Latest Insights on BLUE

Bitcoin’s No. 1 Rival Is Getting an Upgrade June 13, 2022 Cryptocurrency, Winning Investor Daily Bitcoin’s standing as the biggest crypto is in jeopardy.

Bitcoin’s No. 1 Rival Is Getting an Upgrade June 13, 2022 Cryptocurrency, Winning Investor Daily Bitcoin’s standing as the biggest crypto is in jeopardy. A Recession Will Make the Bear MUCH Angrier… June 10, 2022 Investing, Mike's Macro View, Trading Strategies, True Options Masters When applied to GDP data, Mike Carr's Greed Gauge can accurately predict recessions. And what it's saying now might surprise you...

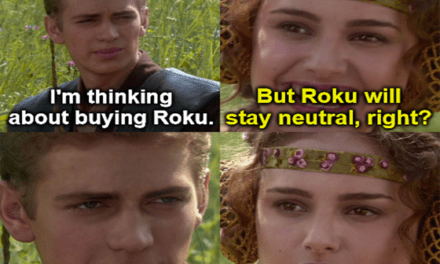

A Recession Will Make the Bear MUCH Angrier… June 10, 2022 Investing, Mike's Macro View, Trading Strategies, True Options Masters When applied to GDP data, Mike Carr's Greed Gauge can accurately predict recessions. And what it's saying now might surprise you... Netflix Needs Roku, Thor’s Lightning Strikes & Campbell’s Cans Can June 8, 2022 Great Stuff Roku’s Superunknown Great Ones, there’s some big news brewing for Great Stuff Picks holding Roku (Nasdaq: ). According to a Business Insider report, Netflix (Nasdaq: ) might possibly have offered a potential takeover bid for Roku. It’s one of those “My best friend’s sister’s boyfriend’s brother’s girlfriend heard from this guy who knows this kid […]

Netflix Needs Roku, Thor’s Lightning Strikes & Campbell’s Cans Can June 8, 2022 Great Stuff Roku’s Superunknown Great Ones, there’s some big news brewing for Great Stuff Picks holding Roku (Nasdaq: ). According to a Business Insider report, Netflix (Nasdaq: ) might possibly have offered a potential takeover bid for Roku. It’s one of those “My best friend’s sister’s boyfriend’s brother’s girlfriend heard from this guy who knows this kid […] Beware the Bear’s Next Catalyst June 8, 2022 Big Picture. Big Profits., News, Trading Strategies, U.S. Economy So, it might seem odd that I’ve recently talked about catalysts impacting stocks in phases or following a neat pattern like a row of toppling dominoes. That almost implies that some orderly course of events can make the next market move predictable. But as I’ve demonstrated throughout 2022, it’s possible to spot the next big move when you combine experience with a disciplined and objective approach. That’s why I want to show you the next shoe to drop for stocks.

Beware the Bear’s Next Catalyst June 8, 2022 Big Picture. Big Profits., News, Trading Strategies, U.S. Economy So, it might seem odd that I’ve recently talked about catalysts impacting stocks in phases or following a neat pattern like a row of toppling dominoes. That almost implies that some orderly course of events can make the next market move predictable. But as I’ve demonstrated throughout 2022, it’s possible to spot the next big move when you combine experience with a disciplined and objective approach. That’s why I want to show you the next shoe to drop for stocks. Will the Fed Hit Their “Self-Destruct” Button? June 1, 2022 Big Picture. Big Profits., Investing, U.S. Economy Over the weekend, it sounds like Federal Reserve Chairman Jerome Powell also received a call to his principal’s office … this one belonging to President Biden. But I’m fairly sure that Powell isn’t being recognized as central banker of the quarter. Ahead of midterm elections, Biden is reaching for anything that can be done to tame inflation. And unfortunately for us all, there is only one thing Powell can do...

Will the Fed Hit Their “Self-Destruct” Button? June 1, 2022 Big Picture. Big Profits., Investing, U.S. Economy Over the weekend, it sounds like Federal Reserve Chairman Jerome Powell also received a call to his principal’s office … this one belonging to President Biden. But I’m fairly sure that Powell isn’t being recognized as central banker of the quarter. Ahead of midterm elections, Biden is reaching for anything that can be done to tame inflation. And unfortunately for us all, there is only one thing Powell can do...