China slapped 25% tariffs on U.S. soy in July. The crop used all over the world for food and fuel is just another in a growing list of items in this escalating trade war.

These tariffs will cost American farmers as much as $12 billion, according to Washington, D.C.

That will hit America’s heartland hard. Soy is the second-most planted crop in the U.S., next to corn.

The price of soy crashed roughly 20% over the past six months on the threat of the trade war.

China, the leading buyer of soy, is looking to Brazil to meet its demand. Brazil is the world’s second-largest soy grower.

Even so, China’s demand could outstrip Brazil’s capacity. Reuters analysts expect China to import over 100 million tons of soy. That’s more than Brazil’s total soy production.

While the disruption in soy is well-covered by the media, the knock-on effects of the trade war will breathe new life into a struggling sector.

Falling Sugar

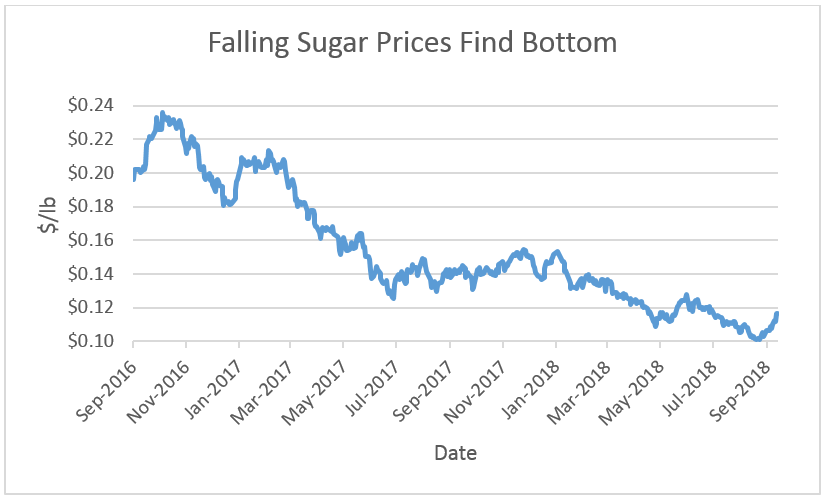

Sugar prices fell 50% since 2016.

Banner outputs from India and southeast Asia are flooding the market with cheap supply.

That’s hurting Brazilian sugar farmers. The nation is the largest sugar producer. It produces a fifth of the world’s supply of sugar.

Low sugar prices are pushing Brazilian farmers out of the market. Brazil lost nearly a million acres of sugar in the past two years.

Now the interest in Brazilian soy is seeing even more farmers ditch sugar.

This loss of supply is driving a rally in sugar. The price bottomed this August at $0.10 per pound. It rallied 15% in the weeks since then.

There are still obstacles to $0.20 sugar. India stockpiles sugar. The nation can begin to sell off excess supplies as the price recovers.

Investors looking to increase their exposure to the recovery in sugar can use the Teucrium Sugar ETF (NYSE: CANE).

Good investing,

Anthony Planas

Internal Analyst, Banyan Hill Publishing