We are seeing amazing changes in our lives today.

Technology is making us more efficient.

Some of you won’t remember this, but you used to have to go to a bank to withdraw money. We didn’t even have automatic teller machines or ATMs.

The first ATM debuted in 1967 in London. And in the U.S. two years later.

But those were only a bit more efficient. You still had to get out of the car and enter the branch.

The first drive-up ATM was in Baton Rouge, Louisiana, in 1980. It was much more efficient.

You didn’t have to enter the branch. And it could be open 24 hours a day.

It was a big deal, but it’s light-years away from where we are today. Now we can transfer money to each other based on our e-mail addresses.

This is because of financial technology, or fintech.

It’s why Forbes says: “The financial sector is currently undergoing possibly the most profound transformation in history…”

It’s part of the Great American Reset.

We’re still in the early stages of this reset. It’s only going to grow going forward.

And it will become a more important part of your life.

Here’s how you can profit.

How Elon Musk Changed Finance Forever

Today, Tesla Chief Executive Officer Elon Musk is one of the most important people in tech.

Electric vehicles, space shuttles and other Musk-led advancements will be an important part of the future.

And did you realize that he played a big role in the evolution of fintech, too?

We need to be on the same page here.

Fintech uses technology to improve the financial services sector. It offers financial services using the internet, software or other tech … not brick-and-mortar branches.

In March 2000, an online banking firm Musk founded merged with an up-and-coming fintech firm.

Musk’s business helped people transfer money more efficiently. And that was a huge deal at the time. You couldn’t do that simply at your local bank.

The new firm changed its name to PayPal in 2001. It went public in 2002. And eBay bought it shortly after for $1.5 billion.

PayPal was the default payment method for most eBay users. And it grew via deals as well.

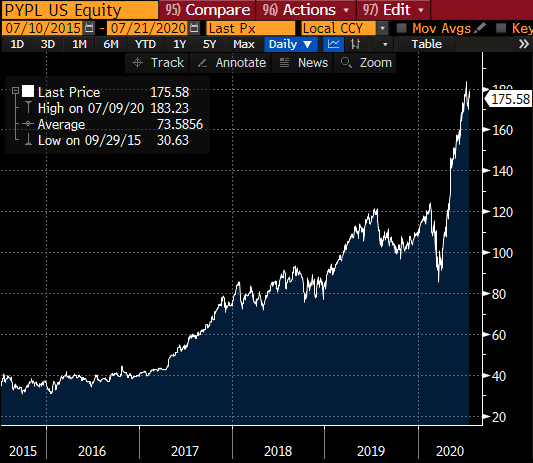

Then, eBay spun PayPal Holdings Inc. (Nasdaq: PYPL) out in 2015. Shareholders have enjoyed the ride ever since:

(Source: Bloomberg)

PayPal shares have increased five times since then. The company has more than 300 million active accounts. It owns Venmo as well.

It’s an example of what fintech can do for your portfolio.

The Next Major Fintech Event

China’s Alibaba Group Holding Ltd. (NYSE: BABA) spun off Alipay in 2010. The company was rebranded as Ant Financial a few years later.

Today, it’s the third-largest payment platform in the world.

Alipay remains the most notable segment. As PayPal is eBay’s payment arm, so is Alipay to Alibaba.

Alibaba has a wide reach. It has 780 million active customers in China and 180 million outside of it.

Ant plans to go public on the Shanghai and Hong Kong exchanges this year. It is seeking a valuation of more than $200 billion.

To put this into perspective, this is Bank of America’s market cap … and PayPal’s.

More Tipping-Point Trends on the Horizon

These are just two examples of important fintech firms.

A simple way to play the growth of fintech is the Global X FinTech ETF (Nasdaq: FINX). The $600 million exchange-traded fund (ETF) holds 33 fintech-focused stocks, including PayPal.

The beauty of this ETF is it holds solid foreign firms as well as the best U.S. names.

It can be volatile, but that goes both ways. It’s up 75% since it bottomed on March 23.

Fintech isn’t slowing down. It continues to displace traditional banks.

That’s why it’s one of several tipping-point trends that Ian King follows in his Automatic Fortunes service.

Ian is showing his subscribers how to profit from the Great American Reset.

I suggest you learn more about this today. You’ll be happy that you did.

You’ll understand why I say this when you see the track record in his service.

Good investing,

Editor, Profit Line