The Big Picture in 5

Your 5-Minute Weekly Update on the World’s Biggest Trends and Opportunities

- This Week’s Earnings Landmines

This earnings season has been more dramatic than anything you’ll see on TV during sweeps week.

From Tesla (Nasdaq: TSLA) beating estimates to Netflix (Nasdaq: NFLX) tanking 67% as subscriber numbers declined, we’ve had no shortage of shocking revelations. And with dozens more major names slated to announce their earnings figures this week, we can certainly expect more excitement:

Eat your heart out, March Madness.

In today’s climate, it’s impossible to tell what kinds of numbers these companies will do — let alone how the markets will respond.

That’s not an easy thing to hear if you own some of these stocks, but take heart in the fact that downturns don’t last forever. And when it comes to good companies, a decline in price is far more of an opportunity than a threat.

- Time to Stash Your Cash?

After months of up-and-down performance in 2022, investors are increasingly looking to safe-haven investments as a way to weather the storm.

And while it’s true that every portfolio should have some small percentage in cash (usually 5% to 20%), it’s also important to be mindful of factors like inflation — especially when it’s near 9%. It’s important to use a mix of interest-bearing tools and other assets to stay one step ahead of the curve.

Ted’s latest special report, Your 2022 Plunge Protection Plan, provides 20+ cash alternatives you can use to “keep your powder dry” and take advantage of potentially outstanding buying opportunities as the year unfolds.

- RIP Meme Investors

COVID lockdown was a weird time. Some folks took up old hobbies. Some started new ones, and others started day trading stocks and options with no relevant experience or real-world education.

Unsurprisingly, Bloomberg is now reporting that 2022’s market turbulence has wiped out the early gains made by this crop of GameStop (NYSE: GME) and AMC (NYSE: AMC) -obsessed investors. The latter has declined 78% since June 2021, and 49% this year alone.

Peloton (Nasdaq: PTON) is another darling of the meme crowd. Their shares are down 90%.

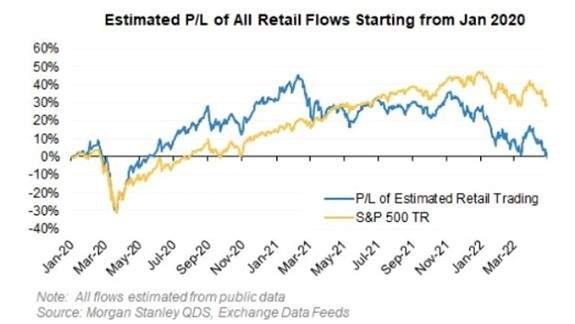

Quick gains, but back to zero for day traders (in blue).

On the one hand, this may seem like just desserts for some upstart new market participants.

On the other hand, they’re not getting burned any harder than the pros on Wall Street who chased tech stocks higher and higher last year. And Melvin Capital — one of the primary hedge funds shorting GME — didn’t survive the fad either.

- Bill Gates vs. Warren Buffett!

Bill Gates is officially bearish.

In an interview with CNN on Sunday, he pointed to Russia’s war in Ukraine as a major disruption that “comes on top of the pandemic where government debt levels were already very, very high, and there were already supply chain problems.” Meanwhile, we’re seeing multiple headlines about Warren Buffett making stock purchases — a potentially bullish indication, to some, that the bottom may be near.

So, which is it?

Well, it’s important to distinguish the two types of perspectives here.

Gates is speaking more broadly of the global economy. Buffett is thinking like an investor, and he’s buying the dip.

Back during the financial crash of 2008, Buffett penned an op-ed titled Buy American. I am. It was published in October, five months before the markets officially hit bottom. But as an investor, it’s better to buy the dip early and often … rather than risk missing out.

- Natural Gas on the Rise as Europe Scrambles for Imports

War is hell.

Over 5.7 million Ukrainians have evacuated their homeland, and millions more have been internally displaced or called up for military service as the war nears its fourth month with no real end in sight.

Even for those outside Ukraine in neighboring countries and Western Europe, the war is taking a financial toll. Natural gas prices have risen sharply and stayed high. And now, with American producers shipping liquefied natural gas across the Atlantic, prices are rising here as well.

The rising energy cost of Russia’s war.

Ted has covered this issue extensively in recent videos, so we won’t get too in-depth here.

Suffice it to say that without a clear resolution to the conflict in Ukraine, the world’s energy markets are likely to remain unstable with high prices and high demand. Europe is currently accelerating its shift to renewables, but that’s hardly as simple as flicking on a light switch.

—

Have any feedback on the new format? Let us know what you think, or what you’d like to see, by emailing BigPictureBigProfits@BanyanHill.com.