SeaWorld is a happy place.

Many of you know that.

The company’s original San Diego park opened in 1964. It’s on 21 acres along the shore of Mission Bay.

The initial $1.5 million investment drew 400,000 visitors in its first year alone.

Today, SeaWorld also has parks in Orlando, Florida, and San Antonio, Texas.

And SeaWorld Entertainment Inc. (NYSE: SEAS) owns nine more theme parks, including names like Busch Gardens, Aquatica and Sesame Place.

Its recent growth has also been great for its stock price. It has returned 78% since the start of 2018.

But that kind of success can have some downsides, too…

(Prefer to listen with audio? Click “play” below!)

Greed Is a Powerful Thing

Business has been good at SeaWorld recently.

In every quarter of 2018, sales, gross profits and free cash flow increased over the prior year.

Things were so good that a former lawyer for the company decided he would make some money on the resurgence.

He learned of the firm’s strong second-quarter performance before the public did. The Securities and Exchange Commission (SEC) alleges he then bought shares.

The stock jumped after SeaWorld released its earnings, and he sold … pocketing $65,000 in profits.

Today, he doesn’t have a job.

He reached a settlement with the SEC that bans him from practicing law at a public company. And he is also facing criminal charges from the Department of Justice.

This is unfortunate for the public at large. Greed-induced activities like this make individual investors more wary of the stock market.

Many may think “insider trading” is a bad word (or two). But you don’t have to.

As a corporate lawyer, this employee had access to material, nonpublic information that a regular investor doesn’t.

If an employee profits on that information, the SEC will come calling.

And the rules worked. Along with the SEC’s oversight and SeaWorld’s due diligence, they caught this person. He will not be acting on inside information again.

These Rules Exist to Monitor Activities…

Insider activities are scrutinized. The SEC requires insiders to file a Form 4 within 48 hours of buying or selling shares of company stock.

The SEC uses the information to monitor trading in company shares.

If it sees something awry, it will contact the company. That’s what it did in this case.

And the reverse applies, too. If the company sees an issue, it can report it to the SEC.

For example, many companies have rules in place to disallow any employee from trading at certain times.

The purpose of this is to remove the incentive for employees to act on important nonpublic information. Many firms call this the “blackout period.” The opposite is the “trading window.”

…And They Actually Benefit Us

The beauty of these filings with the SEC is we can track what insiders are doing.

If insiders are using their own money to buy a lot of a name you like, you may want to join them.

Or, when insiders rarely reach in their pockets to buy shares, it can be illustrative when they do.

Jeff Yastine and I have a research service called Insider Profit Trader that tracks these things.

We monitor legal insider trading activity … and use that knowledge to make subscribers money.

An Example of How Legal Insider Trading Works

As I mentioned, some stocks rarely see insider buying.

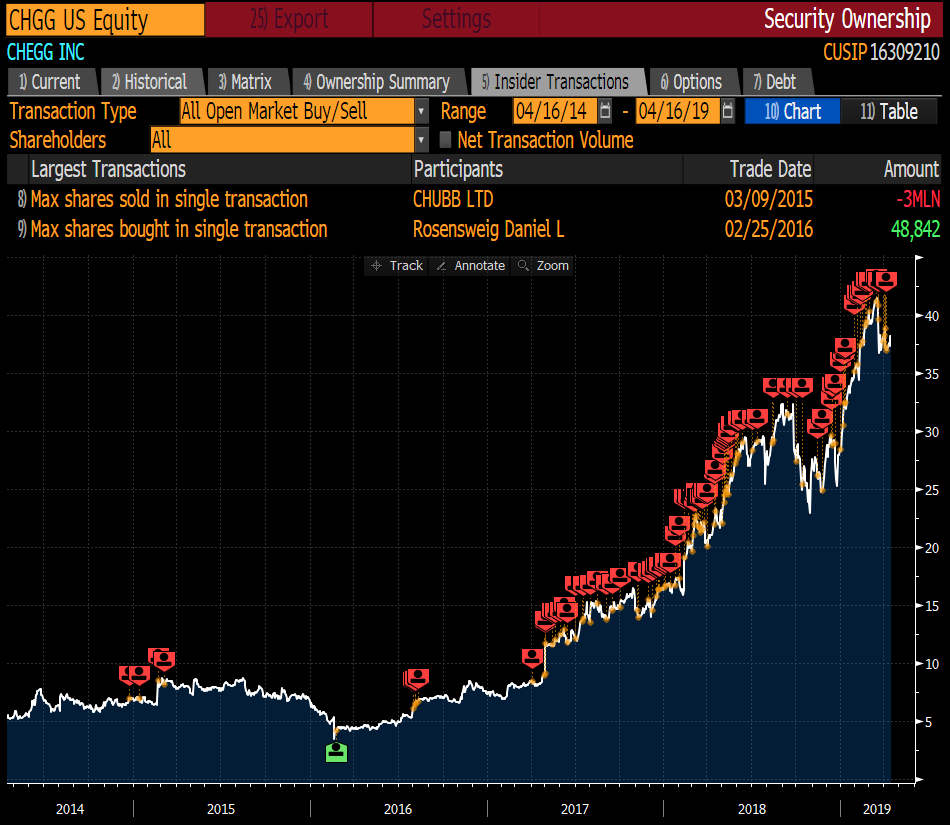

An example is Chegg Inc. (NYSE: CHGG), an online education company.

Daniel Rosensweig is the firm’s CEO.

Over the past five years, he, a fellow officer and a company director are the only three people to make open-market buys. They all did it on the same day in February 2016:

Three years ago, Rosensweig reached into his pocket to buy nearly 49,000 shares for $4.09 each.

Today, those shares are worth nearly 10 times more than he paid.

As you can see in the chart above, this trade stuck out like a sore thumb. Rosensweig invested $200,000 in shares that are worth $1.86 million today.

This is just one example of the power of legal insider trading.

I encourage you to look into it.

Good investing,

Brian Christopher

Editor, Insider Profit Trader