause inflation.

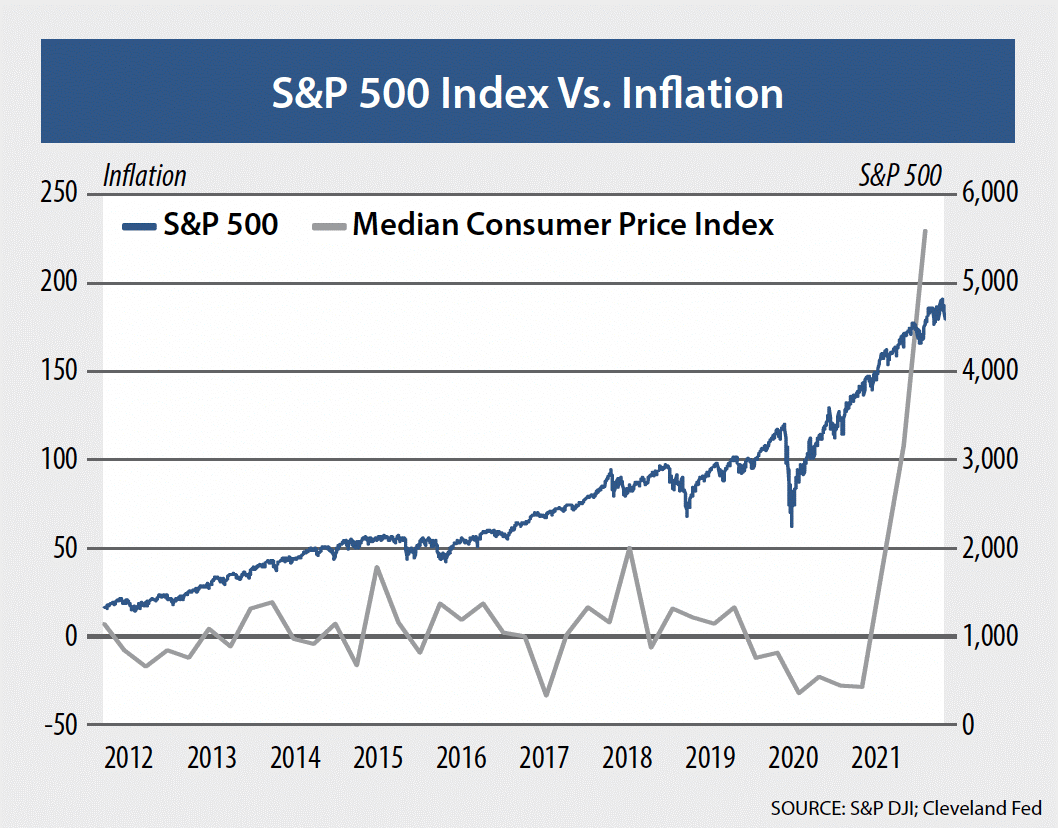

And to prove my point, here’s a chart that I made myself that shows the relationship between the S&P 500 and the Median Consumer Price Index quarterly change from the previous year going back to just after the subprime crisis:

And it’s pretty clear folks … the Fed didn’t cause inflation. The Fed caused inflation in asset prices in the stock market. It wasn’t until we started seeing stimulus from the Federal Government and broken supply chains, that we got inflation.

