Latest Insights on PARA

Hate to Say It: I Doubt You’re Using Seasonality Right

Hate to Say It: I Doubt You’re Using Seasonality Right February 18, 2022 Investing, Trading Strategies, True Options Masters

Most traders slap seasonality on to a chart and call it a day... But Mike Carr knows the indicator is much more complicated than that.  Airbnb Airs It Out, Roblox Touches Grass, Paramount’s Transformers

Airbnb Airs It Out, Roblox Touches Grass, Paramount’s Transformers February 16, 2022 Great Stuff

Welcome To My House Great Ones take control now. We can’t even slow down. We don’t like to go out. What? Don’t tell me you’re not into Flo Rida… What’s a Flo Rida? Didn’t you just misspell a state? Sigh … never mind. I was gonna go with something like: Get ready to pop the […] Angry. Disillusioned. Doomed?

Angry. Disillusioned. Doomed? February 8, 2022 Big Picture. Big Profits., Economy, Investing

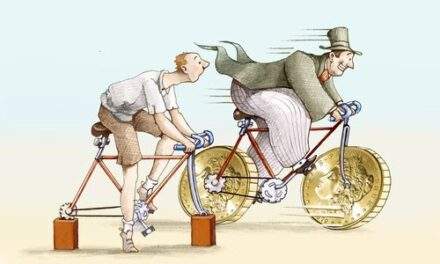

South Africa is drop-dead gorgeous. Its people are the salt of the earth. But it is one of the most unequal societies in the world, which makes it a challenging place to live … to put it mildly. One thing I've learned in my travels is that when inequality reaches extreme levels, dire consequences follow. So, when a new data set on inequality in the U.S. arrived in my inbox, I realized I had the makings of this week's Bauman Daily. If you doubt the relevance to growing and protecting your investments, read on… Sometimes It’s Okay to Lose Your Shovel

Sometimes It’s Okay to Lose Your Shovel February 4, 2022 Investing, Trading Strategies, True Options Masters

Mike Carr never met his grandfather, but his life story still has a profound impact on the way he approaches trading.  A Very Mean Reversion

A Very Mean Reversion January 26, 2022 Big Picture. Big Profits., Trading Strategies, U.S. Economy

Many people believe stock market prices are usually “correct. ”The Efficient Market Hypothesis (EMH) says that, since everybody has access to the same information about a company’s performance, its stock price shouldn’t remain over- or underpriced for long. Try telling that to someone who bought a high momentum stock in late January last year.