Wall Street’s Weird Science

♫ From my heart and from my hand, why don’t people understand … my intentions? ♫

Great Ones, did you see what happened in the biotech market today? Holy cow … it was poetry in motion.

Intellia Therapeutics (Nasdaq: NTLA) skyrocketed more than 50% after early trial data showed the company’s genome-editing treatment worked inside the human body. This is some “Netflix sci-fi” level stuff we’re talking about here.

Call it “precision medicine,” call it “genomics,” call it whatever you want … but Intellia is the first to prove that you can edit and correct the very building blocks of human beings in a meaningful way.

Here’s the skinny: Intellia’s gene-editing treatment was tested on a group of patients suffering from an inherited liver disorder called transthyretin amyloidosis … a name which means absolutely nothing to anyone other than those unfortunate souls who have this nightmare passed down to them.

It’s a genetic disease that causes certain proteins to build up in the nerves and the heart … which, of course, often leads to death.

Currently, this disease is treated by a literal vat of chemicals with various nasty side effects. But, in Intellia’s gene-editing trial, the company’s treatment performed as well or better than a drug cocktail — with no safety problems.

“The average effect is already beyond what you see with other treatment modalities,” said CEO John Leonard. “We have one patient with over 96% reduction from baseline. That doesn’t happen with the other drugs.”

Now, I’m not a big cocktail guy … but if you tell me that one cocktail will give me a hangover and the other won’t, you know which one I’m choosing.

What’s more, said cocktail is designed — at a genetic level — specifically for the person who orders it. That’s the beauty of this new breed of “precision medicine” or “genomics” companies. This is biotechnology at its best, and it’s going to revolutionize medicine and medical care.

This isn’t just weird science … and Wall Street knows it. The halo effect from Intellia’s news lifted fellow gene-editing biotechs, such as CRISPR Therapeutics (Nasdaq: CRSP) and Editas Medicine (Nasdaq: EDIT).

Veritas Editas? What is this, Boondock Saints biotech?

It’s science, ya dolt … they use Latin in science. It doesn’t mean Intellia or CRISPR or Editas is going to come in guns a-blazing to righteously strike down genetic diseases … no, wait, hold up … that’s exactly what it means!

In other words, this is an investment you need to get in on … like, now! But… (There’s always a “but…”)

But … don’t go falling for companies like 23andMe (Nasdaq: ME). These companies are data hoarders … and there are some serious risks to consider first.

And … I wouldn’t recommend diving into NTLA or CRSP or even EDIT today. All three are going gangbusters, and we don’t chase rallies. Buy low, sell high … remember?

No, we wait for a pullback or a minor correction, then we strike. That said, if you want more actionable research on gene-editing companies … we’ve got you covered.

What you’re looking for is called “Imperium.” And according to experts, Imperium is set to go from virtually unknown … to having 2 billion users in the next four years, launching a stock market gravy train almost nobody sees coming.

Click here now to discover details of the No. 1 Imperium investment for 2021.

Going: The Recall That Wasn’t

We have two examples of sensationalist media headlines today, Great Ones. I mean, I’m sure there are a lot more, but I only have room for two.

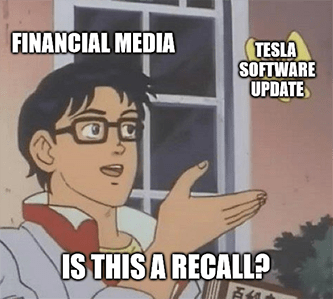

The first is the 300,000 vehicle Tesla (Nasdaq: TSLA) “recall” in China. Headlines across the financial media are bemoaning this recall, which affects 249,855 Model X and Model Y Teslas.

Oh my gosh! A Tesla recall! On 300,000 Chinese vehicles? Whatever shall we do?

Well, nothing, really. And that’s true even if you live in China. You see, this isn’t really a “recall.” It’s more of a software update. What’s more, Chinese regulators didn’t demand the “recall.” Tesla offered the update all on its own.

The software patch, which owners can download on their own, corrects some coding for Tesla’s assisted driving, which the company says can be accidentally activated by drivers … thus causing sudden acceleration.

So, instead of a government-mandated recall where you’re forced to schedule an appointment with a dealer, this is more like when Windows 10 notifies you of an update and asks you to restart. Easy peasy, right?

