Please, sit down. We need to have a talk about earnings and valuations.

Now, I know people are telling you that we’re in the best of all possible investment worlds.

Some of them even advise investing in companies — like Lyft or Uber — that have never made a profit.

They call them “growth” companies. They’re expected to achieve massive profits … someday. We’re supposed to invest in them now and go along for the ride.

To be sure, history has good examples of that.

Amazon lost $2.5 billion in its first 17 quarters. But if you’d bought it at its initial public offering (IPO), you’d have made 10,000% profit by now.

So why not buy Uber at its IPO?

I can think of two reasons.

First, Uber has lost over $10 billion in just the last 12 quarters. It’s burned through $20 billion in total. It’s never made a profit.

Second, unlike Amazon with its growing monopoly, Uber has no obvious pathway to profit.

It’s locked in a price war with rival Lyft, and it’s facing the prospect of having to treat its drivers like employees — potentially raising its costs dramatically.

Uber management says not to worry. It’s going to make money from a fleet of autonomous cars.

Some of them may even be flying cars.

Friend, when we get to the point where we’re waiting for George Jetson to see any positive earnings from companies, something is very wrong in U.S. markets…

Pulling Profit From Thin Air

The health of the U.S. corporate sector is based on an illusion … one that’s about to evaporate.

When that happens, will your investments deserve to keep their valuations?

It’s all about earnings.

Earnings are what’s left over after a company subtracts costs from sales revenue. They increase if revenue increases or costs go down, or both.

U.S. corporate earnings and profit have been exceptionally strong in the last decade. But they’ve been based on temporary tricks, not a healthy economy.

The facts bear this out.

The current bull market started in the second quarter of 2009. From then until the second quarter of 2018, U.S. corporate earnings per share (EPS) increased 353%.

But top-line revenue — i.e., sales — per share only grew 56% during the same period.

How did U.S. companies increase EPS by so much more than revenue?

They used three tricks that are running out of steam and unlikely to be repeated.

The Bernanke Put

Starting in 2013, the Federal Reserve injected $4.5 trillion of liquidity into U.S. markets. This was called quantitative easing, or QE. It also slashed interest rates to near zero.

With so much free money available, investors who could access it bought corporate shares in search of yield. That burst of demand drove up share prices.

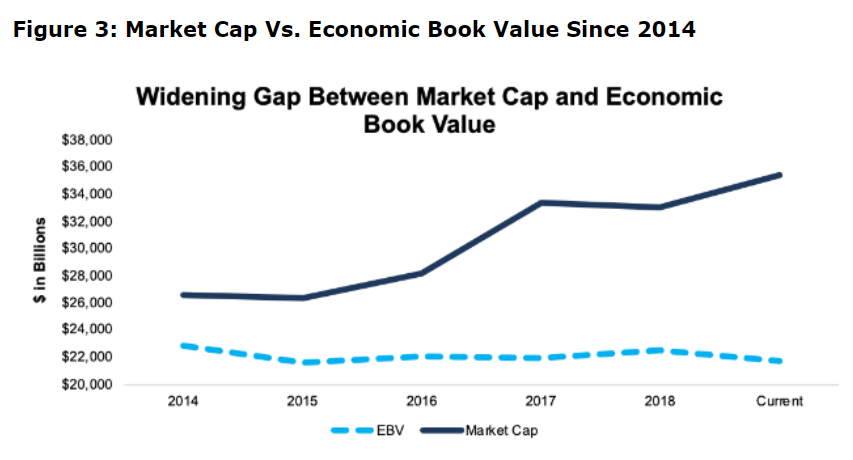

But growth was sluggish, and corporate revenue increased slowly. So, after 2013, the gap between corporate market capitalization (based on share prices) and economic value (based on revenues and capital stock) got ever wider:

(Source: Seeking Alpha)

Lesson 1: The Fed’s monetary policy has caused valuations to rise without a corresponding rise in real revenues.

The Buyback Binge

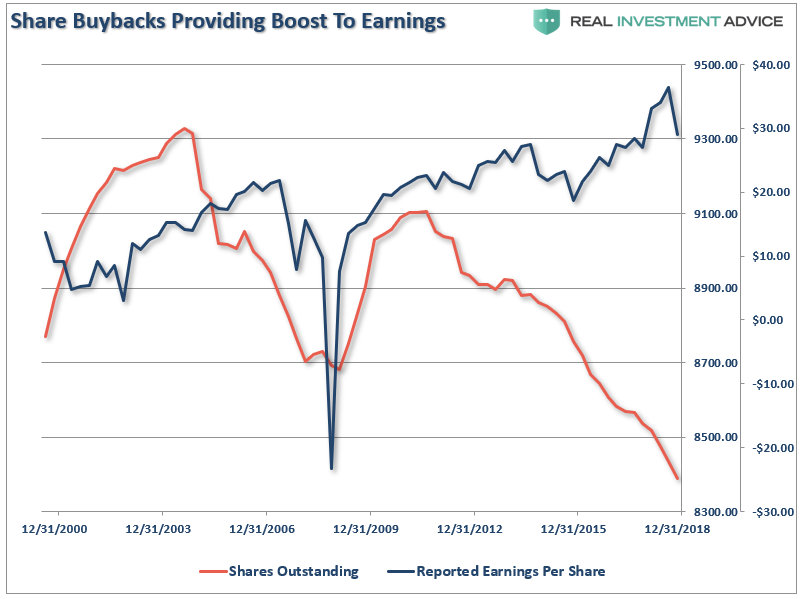

The second trick that created the illusion of EPS growth in a sluggish economy was share buybacks.

Even if it isn’t experiencing organic earnings growth through increased sales, any company can increase its EPS by buying back its shares. Given any level of earnings, fewer shares mean higher EPS.

Even if revenue is falling, buybacks can create the illusion of growing EPS:

Lesson 2: The accounting trick of share buybacks increased EPS without a rise in real revenues.

A Brutal Labor Market

The third way U.S. corporations increased earnings without increasing revenues was by slashing labor costs.

In the aftermath of the financial crisis, millions of Americans were unemployed.

As in any supply-and-demand situation, this excess supply of labor shifted market power to buyers — i.e., employers. They used it to slash payrolls, cut benefits and increase the proportion of temporary and part-time employees.

This strategy suppressed consumer demand in the U.S. economy. But it also slashed corporate costs. So even though corporate revenues continue to stagnate, EPS increased.

Lesson 3: Rising EPS masked the underlying weakness of the economy.

The Last Gasp: The Trump Tax Cuts

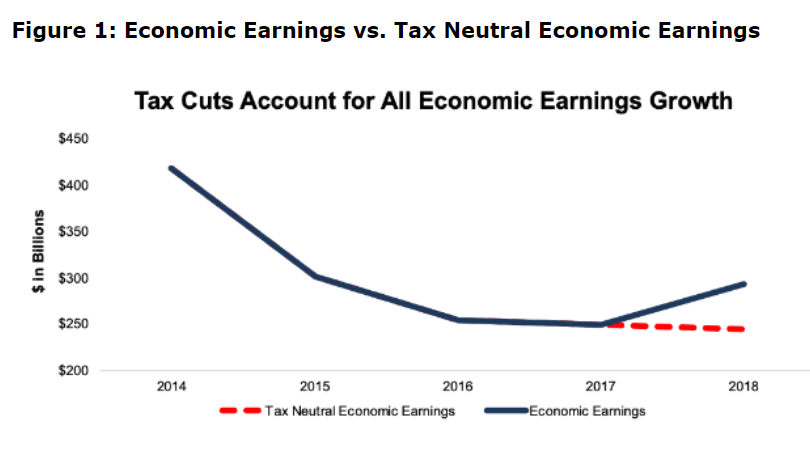

The U.S. corporate tax rate was cut dramatically in 2018. Most companies therefore enjoyed rising after-tax earnings, which boosted their EPS.

But if we strip out the effect of the tax cuts, the trendline of corporate earnings from actual sales continued downwards during 2018:

(Source: Seeking Alpha)

The Future of an Illusion

For the first time in 10 years, U.S. companies are expected to report lower profits on higher revenue in the first quarter of this year.

They’re selling more … but they’re not profiting as much.

That’s because the tricks corporate America used to goose its performance over the last decade are running out of steam.

Labor costs are rising thanks to historically low unemployment. The effect of the Trump tax cuts has evaporated.

The only things that are left are low interest rates and share buybacks. Both continue to drive up stock valuations even though corporate revenue growth remains historically weak.

President Donald Trump understands this. That’s why he’s so insistent that the Fed cut interest rates even further.

But that would only extend the illusion a little while longer … and make it even more fragile.

The only source of long-term sustainable increases in stock prices is rising earnings that come from rising sales and revenue. Anything else is nothing more than a temporary short-term trick.

That means the single most important thing you need to do right now is to find companies whose earnings and valuations are going to rise without gimmicks. That’s why I publish The Bauman Letter — to help you do just that.

Kind regards,

Ted Bauman

Editor, The Bauman Letter