Four months in and it’s already a year for the financial history books.

The market is facing soaring inflation, rising interest rates and war in eastern Europe.

This triple threat has created a sell-off across global markets.

The tech-heavy Nasdaq Composite Index is down 21% for the year, which puts it in bear market territory.

The S&P 500 Index is down 13.8%, marking the worst start to a year since World War II.

In April alone, the Nasdaq dropped 13%. That’s its worst month since the COVID crash in March 2020.

There was so much uncertainty back then, it felt like the world was ending.

The selling picked up in the last few weeks as bellwethers Apple and Amazon were hit hard after reporting earnings.

These blue chips were once considered defensive stocks, as their low debt and high free-cash-flow levels supposedly made them immune from rises in interest rates.

It feels like nothing is safe anymore. But this may be a good sign.

The highest-ranking generals are typically the last ones killed in battle.

And this isn’t the first time the market has suffered a sharp sell-off in the past few decades.

If history is any guide, we may be setting up for a snapback rally in the second half of the year.

A Better Picture of the Bear Market Damage

On the surface, this looks like a run-of-the-mill bear market down 20%.

But the internals of the market are telling a different story.

The damage to individual stocks is as bad as the previous bear markets of the last 20 years.

Take a look at the following chart. It shows the percentage of Nasdaq stocks that are down 50%, 75% or 90%.

This gives us a better picture of the bear market damage:

Internal Damage Is Still Severe

(Source: Portfolio123.)

As you can see:

- 45% of Nasdaq stocks are down 50%.

- 22% of Nasdaq stocks are down 75%.

- 5% of Nasdaq stocks are down 90%.

Think about that for a moment: Almost 50% of Nasdaq stocks have been chopped in half.

Almost one in four is down 75%!

Notice how this puts our current bear market on par with prior bear markets in 2001-2002, 2008-2009 and 2020.

The Market Is Priced for a Recession

The damage suggests that the market is priced for a recession.

The reason for the latest sell-off is a sharp increase in rate hike odds for 2022. Because of this, the market is pricing in rate hikes before they happen.

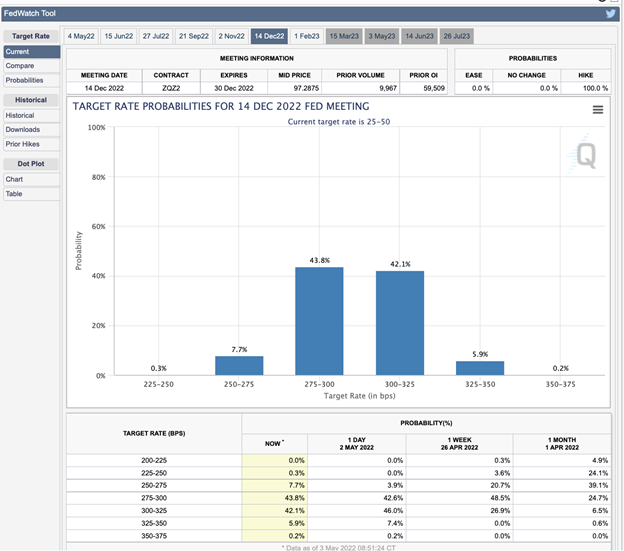

You can see this in CME’s target rate probabilities for the December 2022 Federal Reserve meeting.

Currently, there’s an 85.9% chance that the Fed will raise rates to between 2.75% and 3.25% by the end of the year.

A month ago, the chance of the Fed raising this quickly was only 31.2%.

(Source: CME Group.)

But the actual odds of a recession right now are only 35%.

If we start to see inflation numbers cool off from their 40-year highs, and the Fed begins to signal a more dovish posture, we could be looking at a sharp second-half rally.

Regards,

Editor, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

SoundHound AI Inc. (Nasdaq: SOUN) develops voice-enabled artificial intelligence (AI) and conversational intelligence technology solutions. The stock is up 40% on continued excitement around the stock since it went public via a SPAC deal late last week.

Tetra Technologies Inc. (NYSE: TTI) operates as a diversified oil and gas services company. The stock is up 19% after the company reported first-quarter results that far exceeded Wall Street’s revenue and earnings estimates.

Enovix Corp. (Nasdaq: ENVX) designs, develops and manufactures lithium-ion batteries. The stock jumped 18% after the company cleared a key technology validation milestone and received an initial order for its high-energy density smartwatch battery from a top consumer electronics company.

Credit Acceptance Corp. (Nasdaq: CACC) provides financing programs and related products and services to independent and franchised automobile dealers. It is up 17% after beating first-quarter earnings estimates thanks to an increase in collection rates for consumer loans.

Jakks Pacific Inc. (Nasdaq: JAKK) produces and markets toys, consumables, electronics and related products worldwide. The stock is up 16% after analysts at BMO Capital upgraded the stock to an outperform rating and set a price target of $21.

Blue Apron Holdings Inc. (NYSE: APRN) operates a direct-to-consumer platform that delivers ready-to-cook meal kits. It is up 15%, continuing its run-up from Monday when it announced a capital infusion of $70.5 million into the company.

Western Digital Corp. (Nasdaq: WDC) develops, manufactures and sells data storage devices and solutions. It rose 15% after activist investor Elliott Investment Management disclosed it was pushing the company’s board to spin off its flash memory business.

Atkore Inc. (NYSE: ATKR) manufactures and sells electrical, safety and infrastructure products internationally. The stock is up 13% after the company beat second-quarter estimates and raised its guidance for the full year.

Catalent Inc. (NYSE: CTLT) develops and manufactures solutions for drugs, protein-based biologics, cell and gene therapies and consumer health products. It is up 12% after it reported third-quarter results and raised guidance for the rest of the year thanks to the diminishing impact of pandemic conditions.

IPG Photonics Corp. (Nasdaq: IPGP) develops and manufactures high-performance fiber lasers, fiber amplifiers and diode lasers used in various applications. The stock is up 12% after the company managed to beat expectations for the first-quarter due to high demand in its electric vehicle operations segment.