Well, there is one concern for TSLA investors, and that is Chinese sentiment toward Tesla.

Some analysts, like Wedbush’s Dan Ives, feels like this could further sour Chinese consumers on Tesla. But that train has already left the station, and today’s recall-that-isn’t-a-recall won’t have much effect on that. In fact, it might even help Tesla’s optics … especially given that Tesla initiated this fix on its own and is rolling it out directly to owners right now.

Wall Street thinks so as well, sending TSLA more than 2.5% higher today on the news.

Going: The Binance Ban That Wasn’t

Part two of today’s “what’s wrong with sensational media headlines?!” involves the world’s largest cryptocurrency exchange: Binance.

Over the weekend, U.K. regulators moved to crack down on cryptocurrency trading. Britain’s Financial Conduct Authority (FCA) — think of it like the SEC — told Binance that it “is not permitted to undertake any regulated activity in the U.K.”

The most common headline for this story goes as follows:

“Binance, the world’s largest cryptocurrency exchange, gets banned by UK regulator.”

Now, reading this information and that headline, you’d think that Binance was completely shut down in the U.K. and that crypto trading was now banned there.

Except … it isn’t. The regulation doesn’t affect products or services offered at Binance.com, the company’s website. Nor does it affect the company’s ability to offer cryptocurrencies such as Bitcoin or Dogecoin.

“Providing access to cryptocurrencies itself is not a regulated activity, but offering derivatives is, which is presumably the activity the FCA is clamping down on,” said Laith Khalaf, financial analyst at AJ Bell.

Hold up. So, cryptos aren’t banned? Just derivatives? Figures. But then, that wouldn’t get your attention, now, would it? Not as much as “Binance Banned In The U.K.!”

Furthermore, what Adderall-addicted tweaker is out there trading options on bitcoin? Regular options just don’t cut it for you anymore? Futures options contracts not risky enough? Gotta have those dogecoin weekly options to satisfy that urge?

Y’all need Betty Ford.

Gone: Unlucky 7s

If, like the Steve Miller Band, you were worried about that big ol’ jet airliner carrying you too far away … worry no more.

It seems that Boeing’s (NYSE: BA) new long-haul 777X jet airliner won’t take off in 2020 as expected. I mean … duh? It’s already 2021.

The FAA laid that smackdown last month — May 13 to be precise — telling Boeing that it “realistically” won’t certify the 777X until 2023.

Apparently, there are 737 Max-style issues with the 777X that the FAA isn’t convinced that Boeing has adequately addressed.

And the FAA is just the first regulating body to weigh in. European regulators have yet to have their say, and indications are that they may be even harsher on Boeing after the 737 Max was grounded for 20 months.

For its part, Boeing said exactly what you’d expect, stating that it “remains fully focused on safety as our highest priority throughout 777X development.”

Now, Great Stuff Picks readers … if you bought BA when I recommended it back in December, you’re sitting on a gain of about 11.75%. That’s not too shabby, but it is a rather thin gain compared to our other positions. Thin enough to cause some worry following the latest BA news.

But do not worry: This, too, shall pass. Wall Street already knew the 777X was delayed, and there were already expectations after the 737 Max issues that the FAA would force more delays. If this announcement were a complete system shock for BA investors, the stock would’ve fallen a lot more than just 3% today.

We’re gonna ride this turbulence out with our seatbelts fastened and our tray tables in the upright and locked position. Boeing will gain altitude again.

Biotech In The Sky With Diamonds

How’s that for a Monday issue?

Several great opportunities in biotech, two all-but-fake major headlines … and a Boeing in a pear tree!

I was going to give you a rundown of the week’s corporate earnings reports, but, honestly … there isn’t much to talk about.

Maybe Micron Technologies (NYSE: MU)? It reports on Wednesday, but literally nobody will pay attention to last quarter’s results. It’s all about guidance for chip companies right now and how they’re dealing with the shortage. Keep an eye out for this event if you’re a MU stockholder.

What about you, Great Ones? Are you investing in biotech … aka “precision medicine” … aka “genomics”?

Are you worried about bitcoin and Binance in the U.K.? Or Tesla’s recall that wasn’t a recall?

Maybe Boeing has you up in the air right now?

Whatever you feel like sharing — market-related or otherwise — drop us a line at GreatStuffToday@BanyanHill.com.

In the meantime, here’s where else you can find us:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff