Hurricane Fran struck Cape Fear, North Carolina, as a Category 3 hurricane on September 5, 1996.

It was the first major storm to hit the North Carolina coast in 40 years. The storm caused $7.2 billion in damages to the state. It killed 37 people, wrecked homes, destroyed crops and flattened timber.

Today, North Carolina faces a similar situation. Hurricane Florence made landfall as a strong Category 1 storm. The destruction will be widespread and costly. Words like “catastrophic” describe the wind and rain coming to North Carolina again.

Federal Emergency Management Agency associate administrator Jeff Byard described it like this:

This is not going to be a glancing blow. … This is going to be a Mike Tyson punch to the Carolina coast…

Florence is one of the strongest storms to threaten the Eastern Seaboard in decades. However, there will be a silver lining for some.

The Coming Shortage of Lean Hogs

Duplin County, North Carolina, is just 50 miles north of Wrightsville Beach. The county seat is Kenansville. It has a population of 58,500 people. According to the Department of Agriculture, it tops the list in hog and pig sales in the U.S.

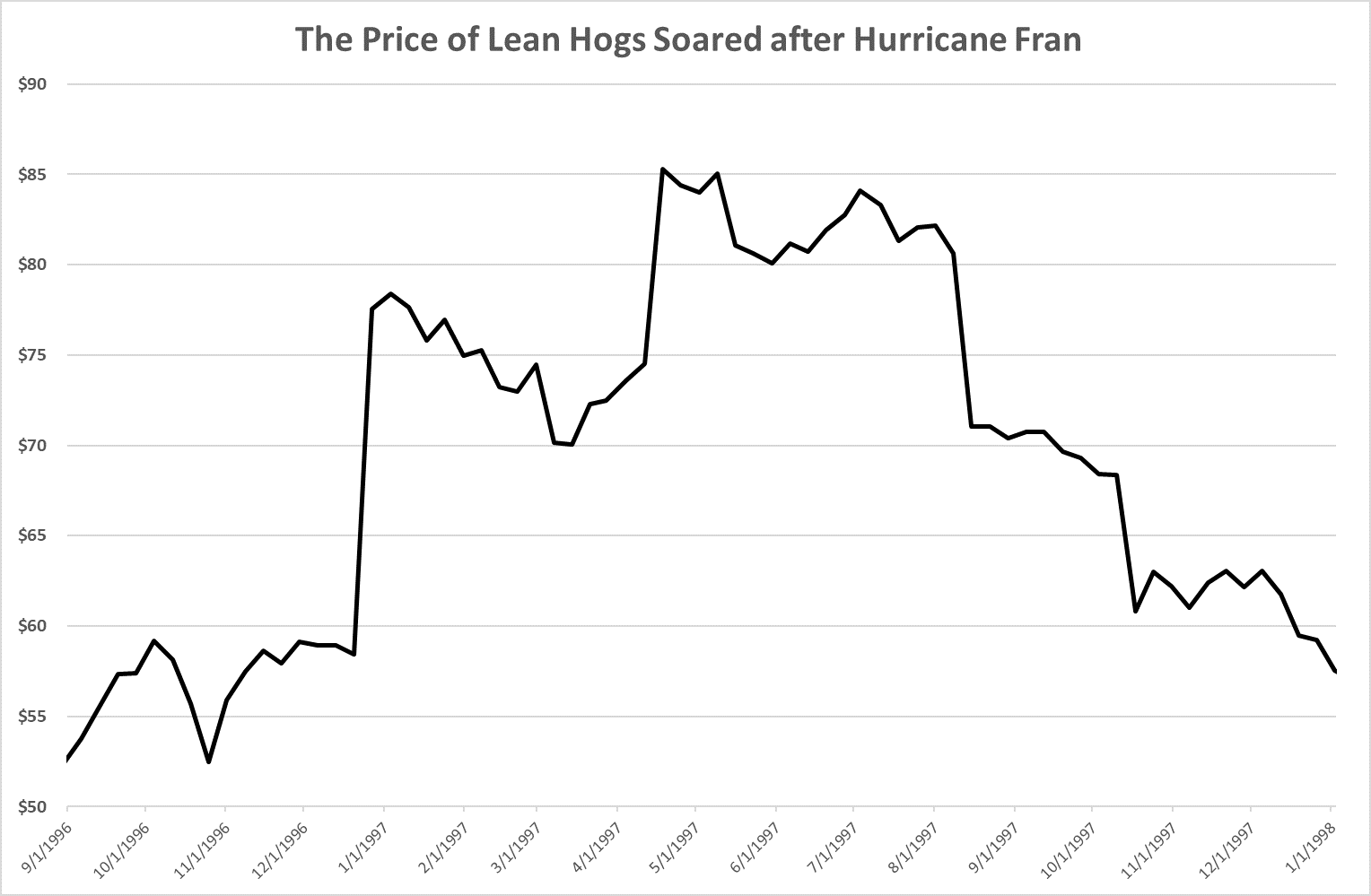

When Fran slammed into the state in 1996, it had a huge impact on pork prices. As you can see below, the price of lean hogs ripped higher:

Lean hog futures sat at $53 as Fran approached. But then, as the damage became clear, the price soared. By April 1997, the price broke $85. That’s a 60% gain in about six months.

Today, Hurricane Florence poses a similar problem for Eastern North Carolina hog farmers. The concern is that the farms will be damaged or destroyed by the strong storm. After the high winds pass, rain poses another, long-term threat.

Eastern North Carolina could get up to 40 inches of rain from the storm. That will cause massive flooding. All that points to huge disruption for the hog farms located there.

While that’s tragic for the folks located there, it means hog farmers elsewhere will see a windfall. There are two ways to play the coming shortage of lean hogs.

The iPath Series B Bloomberg Livestock Subindex Total Return ETN (NYSE: COWB) tracks the Bloomberg livestock subindex. That means it holds about 28.4% in lean hog futures.

The Invesco DB Agriculture ETF (NYSE: DBA) is an agriculture exchange-traded fund that holds about 8.3% in lean hogs.

Both offer investors exposure to the potential spike in lean hogs after the destruction caused by Florence.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist