Some investors believe that you need to hold stocks for years before you can sell them for a profit.

So what do you do if you want money now rather than later?

You can invest in meme stocks … but those rise and fall on the whims of Reddit traders.

You can buy options … but options buyers lose money 90% of the time.

You can trade cryptos … but only if you don’t mind volatility.

It may seem impossible to make money quickly without taking on too much risk.

But there’s one industry with a proven track record of pumping out double- and triple-digit winners.

And all you need to do is buy the right stocks at the right time…

Incredible Gains in a Single Day

Every Monday through Friday, we feature the Morning Movers in Winning Investor Daily.

These are the stocks with the biggest gains between the open and noon Eastern time.

You can see today’s Morning Movers by scrolling down to the bottom of this article.

And a lot of the time, the biggest movers are biotech stocks.

That makes sense.

As Ian King explained to me, this industry has catalysts that can send a stock’s price soaring in an instant.

For example, an acquisition or successful clinical trial can quickly lead to double- or triple-digit gains.

So here are a few biotechs that recently made incredible gains in a single day.

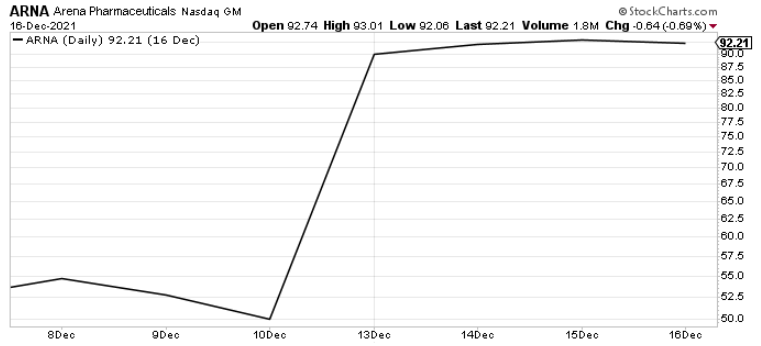

Arena Pharmaceuticals Inc. (Nasdaq: ARNA)

The California-based biotech develops treatments for immuno-inflammatory diseases.

On December 13, Pfizer acquired Arena for $6.7 billion in cash.

That sent the stock soaring 80% that day.

ARNA Soared 80% in 1 Day

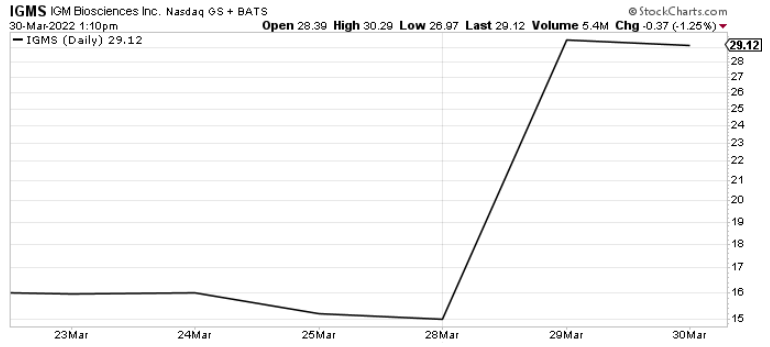

IGM Biosciences Inc. (Nasdaq: IGMS)

On Tuesday, the small-cap biotech company announced a $6.15 billion deal with pharma giant Sanofi.

The stock surged from $15 to $29.50 on the news.

That’s a gain of 97% in just one day.

IGMS Gained 97% in 1 Day

Theralink Technologies Inc. (OTC: THER)

This precision medicine firm traded for as little as $0.05 a share in late September.

Then a flood of investors rushed in, creating a mania for the stock.

THER skyrocketed, posting single-day gains of 1,320%, 413% and 168%.

By the end of its two week rally, the stock had soared 122,900%.

THER Soared 122,900% in 2 Weeks

Don’t Miss Ian King’s Special Biotech Report

Ian and his team are putting the finishing touches on their latest special report.

It’s called Profit Now With 3 Biotechs Set to Soar.

This report gives you all the details on Ian’s top three biotechs to buy now.

Each of these stocks has a catalyst that Ian and his team believe will send shares skyrocketing.

The dates that they could take off are coming up fast.

So you’re going to want to get this information in your hands ASAP.

You can find out more by signing up for Ian’s “Breakout Stocks Summit” webinar.

Click here to reserve your spot now.

Regards,

Assistant Managing Editor, Banyan Hill Publishing

Morning Movers

From open till noon Eastern time.

Longeveron Inc. (Nasdaq: LGVN) develops cellular therapies for aging-related and life-threatening conditions. The stock jumped an incredible 72% after it showed great results from its Phase 1 study of Lomecel-B, its treatment candidate for patients with mild Alzheimer’s disease.

Clovis Oncology Inc. (Nasdaq: CLVS) is a biopharmaceutical company that acquires, develops and commercializes anti-cancer treatments. The stock rose 57% after the company released positive data from the Phase 3 trials for its ovarian cancer treatment candidate.

Icosavax Inc. (Nasdaq: ICVX) develops vaccines against infectious diseases. The stock is up 28% today on a rebound thanks to its fourth-quarter business update after a recent drop due to disappointing trial data from its COVID-19 vaccine candidate.

Sab Biotherapeutics Inc. (Nasdaq: SABS) produces human antibodies targeted at infectious diseases, immune system disorders and cancer. It is up 20%, continuing its uptrend from Wednesday when it provided a business update showing the progress it made on its COVID-19 and influenza antibodies.

Vector Group Ltd. (NYSE: VGR) manufactures and sells cigarettes and other tobacco products in the U.S. The stock is up 17% after analysts at Barclays upgraded the stock from the equivalent of a hold rating to a buy and raised its price target.

Nano-X Imaging Ltd. (Nasdaq: NNOX) develops and produces digital X-ray source technology for the medical imaging industry. It is up 16% after the company managed to beat revenue estimates for the fourth quarter as its recent commercialization efforts start to yield results.

Inspirato Inc. (Nasdaq: ISPO) operates as a subscription-based luxury travel company. The stock is up 14% today as meme traders reignited their interest in the stock as a potential short-squeeze target.

American Resources Corp. (Nasdaq: AREC) extracts and processes metallurgical carbon, rare earth minerals and reprocessed metal. It is one of the electrification-related stocks that is up 12% on the news that President Joe Biden plans to invoke Cold War powers to ramp up domestic production of critical minerals for EVs and other types of batteries.

Crinetics Pharmaceuticals Inc. (Nasdaq: CRNX) discovers and develops therapeutics for rare endocrine diseases and endocrine-related tumors. The stock is up 12% after JMP Securities raised the price target on the stock following positive data from the early trial of its hyperinsulinism candidate.

Flex Ltd. (Nasdaq: FLEX) provides design, engineering, manufacturing and supply chain services and solutions to original equipment manufacturers. The stock is up 8% after the company released strong guidance for the fourth quarter and full-year 2022.