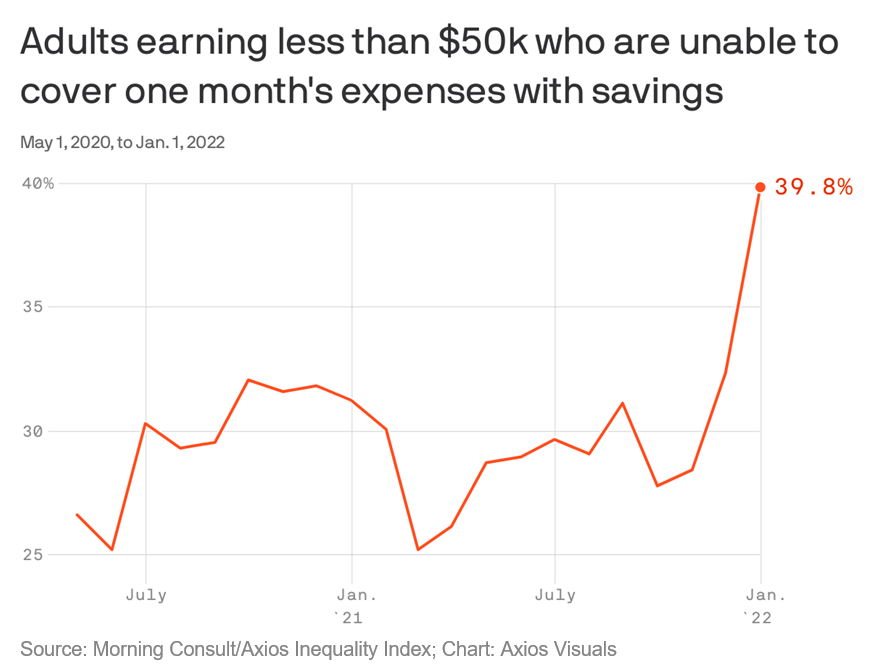

So the big question, is what’s going to happen to inflation when the Fed tightens? Well, my argument is that probably nothing because the Fed didn’t cause it. It’s really the result of people having a lot of money and they no longer have a lot of money, at least the average American. Here’s a chart that shows adults earning less than $50,000 who are unable to cover one month’s expenses with savings.

It was down near 25% just after the second big stimulus package in early 2021, it then got up to 30, now it’s headed toward 40%. So, that means that we can’t rely on the burst of spending power that caused inflation to support the economy and so if the Fed tightens in the face of that, you could definitely see some issues, but I’m still convinced that the big boys will survive.

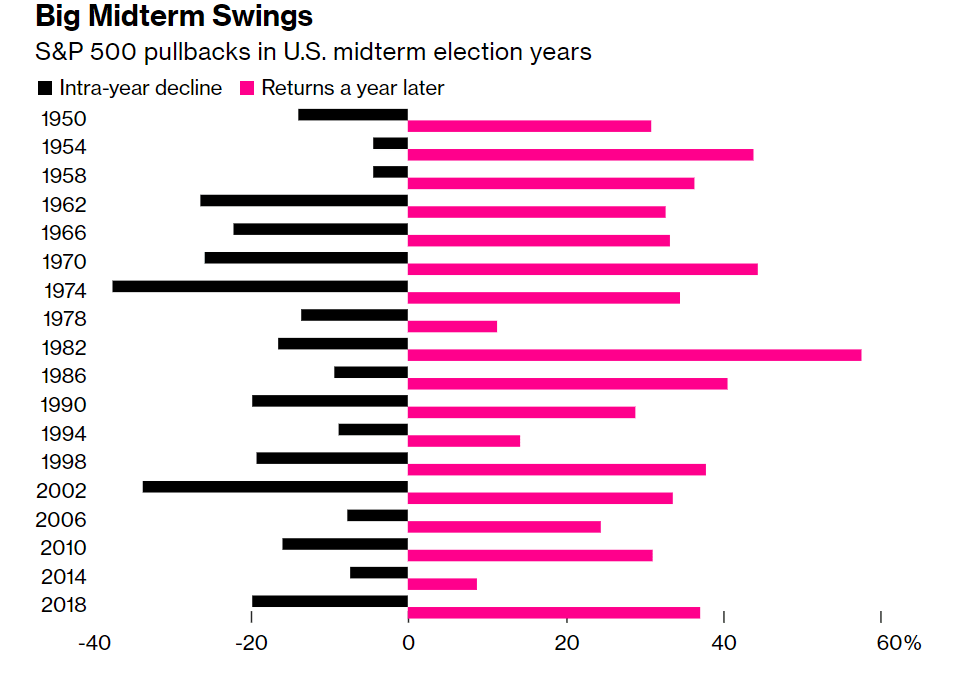

The other term or other thing to bear in mind is that this is a year of midterm elections. Here’s a chart that shows what tends to happen during midterm election years, and then the returns a year later:

Generally speaking, you do see declines in those years and particularly in years where there’s a big election and where the stakes are pretty high, but we tend to bounce back. But this is a midterm year and that’s something to remember. I believe that the Republicans are going to are going to just throw the Democrats out of the house in the Senate.

No comment on why I think that. It doesn’t matter to you, and it shouldn’t matter to anybody what I think, but I think it’s going to happen. And that means that we are likely to see a lot of action based on that expectation and that means that companies that would’ve done well with this kind of democratic approach to policy are probably going to tank those who would do well under a Republican approach, which is basically: cut taxes, cut social spending, boost subsidies to companies that employ low-wage labor and extractive industries such as fossil fuels. They’ll do better. So, that’s basically something to consider as well.

So, what about projections for the end of the year:

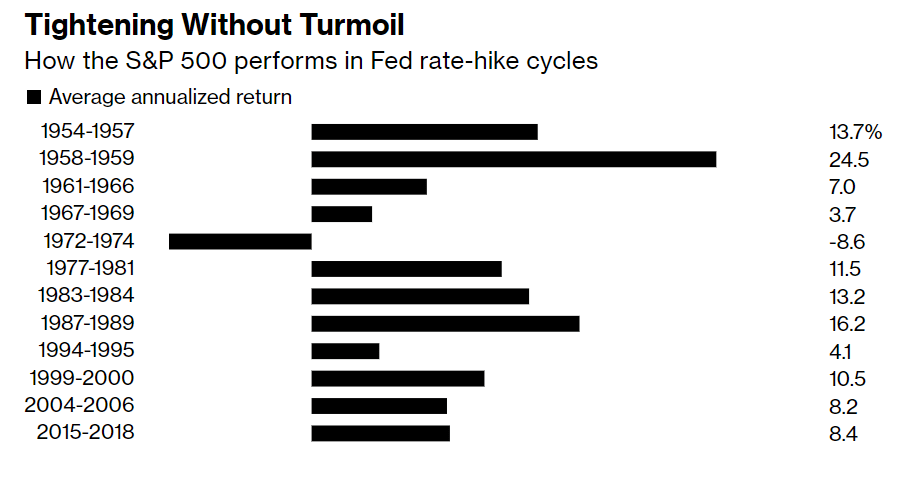

Here’s what’s happened in Fed rate hike cycles. Basically, right now, the average is that the Fed or that the S&P 500 will probably end the year at about 12% above its closing level last Friday, but as you can see going back in history, there has been a lot of variation in that, and we could see some pretty good gains during tightening years. But again, it depends on what kind of companies are benefiting and if the Fed’s tightening, it’s going to be companies that are resilient in the face of higher interest costs.

So, what we’re looking at today, I believe is the end of the 35-year period since Alan Greenspan first introduced the Fed’s put 35 years ago. During that period, the market and Main Street could cohabit perfectly well because inflation was not going up and stock prices were. So it made sense for the Fed to keep loose money, but that’s no longer the case. The interests of Wall Street and Main Street, more particularly the politicians, who are accountable to Main Street, are no longer aligned and that means that we’re about to enter a situation that most investors have never experienced and that is one where the Fed is in fact tightening in the face of inflation. The stock markets be damned. Let them suffer as they will. Our interest is in protecting purchasing power.

Now, in this context, I will leave you with a metaphor. When I used to work in the housing industry, I often watch people make concrete and that involves adding rocks called aggregate to cement and you do that to bulk it up, to make it strong and to give it good tensile strength. What you do is, you take a bunch of rock, you throw it on top of a grid and all the stones you don’t want fall through, the ones you want to keep, stay on top. You add that to your cement.

That’s what’s happening right now in stock markets. The stocks that are not cut to be part of the cement under the stock market, the concrete, are going to fall through the cracks. But many of them will recover, but many of them won’t, but above all, what we’re seeing is what somebody called in Bloomberg yesterday said, “What we’re seeing is, markets are finding out what’s real and what’s not real.” And I think that’s really the message for today. We’re going to start seeing pretty quickly what’s real and what’s not real, thanks to interest rates. Anyway, this is Ted Bauman signing off. I’ll talk to you again next week.

Kind regards,

Ted Bauman

Editor, The Bauman Letter