Investor Insights:

- From the end of 1999 to early 2000, small-cap stocks gained 21%.

- A buy signal recently triggered for a small-cap exchange-traded fund.

- You can participate in the rally and make a 100% gain. Here’s how…

With major market averages at record highs, many investors are worried about the end of the bull market. That’s because previous bull markets ended with stocks at record highs.

But there’s more to the story. Bull markets generally end in speculative frenzies.

The internet bubble provides an example.

In 1999, major averages roared to all-time highs. In early 2000, the Dow Jones Industrial Average and S&P 500 Index reached new highs.

But the real action was in smaller stocks.

The Russell 2000 Index, a popular benchmark for small-cap stocks, gained 21% from the end of 1999 to its all-time high in March 2000. Benchmarks for large-cap stocks gained less than 5% in that time.

At the end of a bull market, investors push small stocks to unimaginable highs. We’re far from that environment now. Small caps remain well below their all-time highs.

That sets up an opportunity for you to make a 100% gain in less than five months.

Peak Velocity Gave Us a Buy Signal

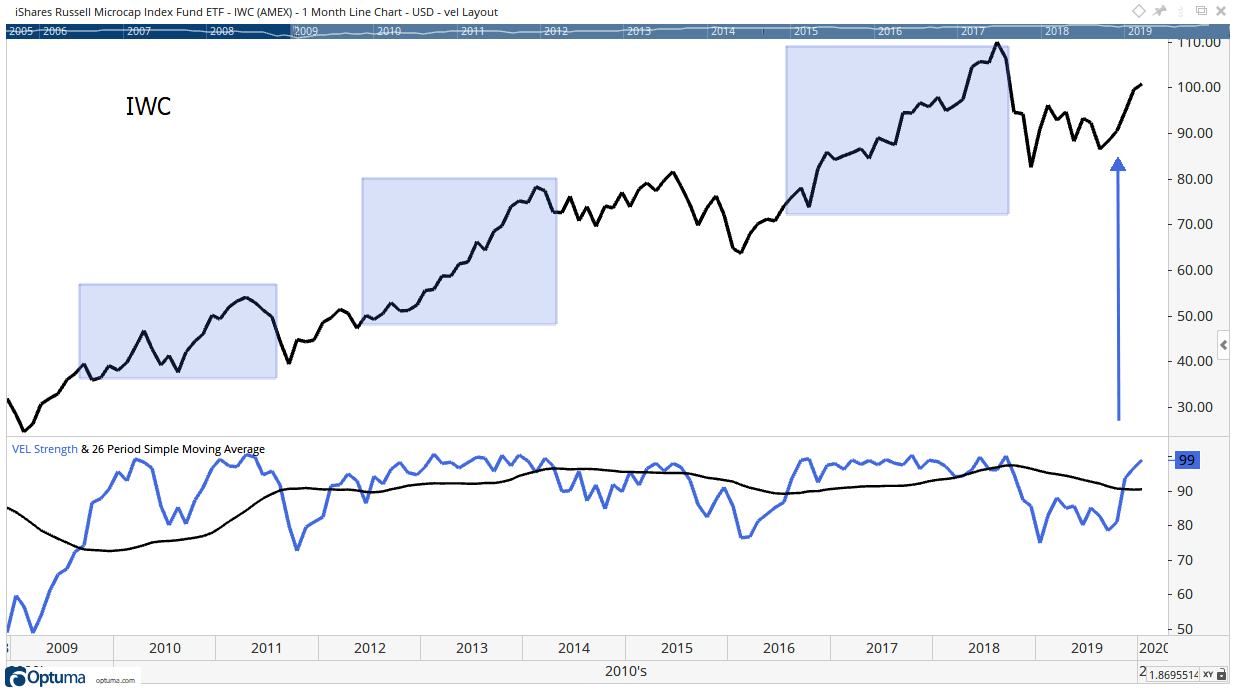

The chart below shows the iShares Micro-Cap ETF (NYSE: IWC), an exchange-traded fund (ETF) that tracks the smallest stocks in the Russell 2000.

Blue rectangles in the chart highlight some of the previous buy signals. A recent buy signal is highlighted by the arrow in the chart.

A New Buy Signal for IWC

At the bottom of the chart is an indicator I call peak velocity. It’s the blue line.

The black line is a moving average of peak velocity. Buy signals occur when the indicator crosses above its moving average.

This indicator relies solely on the price action. In other words, it quantifies the urgency of buyers and sellers.

Your Guide to Trading IWC

You can participate in the rally likely to unfold in IWC with a call option.

A call option gives the buyer the right, but not the obligation, to buy IWC at a specified price at any time before the option expires.

You won’t have to exercise the option to collect a gain. You could simply close it with a sell order.

Options offer defined risks. You can never lose more than you paid for the option. This means risks are small in dollar terms since options usually trade for just a few hundred dollars or less.

For IWC, traders could buy June 19 $100 call options.

These options were recently trading for about $480. This is the right to buy 100 shares of IWC at $100 any time before June 19. The option can be closed at any time prior to June 19.

If IWC gains 10%, this option will deliver a 100% gain.

Regards,

Editor, Peak Velocity Trader

P.S. I tested my Peak Velocity strategy against 10 years of historical data … and over time, there were 800 opportunities to make gains of 25% or more. Better yet, 300 of those gains reached 100% or higher. That’s an average of 30 triple-digit gains a year, or two to three every month. To see how Peak Velocity works, click here for more details.