Investor Insights:

- In 2016, golf drove $84 billion in economic activity just in the U.S.

- There aren’t many ways to profit from golf. But there’s one I’d like to tell you about.

- At less than $4 a share, this golf stock presents a solid opportunity.

I’m a big fan of golf.

And I’m not alone. In 2018, 107 million Americans played some form of golf, watched the sport on TV or read about it.

Last weekend, I enjoyed watching the U.S. emerge victorious in the Presidents Cup.

The Presidents Cup occurs once every two years. It pits a team from the U.S. against one from the rest of the world minus Europe. (The U.S. and Europe compete in the Ryder Cup in the even years.)

It was held in Melbourne, Australia.

In the U.S., patriots and golf fans alike tuned in each evening to watch the event held halfway around the world.

The event was exciting. And the telecast broke viewership records.

More than twice as many people tuned in to watch the final day of the Presidents Cup this year versus two years ago. They watched the U.S. come from behind to win in dramatic fashion.

In 2016, golf drove $84 billion in economic activity in the U.S. That was up 22% over the previous study in 2011.

For investors, there aren’t currently many ways to profit from golf. But there’s a new, emerging entertainment industry that’s taking advantage of golf’s popularity.

Read on to learn about the golf stock that’s benefiting from this trend. I believe it’s set to double…

A New, Booming Industry

I suspect many of you know what Topgolf is.

It’s a golf-focused entertainment complex. It was started by twin brothers who redesigned a driving range to make it more fun. There are 65 Topgolf locations in the U.S. and the U.K. (Eight are under construction.)

In addition to hitting balls, you can eat, drink, socialize and be merry.

In short, you don’t have to be a golfer to enjoy your time there. More than half of Topgolf’s guests don’t play golf.

And millennials love it. Nearly 70% of the visitors are between 18 and 44 years old.

This is great for Topgolf itself … but it’s also important for the industry. It needs to find ways to appeal to young people who will play golf for the rest of their lives.

I assure you, it’s fun.

However, as an investor, you can’t buy shares of Topgolf.

Luckily, you have another option in this golf stock…

Quite Impressive … for a Shack

Entertainment firm Drive Shack Inc. (NYSE: DS) is for golfers. But it also caters to people who don’t care about golf.

Its large venues allow pros, amateurs and duffers alike to smack little white balls around:

(Source: Drive Shack)

Drive Shack offers arcade games, TVs and multiple bars and restaurants.

It also has meeting spaces and free Wi-Fi, so you can get work done there.

There’s one big difference between Drive Shack and Topgolf…

You can buy shares of Drive Shack.

In fact, I encourage you to do so at its current price.

I just visited the newest Drive Shack location in West Palm Beach, Florida. And I can confirm business is booming.

I was there on a weekday morning … and I would say 60% to 70% of the bays were in use. That’s good for sales … and for the stock price.

I spoke to the manager, who said the center just opened in October. And he confirmed it’s been super busy. He didn’t have much time to talk.

Drive Shack is currently doing a lot of parties and corporate get-togethers … and that will continue throughout the holidays. If people enjoy themselves, they’ll return.

More Shacks on the Way

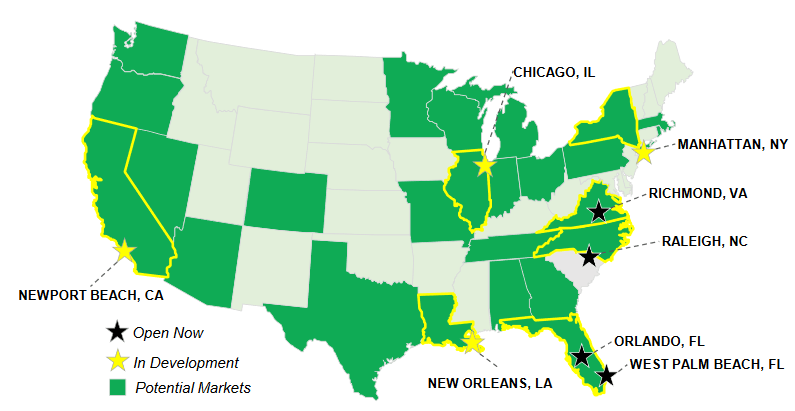

West Palm Beach is Drive Shack’s fourth location. So, you can see it has a lot of growing to do.

It’s much smaller than Topgolf. And that’s where our opportunity lies. The company wants to get bigger fast.

(Source: Drive Shack)

In addition to its larger core stores like the one I visited, Drive Shack is starting a format it calls Urban Box. The concept is a smaller, indoor, putting-based location that’s already in use in Europe.

It expects to open three of these by the end of 2020 in New York City, Chicago and Newport Beach, California.

Going forward, it will add one to four core stores and seven to 10 Urban Box venues per year. That’s good for this golf stock.

By the end of 2022, Drive Shack expects to have 30 sites. They will more than quadruple the company’s sales and profits.

The company expects sales will increase to about $380 million over this stretch. That will result in solid profits at a company with a meager $250 million market cap today.

If you’re a fan of golf — or just a fan of making money — I suggest you look into shares of this today.

At less than $4 a share, they’re down from recent levels and present a solid opportunity here. I expect they will at least double over the next three years.

Good investing,

Editor, Profit Line

P.S. There’s a great $5 stock in my and Jeff Yastine’s Total Wealth Insider portfolio. This tiny company is already starting to revolutionize the entire health care industry, and the odds are very strong that the next 12 months will be a breakout for its stock. To find out more, click here to watch Jeff’s special presentation.